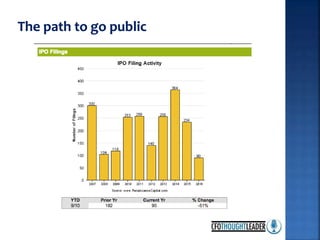

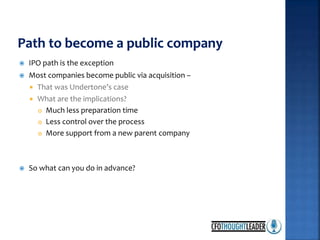

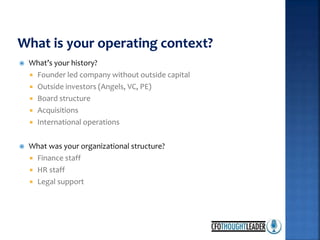

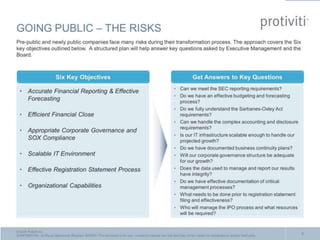

This document summarizes a presentation on preparing a company for acquisition or going public. It discusses Undertone's experience being acquired and the implications of less preparation time and less control over the process than with an IPO. The presentation recommends companies focus on seven key areas: organization, controls, financial management, policy/procedures, IT, legal, and education. It also suggests considering a company's history with investors and capital as well as its organizational structure and talent. The document concludes by thanking the speakers Steve Hobbs, Susan Parcells and Michael Waxman-Lenz.