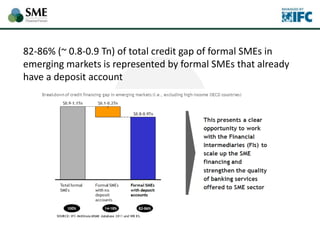

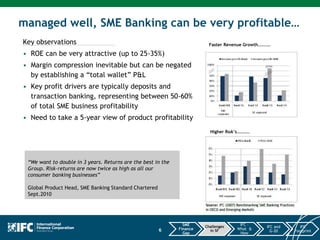

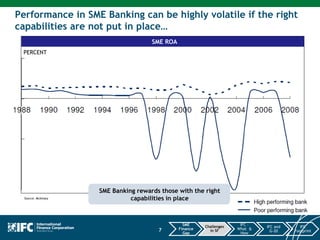

The document summarizes the SME Finance Forum, an initiative launched in 2012 to promote SME finance. It discusses the forum's achievements to date, including daily news/report feeds, a growing LinkedIn group, and promoting innovative SME finance approaches. It lists the forum's team members and notes support is provided by IFC and the G20 Finance Innovation Fund. It also discusses common myths around SME banking profitability and notes returns can be attractive if the right capabilities are put in place, with partnerships beyond just banks also important to SME finance.