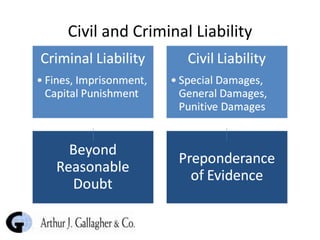

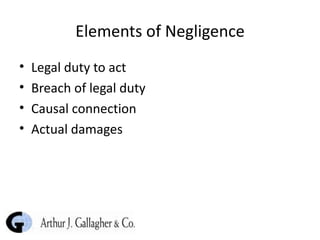

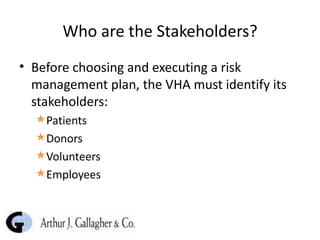

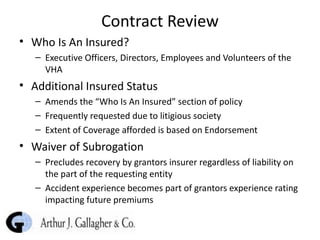

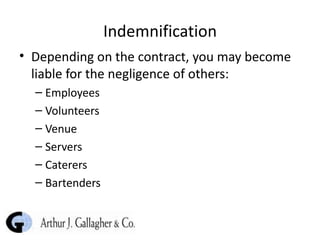

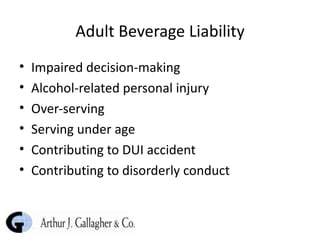

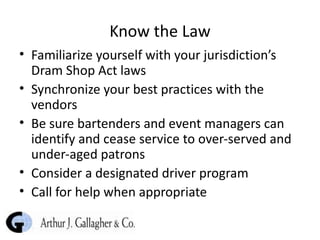

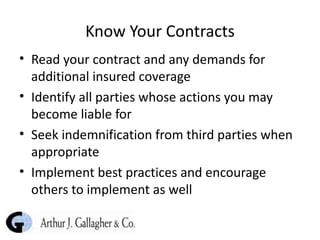

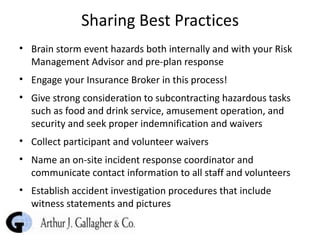

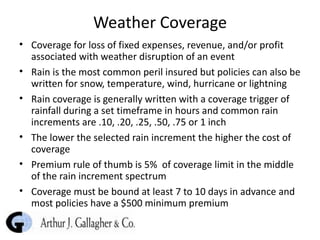

The document outlines risk management practices specific to nonprofit organizations, emphasizing the importance of identifying stakeholders including patients, donors, volunteers, and employees. It discusses various risks associated with events, such as liability for injuries and alcohol-related incidents, and highlights the need for proper contracts, insurance, and best practices. Additionally, it provides information on weather coverage for events, including specific details on triggers and premiums.

![Our Presenters Joseph Caruso CIC, SCLA Area Senior Vice President, 25 years risk management experience, Finance and Claims background. Phone: 678-393-5281 Mobile: 770-845-7075 Email: [email_address] Jim Linn Area Senior Vice President, 31 years risk management experience, Finance, Audit, and Underwriting background. Phone: 678-393-5280 Mobile: 770-714-4714 Email: [email_address]](https://image.slidesharecdn.com/nhcriskmanagement-specialevents-111120142337-phpapp01/85/Risk-Management-and-Special-Events-2-320.jpg)