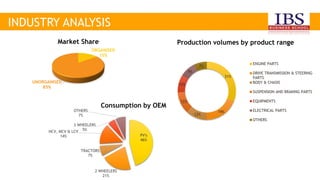

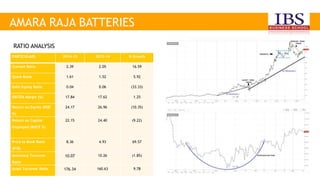

This document analyzes the Indian automobile industry. It notes that India has emerged as the fastest growing major economy and was ranked highest globally in terms of consumer confidence. The "Make in India" and "Digital India" campaigns are expected to drive further growth. The automobile industry's production is led by engine parts at 31% of the total. The industry also provides a SWOT analysis and examines key financial ratios for three automobile companies: Amara Raja Batteries, Exide Industries, and Bharat Forge. Based on the analysis, it recommends buying shares of Amara Raja Batteries, holding shares of Exide Industries, and selling shares of Bharat Forge.