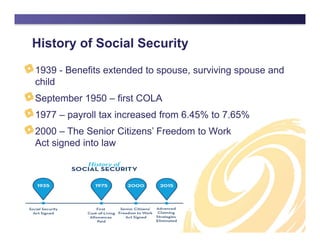

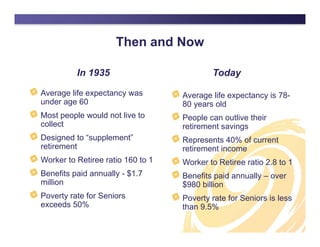

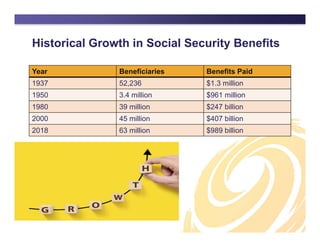

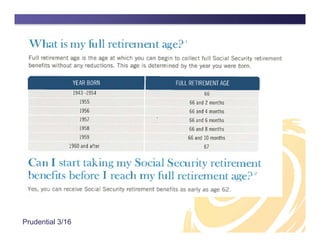

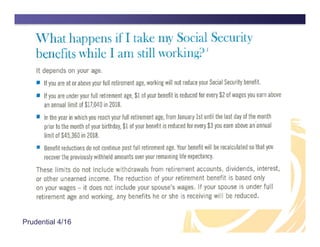

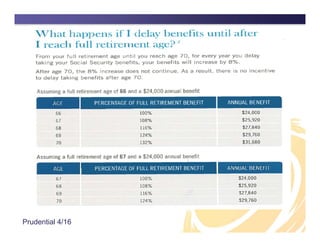

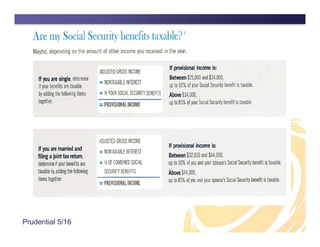

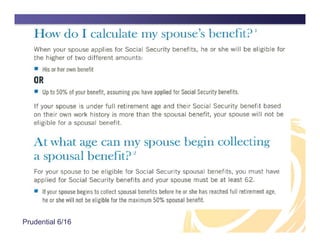

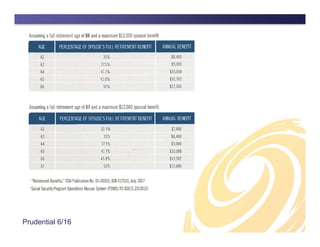

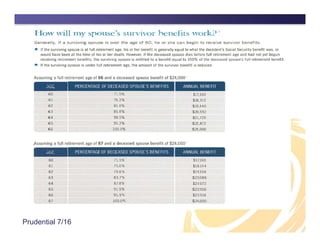

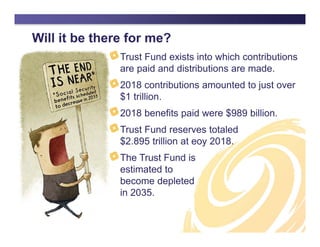

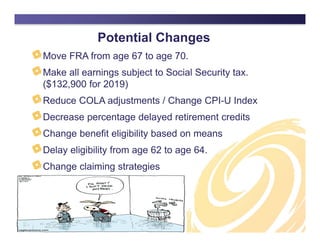

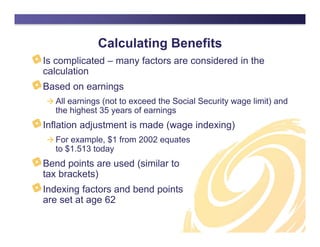

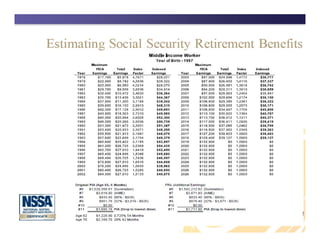

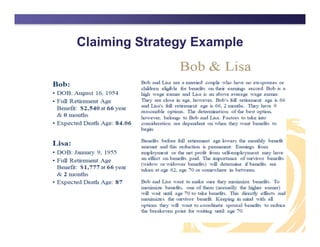

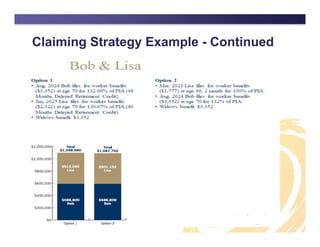

The document outlines the history and evolution of the Social Security system since its inception in 1935, highlighting its purpose as a safety net and its impacts on retirees. It raises concerns about the sustainability of benefits and the complexities of maximizing individual benefits, especially given the declining worker-to-retiree ratio and potential changes to the system. Additionally, it emphasizes the importance of informed claiming strategies to ensure optimal retirement income.