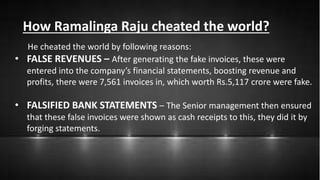

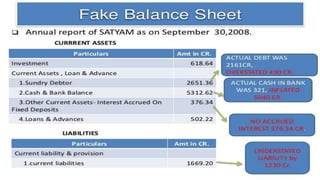

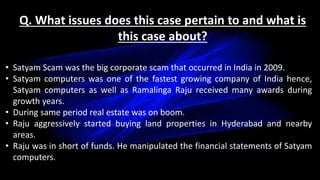

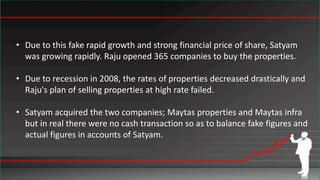

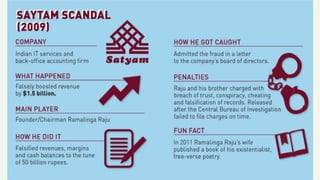

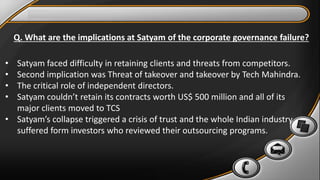

This case pertains to the corporate governance failure at Satyam Computer Services in 2009. Satyam was one of the largest IT companies in India but its former CEO, Ramalinga Raju, falsified the company's financial statements by creating fake invoices and bank statements to inflate revenues and profits. After the scandal was revealed, the government took action against those responsible. There were major implications for Satyam, including difficulty retaining clients, threats from competitors, and its acquisition by Tech Mahindra. The scandal highlighted the need for stronger corporate governance policies and oversight of companies in India.