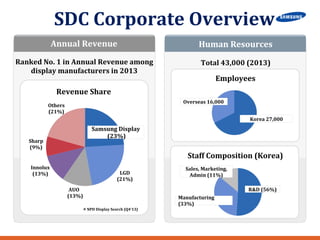

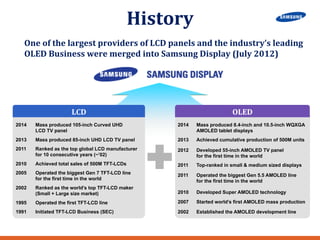

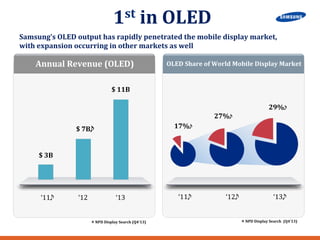

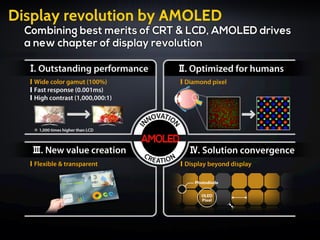

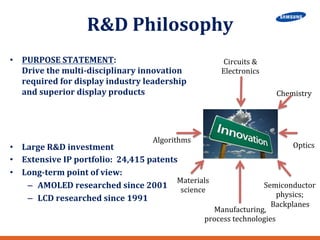

Samsung Display, a leader in the display manufacturing industry, focuses on innovation in LCD and OLED technologies, achieving significant market share and revenue growth. The company has a robust research and development framework, investing heavily in advanced display technologies and maintaining a global presence. Their mission emphasizes multi-disciplinary innovation and enhancing display performance while collaborating with industry standards.