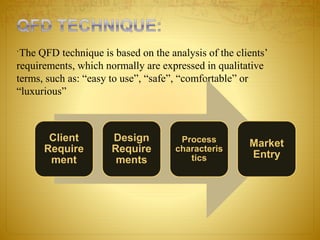

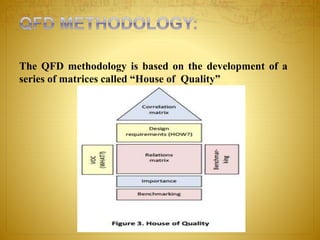

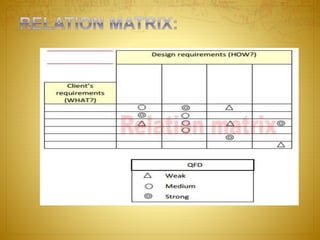

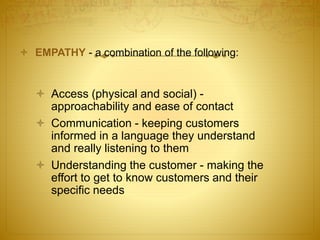

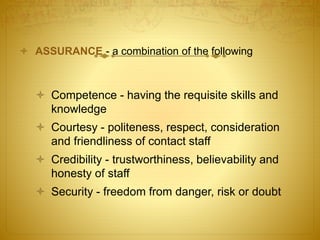

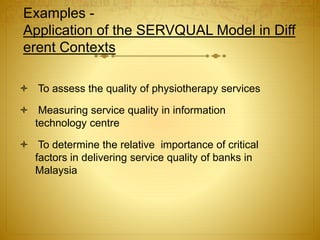

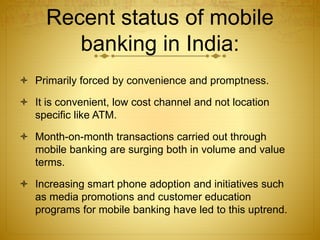

The document discusses ABC bank's plans to launch mobile banking services. It summarizes RBI guidelines for mobile banking and key risks like anonymity. It also discusses Anjali's plan to use SERVQUAL and QFD tools to understand customer expectations and requirements. This will help design attractive mobile banking services and identify specifications to gain a competitive edge. The document also provides an overview of the current mobile banking landscape in India and common mobile banking services provided.