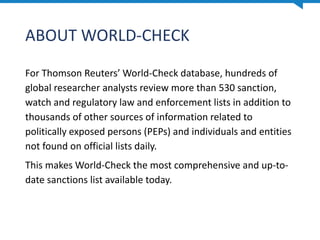

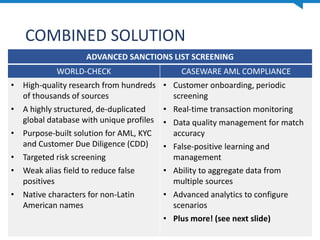

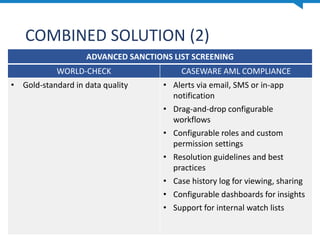

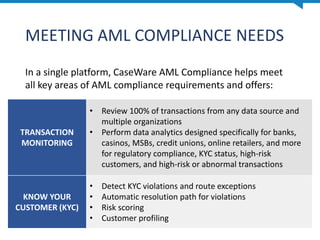

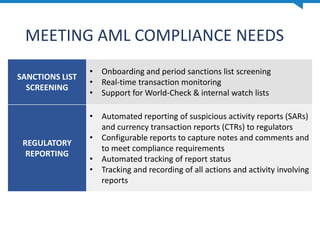

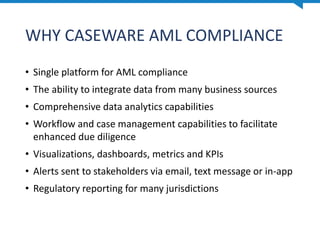

The document discusses the integration of Thomson Reuters' World-Check database and CaseWare's AML Compliance solution for advanced sanctions list screening and compliance with AML regulations. It highlights the comprehensive research and data management capabilities of the combined solutions, including KYC, transaction monitoring, and regulatory reporting. The system aims to enhance due diligence, reduce false positives, and automate compliance processes across various industries.