The document discusses challenges facing the coal industry over the medium term, including:

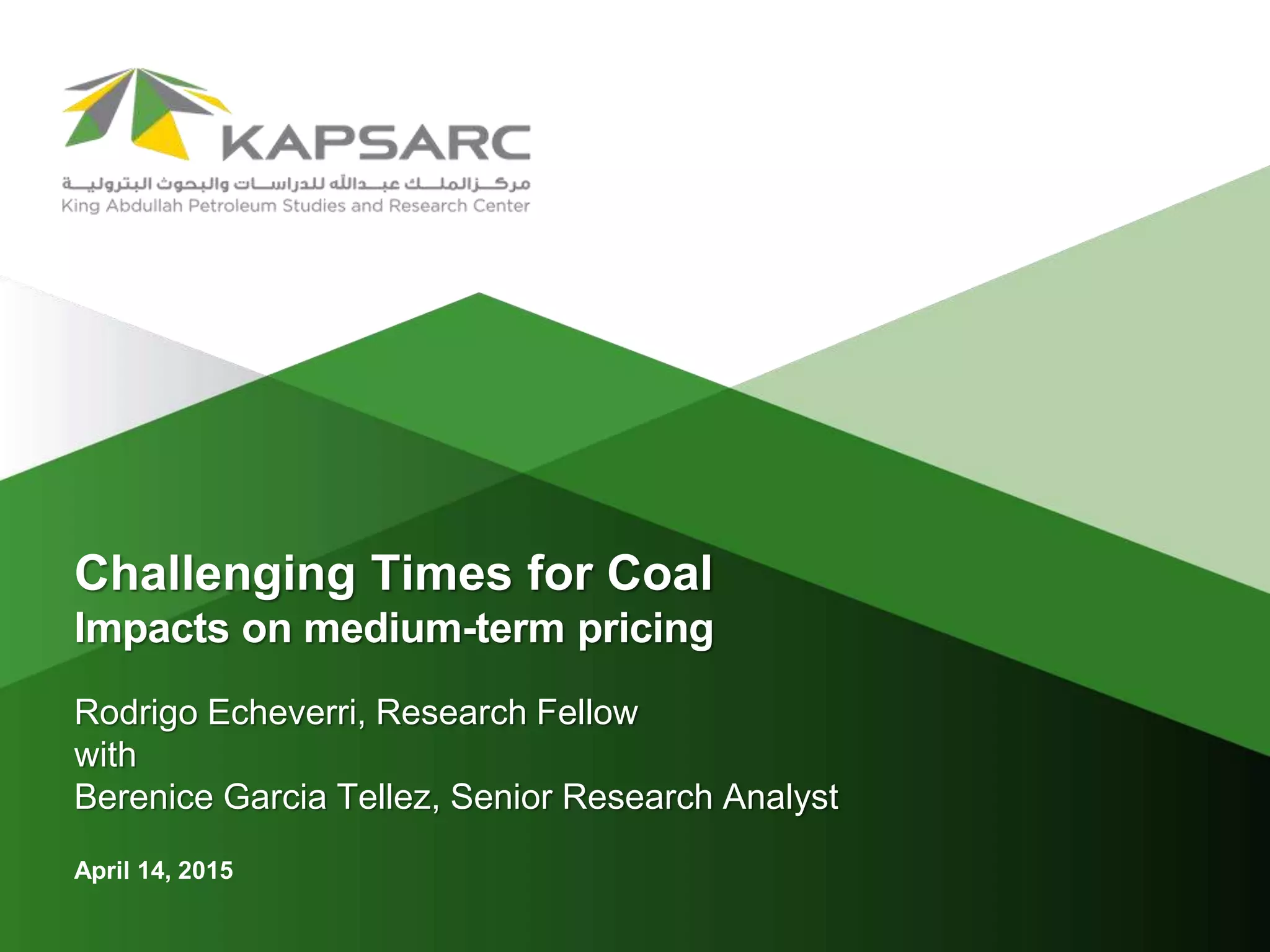

- Global coal demand growth is slowing as China's imports decline due to policy changes and efficiency gains. Other countries may not compensate for China's losses.

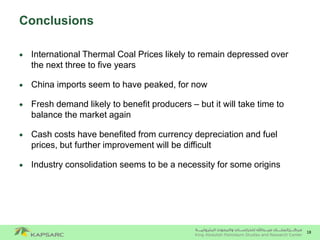

- Supply is decreasing from high-cost producers like Indonesia as low-cost countries like Russia, Australia, and Colombia increase market share.

- International thermal coal prices are expected to remain depressed for 3-5 years as the market works to rebalance slower demand and competitive supply. Industry consolidation may be needed for some high-cost producers.

![6

Has the coal market run out of steam?

Coal market recovery not likely before 2017 - Even then, improvement might only be marginal…

Source: McCloskey, Salva, Argus Consulting, KAPSARC Analysis

(40)

(20)

-

20

40

60

80

100

120

140

160

0

200

400

600

800

1000

1200

2009 2010 2011 2012 2013 2014 2015E 2016E 2017E 2018E 2019E

Year-on-YearChange[Mt]/Newcastle

[$/t]

CoalDemand[Mt]

Seaborne Thermal Coal Market Demand

Year-on-Year Change Seaborne Coal Demand Newcastle price](https://image.slidesharecdn.com/3238ca1f-092d-419d-a881-8dfc4a7b2954-150416164506-conversion-gate02/85/Rodrigo-Flame-April-14-FINAL-6-320.jpg)

![7

Can India and ASEAN compensate

for the losses in China?

India and ASEAN show promise but have their own challenges…

Source: McCloskey, Salva, Argus Consulting, KAPSARC Analysis

-60

-50

-40

-30

-20

-10

0

10

20

30

40

2013 2014 2015E 2016E 2017E 2018E 2019E

Year-on-yearchange[Mt]

China

India

ASEAN](https://image.slidesharecdn.com/3238ca1f-092d-419d-a881-8dfc4a7b2954-150416164506-conversion-gate02/85/Rodrigo-Flame-April-14-FINAL-7-320.jpg)

![10

-15

-10

-5

0

5

10

15

2013 2014 2015E 2016E 2017E 2018E 2019E

Year-on-yearchange[Mt]

Taiwan and HK

Japan/S.Korea

Europe

MENA

Americas

Demand: Japan, Korea, MENA and Europe

Europe making

further attempts to

improve its ETS will

likely result in coal

being displaced in

the merit order

Coal is still a good

alternative for Korea

and Japan due to

shortage of power

and challenges with

other sources of

energy

Egypt and UAE

moving to build new

coal-fired capacity

Source: McCloskey, Salva, Argus Consulting, KAPSARC Analysis](https://image.slidesharecdn.com/3238ca1f-092d-419d-a881-8dfc4a7b2954-150416164506-conversion-gate02/85/Rodrigo-Flame-April-14-FINAL-10-320.jpg)

![12

ASEAN: A stronghold for coal?

0

5

10

15

20

25

30

35

40

0

5

10

15

20

25

30

2014 2015 2016 2017 2018 2019

CoalDemand[Mt]

GenerationCapacity[GW] Malaysian fuel mix and coal demand

Coal Gas Hydro Coal demand

Source: Tanaga Nasional Berhad (TNB)

Philippines, Vietnam, Indonesia are also expanding their coal-fired capacity…](https://image.slidesharecdn.com/3238ca1f-092d-419d-a881-8dfc4a7b2954-150416164506-conversion-gate02/85/Rodrigo-Flame-April-14-FINAL-12-320.jpg)

![15

Supply: Who wins and who loses?

Indonesia has probably peaked, and the US is already retreating from the export

market. Colombia, Russia and Australia holding better than the rest.

Source: McCloskey, Salva, Argus Consulting, KAPSARC Analysis

0

50

100

150

200

250

300

0

50

100

150

200

250

300

350

400

450

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019

Other–[Mt]

Indonesia–[Mt]

Indonesia (LHS) Australia Steam (RHS) USA (RHS) Russia (RHS) Colombia (RHS)](https://image.slidesharecdn.com/3238ca1f-092d-419d-a881-8dfc4a7b2954-150416164506-conversion-gate02/85/Rodrigo-Flame-April-14-FINAL-15-320.jpg)