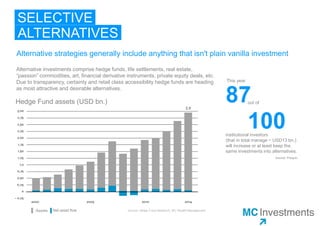

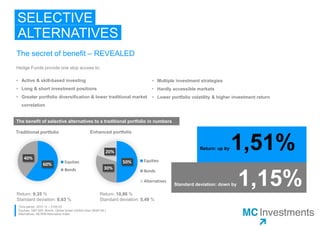

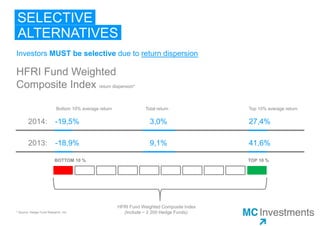

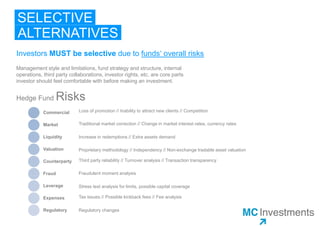

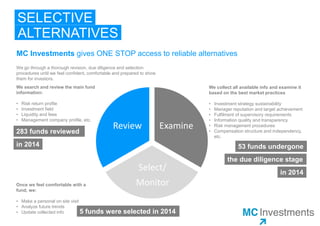

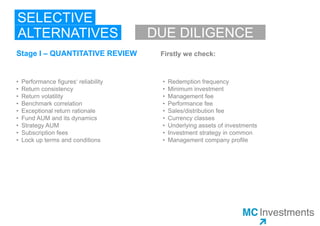

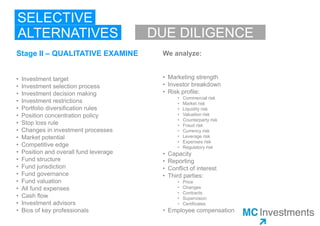

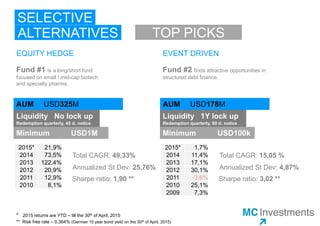

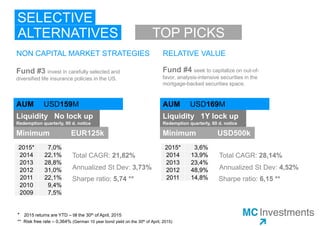

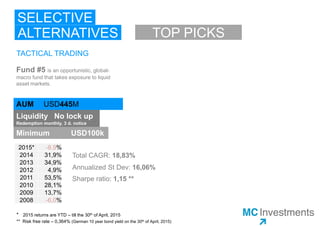

This document discusses alternative investment strategies and hedge funds. It provides information on 5 hedge funds that have been selected through a thorough due diligence process. The funds represent different alternative investment strategies - Equity Hedge, Event Driven, Relative Value, Tactical Trading, and non-capital market strategies. For each fund, the document summarizes key details like assets under management, liquidity terms, minimum investment size, historical returns and risk metrics. The document emphasizes the importance of being selective in hedge fund investing due to risks and return dispersion across funds. It describes MC Investments' multi-stage due diligence process for evaluating hedge funds before selecting them for investors.