Risks and returns

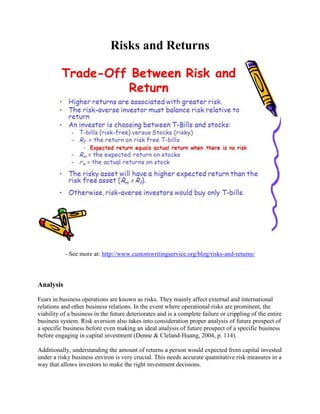

- 1. Risks and Returns - See more at: http://www.customwritingservice.org/blog/risks-and-returns/ Analysis Fears in business operations are known as risks. They mainly affect external and international relations and other business relations. In the event where operational risks are prominent, the viability of a business in the future deteriorates and is a complete failure or crippling of the entire business system. Risk aversion also takes into consideration proper analysis of future prospect of a specific business before even making an ideal analysis of future prospect of a specific business before engaging in capital investment (Denne & Cleland-Huang, 2004, p. 114). Additionally, understanding the amount of returns a person would expected from capital invested under a risky business environ is very crucial. This needs accurate quantitative risk measures in a way that allows investors to make the right investment decisions.

- 2. 1) Discuss the concept of stand-alone or project risk and distinguish this risk and its measure from portfolio risks Standalone risk is a term in portfolio management. Under risk evaluation and management, risk diversification would ensure proximity towards the aversion. In this kind of risk, the interest of top leadership would help to ensure that undiversified personal risk within the complete portfolio (Denne & Cleland-Huang, 2004, p. 129). Project managers under the stand alone risk are able to determine risks associated with a specific project as an individual entity. Whereas the standalone risk if often a measure of the standard nonconformity of anticipated returns, variance co-efficiency of expected return, portfolio risk is still a measure of beta coefficient. One is therefore able to judge the suitability of a specific project portfolio. 2) Using the information given in exhibit 1, determine the most likely rate of return for each investment in the upcoming period. In addition, find the standard deviation of return for each investment. Workings Assuming that all the four incidences have equal opportunities of influencing return levels within the three industries, the probability (Pi) would be 25 percent for I=1, 2, 3 and 4 Hence, E(R) Where E(R) = the predictable return on the store N= the number of situations Pi = the likelihood of scenario i Ri = the return on the stock in state i E (Rw) for Waxell Inc. = 0.25(-2.00%) +0.25(6.75%) + 0.25(9.21%) + 0.25(14.50%) (Rw) = -0.5 + 1.6875 + 2.3025 + 3.625 = 7.115% E (Rs) for Stewart Inc. = 0.25(2.54%) + 0.25(4.35%) + 0.25(6.78%) + 0.25(9.71%) E (Rs) = 0.635 + 1.0875 + 1.695 + 2.4275 = 5.845% E(RE) for Edelman Inc. = 0.25(15.46%) + 0.25(7.50%) + 0.25(4.60%) + 0.25(1.54%) E (RE) = 3.91 + 1.875 + 1.15 + 0.385 = 7.32% From the calculations above, Edelman Inc. has the uppermost expected rate of return.

- 3. Standard deviation = √δ2 , where δ2 is the variance. But discrepancy (δ2 ) 2 For Waxell, δ2 w = 0.25(-2.00-7.115)2 + 0.25(6.75 – 7.115)2 + 0.25(9.21 – 7.115)2 + 0.25(14.50- 7.115)2 δ2 w = 20.77080625 + 0.03330625 + 1.09725625 + 13.63455625 = 35.53592525 Therefore √ δ2 w = 5.961201662 For Stewart, δ2 s = 0.25(2.54 – 5.845)2 + 0.25(4.35 – 5.845)2 + 0.25(6.78 – 5.845)2 + 0.25(9.71 – 5.845)2 δ2 s = 11.173025 + 0.55875625 + 0.21855625 + 14.938225 = 26.88856275 Therefore √ δ2 s = 5.185418281 For Edelman, δ2 E = 0.25(15.46 – 7.32)2 + 0.25(7.50 – 7.32)2 + 0.25(4.60 – 7.32)2 + 0.25(1.54 – 7.32)2 δ2 E = 16.5649 + 0.0081 + 0.4624 + 8.7616 = 25.797 Therefore √ δ2 E = 5.079074719 Using your answer to 2 above and assuming that stockholders can only invest in one of the three alternatives in exhibit 1, use expected returns and standard deviation to determine which alternative would be the most appropriate for a risk-averse investor. Justify your method of comparison. Besides offering the uppermost expected returns on investment among the three companies investing in Edelman Inc. is less risky compared to Waxell or Stewart. This is based on the fact that the variance as well as deviance standards of Edelman Inc. investment are smaller than the two corporations Stewart Inc. and Waxell. From the foregoing, the most ideal alternative for a risk averse stockholder would be Edelman Inc. This is based on the fact that an investor would be better placed to get the highest returns on investment. Similarly, the investor has some confidence level that Edelman Inc. would keep up with its operations even in the unpredictable future since the invested capital is safe. 3) Determine the expected returns and standard deviation of a portfolio comprised of Waxell shares and Stewart shares in equal dollar amounts. Without making any calculation, explain how the computation would be more complex if you were to consider risks and returns for a portfolio of Waxell, Stewart and Edelman shares. Where E[Rp] = the projected return on the portfolio,

- 4. N = the number of stocks in the assortment, wi = the amount of the portfolio invested in stock i, and E[Ri] = the expected return on stock i. For a collection comprising of two shares, the above equation changes to the equation below: We assume that Waxell shares are 50% and Stewarts are 50% within the portfolio E(Rw) = 7.115% E(Rs) = 5.845% Hence a portfolio consisting of 50% Waxell and 50% Stewart would be E(RP) = 0.50 (7.115%) + (1 – 0.50)5.845% = 6.48% δp = √w2 1δ2 1 + w2 2δ2 2 + 2w1w2cov1,2 where w1 is quantity of Waxell share in the assortment, w2 is proportion of Stewart share in the portfolio and δp in the standard deviation of the portfolio. But association coefficient = Cov1, 2/δ1δ2, hence Cov1, 2 = 0.357(5.961201662) (5.185418281) Cov1, 2 = 11.03534269 δp = √0.502 (35.53592525) + 0.502 (26.88856275) + 2(0.50)(0.50)11.03534269 δp = √8.883981313 + 6.722140688 + 5.517671345 δp = 4.596062809 Calculation of anticipated returns from a portfolio of more than one capital share includes the use of subjective averages of respective share capitals. Calculating the weighted the typical of the three share capitals can be complex hence, a reason as to why the entire process of finding the expected returns and a standard variation for a portfolio with the three company shares may be hectic. 4) Use the numbers in exhibition 2 to determine the systemic risk (beta) of stock A and Stock B. which measure, beta or standard deviation is more useful when analyzing stocks that are to be placed in a portfolio? Beta coefficient of stock, β = Cov (Rs, Rm)/δ2 m, where Rs is stock return, Rm is market return and δ2 m is market variance. But Cov (Rs, Rm) = 1/(n – 1)(ΣRmRs – nRmRs) From Exhibit 2, Cov(RA, Rm) = 1/(24 – 1)(1070.5564 – 24(7.650416667)(3.87)) = 15.89104348

- 5. δ2 m = Σ(Rm– Rm)2 /n =33660.4449/24 = 1402.518538 Hence, βA = 15.89104348/1402.518538 = 0.011330362 Cov(RB, Rm) = 1/(24-1)(-73.0987-24(3.84)(4.375416667)) = – 20.7103087 Hence, βB = -20.7103087/1402.518538 = -0.014766513 Beta use is more proficient in evaluating systemic risk involved when combining two stocks in a portfolio. Systemic risk is a volatility of investments measure within a portfolio therefore; one cannot accurately gauge the variability that would occur by utilizing standard deviations. 5) Referring to your solution in the question above, discuss how beta and standard deviation (volatility) are different. In addition, explain how systemic risks and unsystemic risks are different and how each risk is dealt with in the capital markets. Systematic risk is the quantity of venture risk, which the company cannot eliminate via diversification. A company would use the risk to offer an indication of how a specific investment stock in diversified portfolio would contribute towards ensuring that the portfolio is risky for an investment. Since systemic risk cannot be diversified by a company, the risk is mainly known as undiversified risk. Unsystematic risk on the other hand is the amount of invested capital asset’s risk capable of being run by the company by integrating part of the security within the diversifiable company’s portfolio (Tuller, 1994, p. 209). Calculating the systemic risk also needs measure of vulnerability of invested stock by a company against the security portfolio’s average risk. In relevance to connection to stock vulnerability, one can also determine whether the economic bid is more that the security or less that than the security a financial situation presents. It is therefore a common idea that stockholders are risk averse. Therefore, investors make decisions to hold the portfolios with high financial securities level to mitigate with correspondence on the advantages of the divergence processes. Therefore based on the evaluation of costs involved in investment making, investors have the potency of deciding on the most ideal portfolios for investment. The most common question that many stockholders ask before making financial investment in a given portfolio is how good does a market risk contribute to the Expected Return of an investment? 6) The Capital Asset Pricing Model (CAPM) relies on beta as a measure of a firm’s risk. Explain how the CAPM uses beta and illustrate, with an example, how the CAPM or the Security Market Line (SML) can be used to measure a firm’s risk premium and required rate of return Just like in any other business, managers can measure business risks and differentiate between high risk productions processes from low risk processes. There are different methods that have been widely used by managers to determine the amount of risks and how they create the right

- 6. audit to help counteract diverse effects of related risks. Today, many businesses use Capital Asset Pricing Model (CAPM) or Security Market Line (SML) to measure a company’s risk premium (Friend, Bicksler, American Telephone and Telegraph Company and Conference on Risk and Rate of Return, 1977, p. 323). Risk premium is the difference between investment (asset) return and risk free return. This is to say, Risk Premium = Ra – Rf, where Ra and Rf are asset and risk free returns respectively. The formula tries to investigate the amount that a stockholder is likely to get as reward from a venture that faces various risks. In regards to calculation of risk premium, the CAPM formula utilizes beta coefficient to calculate the risk premium of a specific investment. With CAPM in mind, the formula for risk premium would be as bellow. Risk premium = (Rf + β(Rm -Rf)) – Rf where Rf is the risk free return, β is the beta constant and Rm is the marketplace rate of return. For instance, given that the value of beta is 1.08, the market rate of return is 8 percent and risk free rate is 4 percent. One may also calculate risk premium as follows using the CAPM Risk premium = Ra – Rf But Ra = Rf + β(Rm – Rf) = 0.04 + 1.08(0.08- 0.04) = 0.0832 = 8.32% Hence, Risk Premium = 0.0832 – 0.04 = 0.0432 = 4.32% On the other hand, a person can also measure premium risk using the SML method. The SML method becomes quite easy to evaluate and understand when one uses the graphical approach as below (Douglas, 1988, p. 201). It would also be convenient to know that the SML slope is the market risk premium and it can be calculated as Risk Premium = (E[Rm] – Rf). Most importantly, a risk averse investor should be able to interpret the y-intercept of the SML as it is Risk Free rate. Conclusion The main reason as to why people make investments in different businesses is to realize high returns at the end of an accounting period. Investors make investments if they conclude that their investments can grow to a level of capturing high returns in the long run. Businesses also operate in uncertain future full of fears. Such fears are constraints that make stockholders shun away from making contributions via financial engagement and in a way that will help the business to grow. When it comes to performance of the business, the viability of future operation strategies depend on the fact that the management are able to evaluate the future prospect of the business through policy makers. Therefore, it calls for ideal financial audit as well as planning in light to anticipated returns and possible constraints.

- 7. Every business is also expected to operate within set goals, which to some level may end up facing financial risks of high levels. Even so, one should note with a lot of confidence that for any business operations, risks are inevitable and should not prevent anyone from making an investment. Realization of the viability of the future of a business in terms of capital stock is also highly proponent in risk aversion. Recommendation It is true that as businesses focus on maximizing output levels, thus returns generated from different production processes, stockholders also aim at achieving high returns from their invested capital and at constant intervals of time throughout a business’s life cycle (Tuller, 1994, p. 202). Before accepting to engage in a specific production processes, businesses should try and understand the nature of complexities involved as well as possible risks under such a production environment. Risks can be managed through proper analysis and understanding of external and internal business environment (Tuller, 1994, p. 205). In the event where the possibility of reducing specific operational risks is zero then the production analysis would be more ideal compared to making an investment in a business environment that is very risky. Investors on the same note should be able to interpret presented information by companies over risks involved and expected returns. This return as well as risk analysis would also put investors on the verge of choosing what is more ideal to them. The intention is to maximize on returns arising from production processes. From such incidences, more specifically example 1, a rational investor should be in a position to link his or her interests to make an investment to the company that would guarantee high returns and being subjected to share stocks as a way of achieving an environment that is less risky. The underlying factor is that many stockholders are risk averse and it means they do not interact often with business plans that are risky. REFERENCES Denne, M., & Cleland-Huang, J. (2004). Software by numbers: Low-risk, high-return development. Upper Saddle River, NJ: Prentice Hall PTR. Douglas, L. G. (1988). Yield curve analysis: The fundamentals of risk and return. New York: New York Institute of Finance. Friend, I., Bicksler, J. L., American Telephone and Telegraph Company., & Conference on Risk and the Rate of Return. (1977). Risk and return in finance. Cambridge, Mass: Ballinger Pub. Co.

- 8. Tuller, L. W. (1994). High-risk, high-return investing. New York: J. Wiley & Sons. We can assist you write a business paper like the one above. Get in touch with us today if you want us to assist you by visiting our homepage. You can also learn more from this blog by perusing through the archives for many academic papers posted here. - See more at: http://www.customwritingservice.org/blog/risks-and-returns/