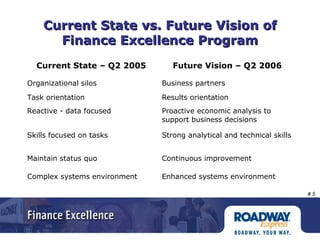

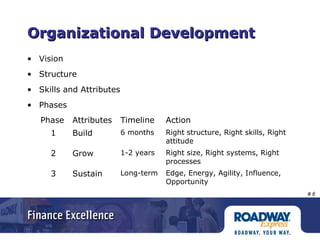

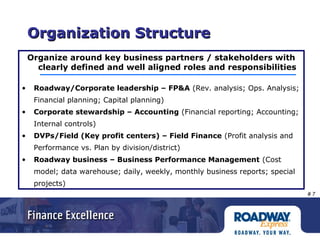

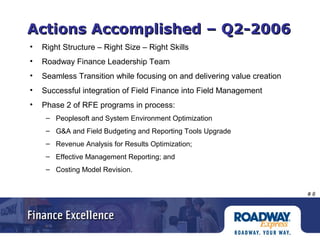

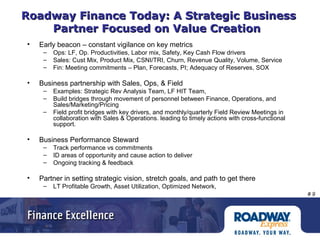

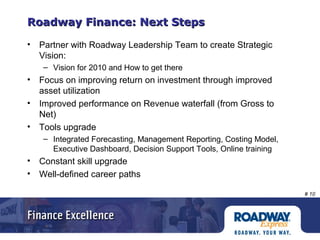

This document outlines Roadway's transition of its Finance department from an organization focused on tasks to a strategic business partner focused on value creation. It discusses establishing the right structure, skills, and processes through organizational development phases to build, grow and sustain the program. The Finance department now closely partners with other departments to provide early warnings on metrics, perform business analysis, and set strategic visions to improve returns.