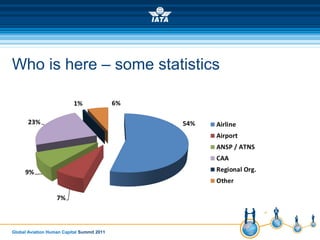

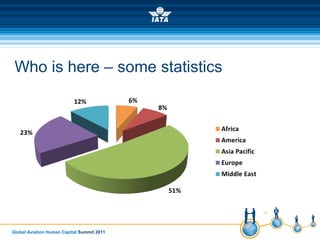

The document summarizes the proceedings of the Global Aviation Human Capital Summit 2011. It discusses the challenges and opportunities for human capital in the aviation industry. Specifically, it notes that 500 HR leaders from airlines, airports, and other aviation organizations were invited to the summit to discuss issues like attracting and retaining talent, leadership development, and managing labor costs and unions. The summit provided a forum for participants to network, share best practices, and identify ways that IATA can better support the human capital needs of the aviation industry.