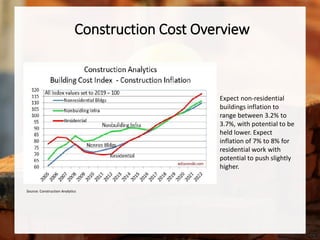

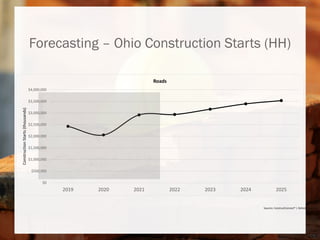

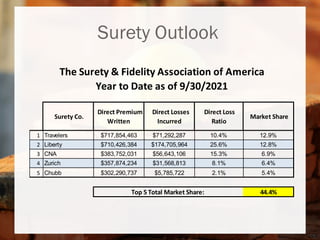

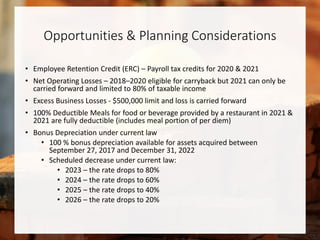

The document discusses the current state and outlook of construction in central Ohio, highlighting population growth's impact on the construction market. It presents key data on construction costs, insurance market trends, and recent legal developments affecting the industry, such as changes in limitations for breach of contract claims. Additionally, it addresses various economic factors influencing construction costs and employment, alongside legislative updates and planning considerations for businesses in the sector.