Embed presentation

Download to read offline

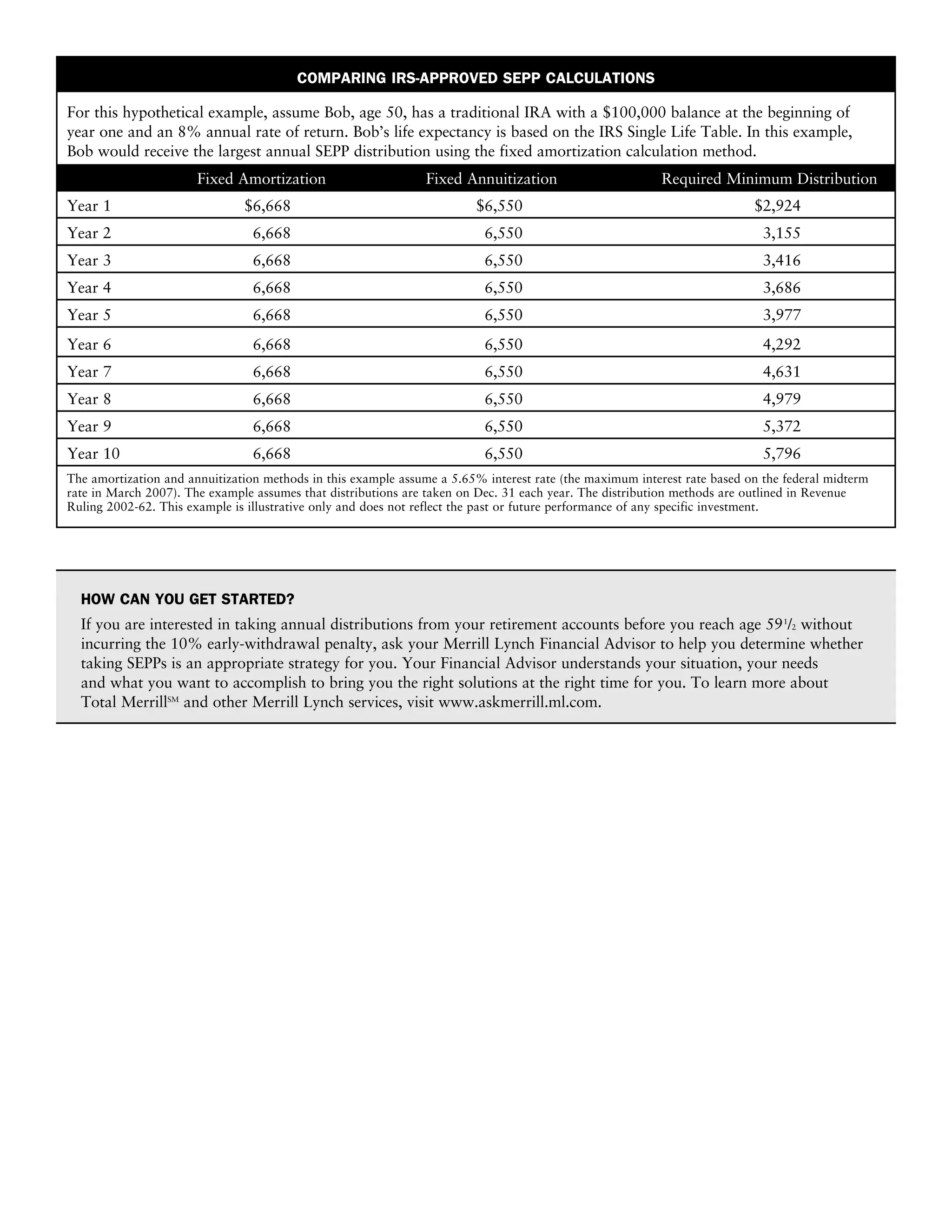

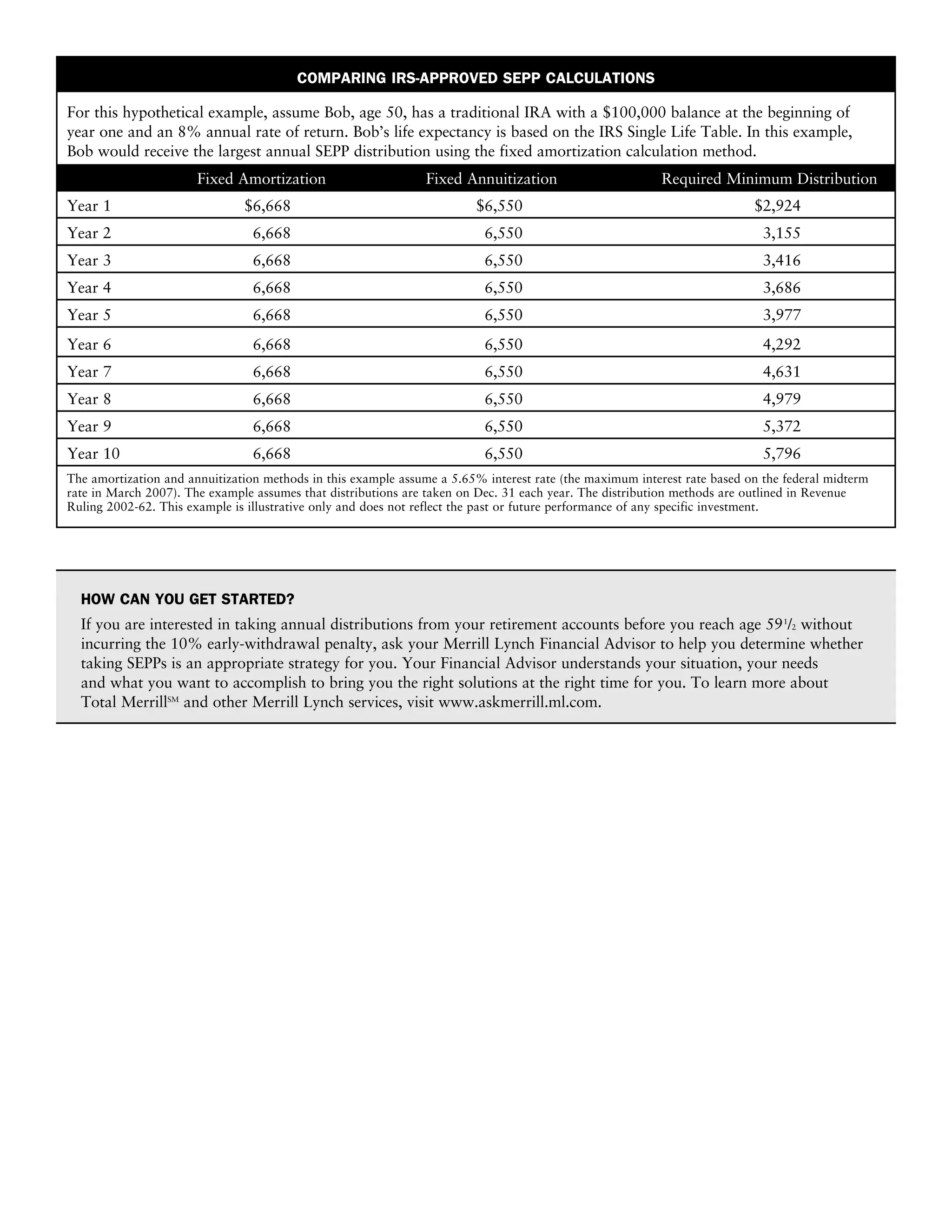

Substantially equal periodic payments (SEPPs) allow individuals to take early distributions from retirement accounts before age 59.5 without incurring a 10% penalty. SEPPs must be taken annually for 5 years or until age 59.5, whichever is longer. There are 3 IRS-approved methods for calculating SEPPs amounts: fixed amortization, fixed annuitization, and required minimum distribution. A SEPP analysis can help determine which calculation method provides the optimal payment amount and duration for an individual's needs and situation.