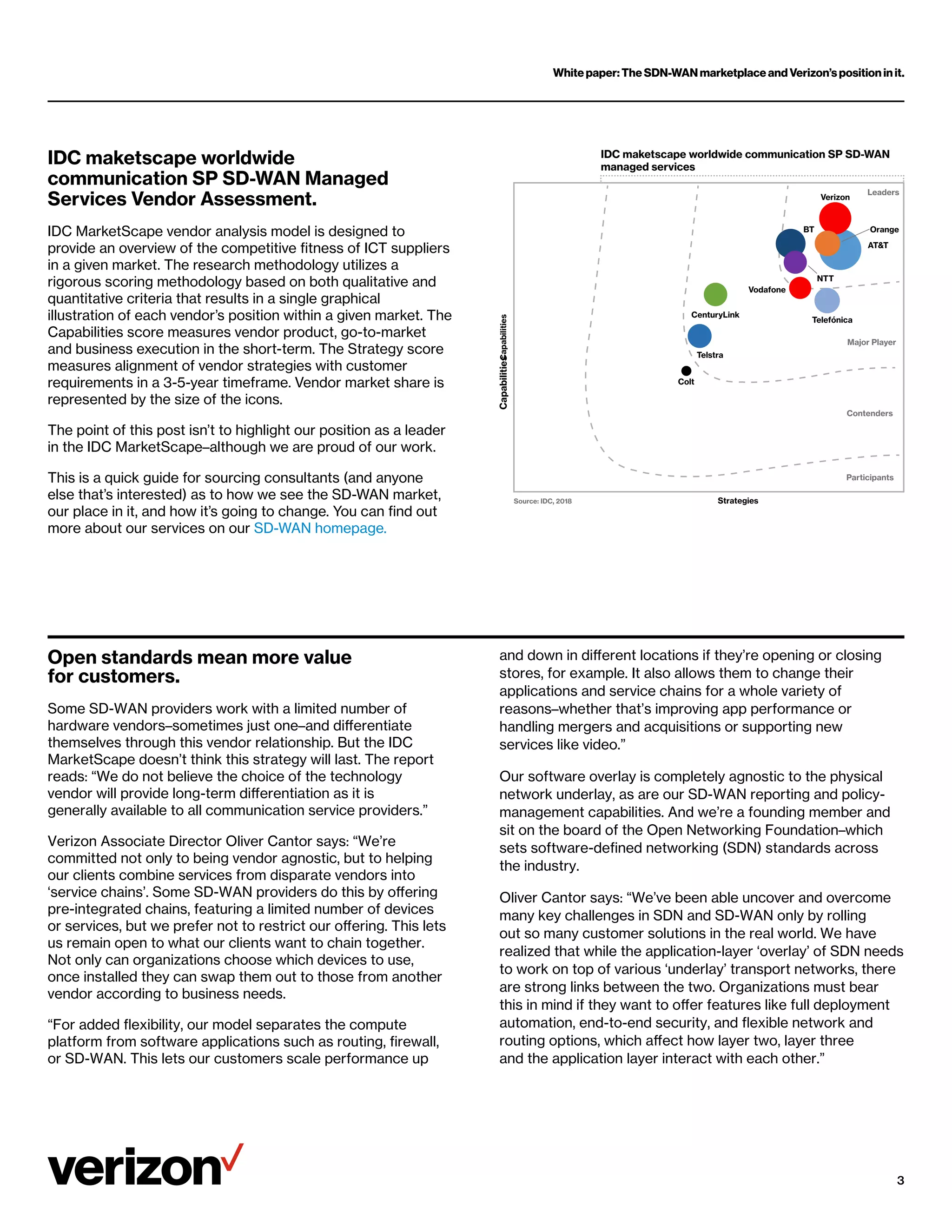

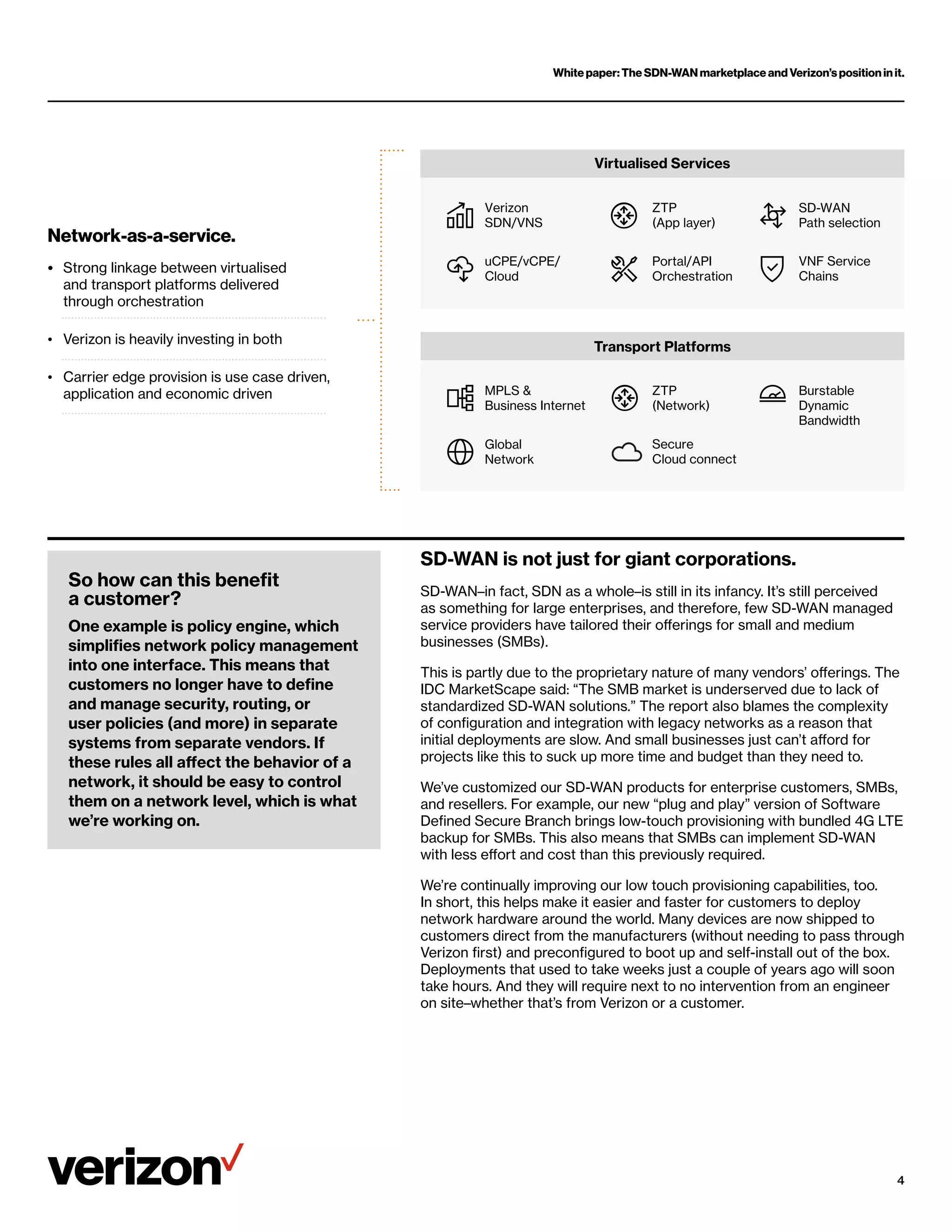

The document discusses the SD-WAN marketplace and highlights Verizon's position as a leader in SD-WAN managed services according to IDC's 2018 vendor assessment. It emphasizes Verizon's commitment to an open, vendor-agnostic approach, enabling custom service chains for clients while catering to the emerging SMB market with simplified deployment solutions. Additionally, it outlines trends toward flexible, pay-as-you-go networking models as organizations move away from traditional long-term contracts.