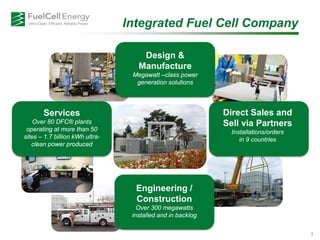

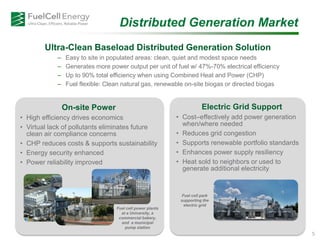

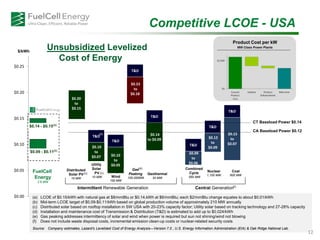

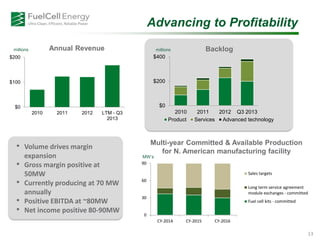

This presentation provides an overview and update on FuelCell Energy, Inc. It discusses the company's global footprint and initiatives to increase annual production capacity. Key points include plans to establish local manufacturing in Asia to reduce costs and support market growth. FuelCell also discusses multi-megawatt fuel cell installations, progress towards profitability, and its technology roadmap including expanding into carbon capture, renewable hydrogen, and new applications like data centers.