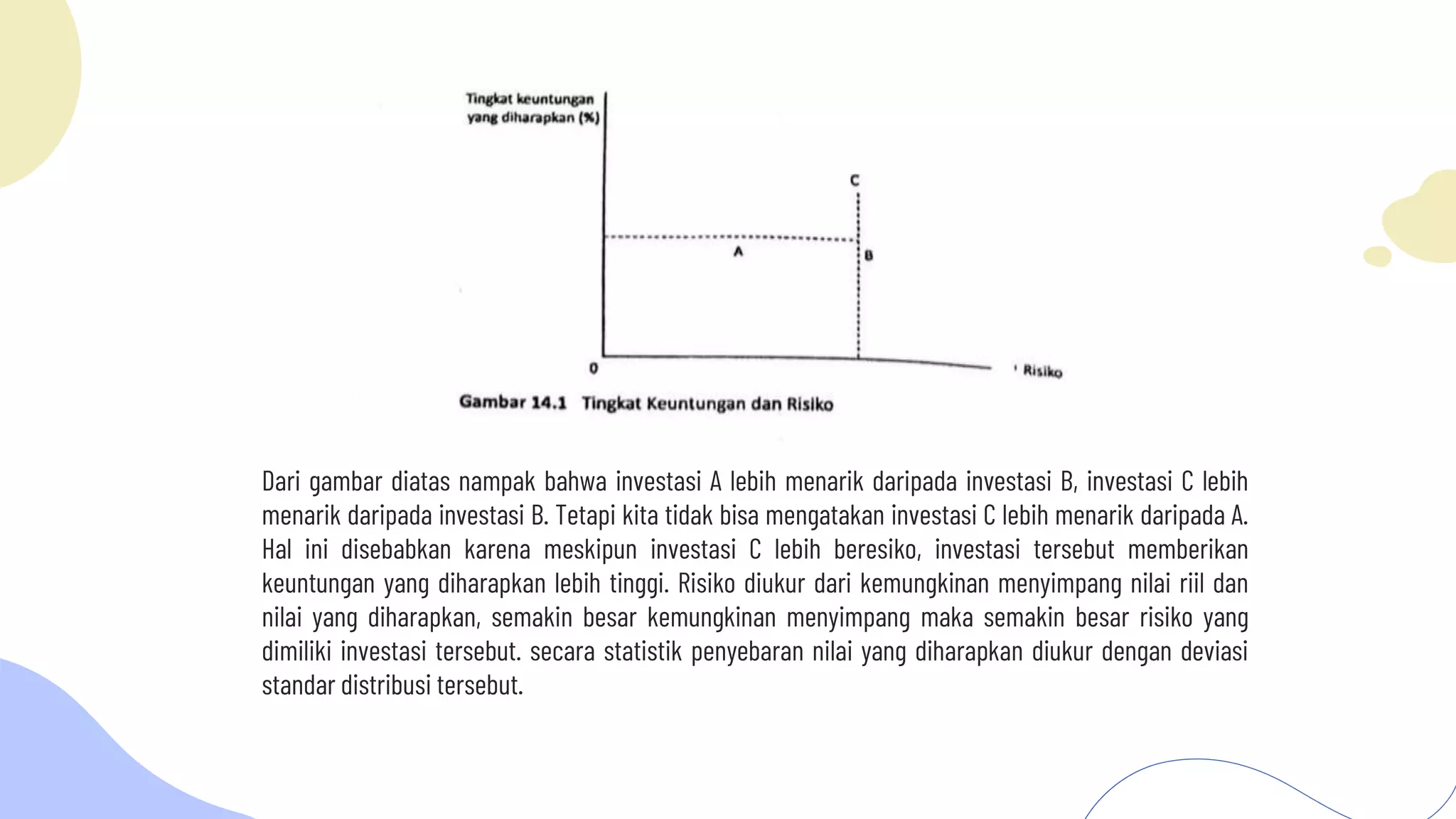

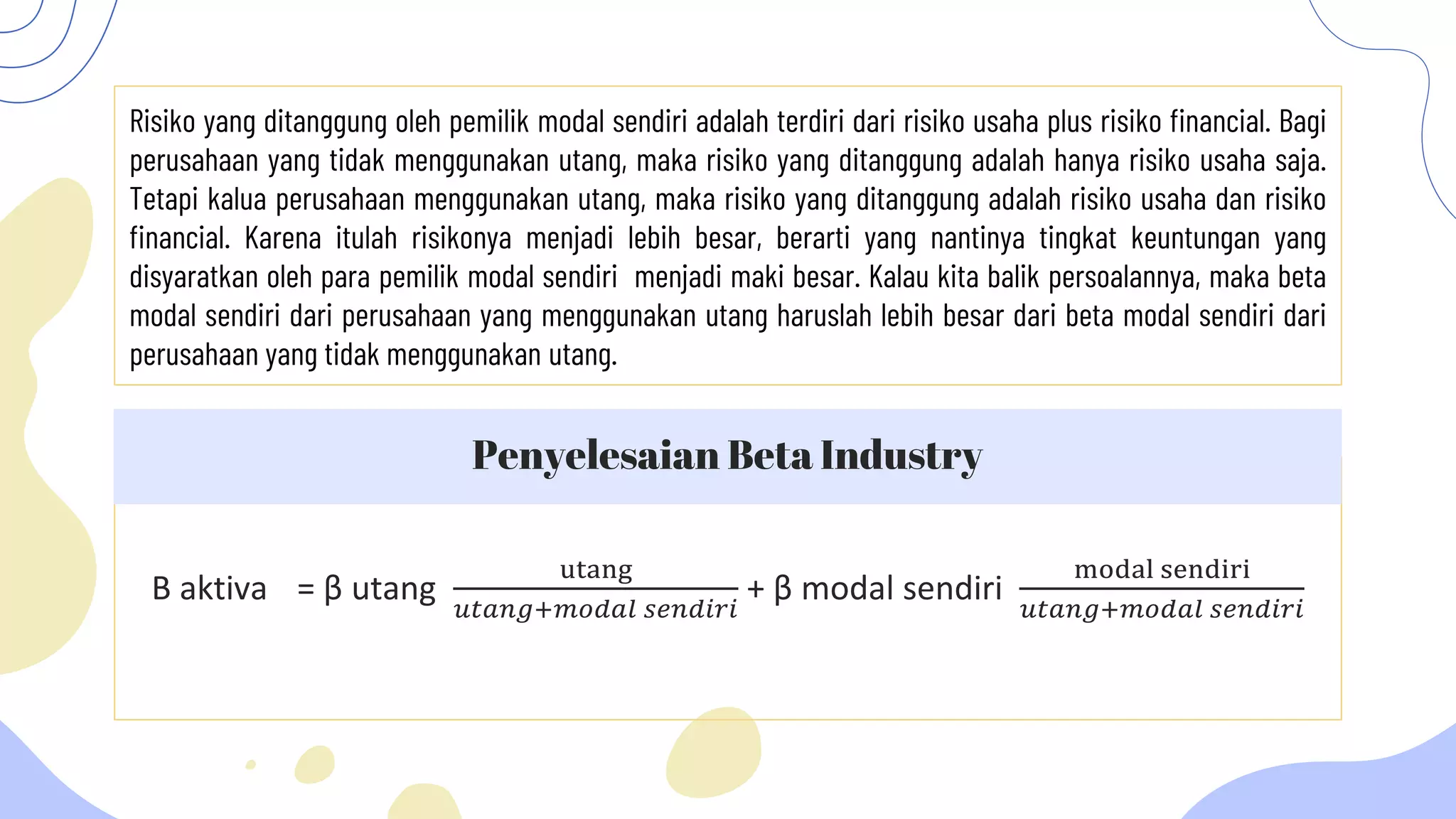

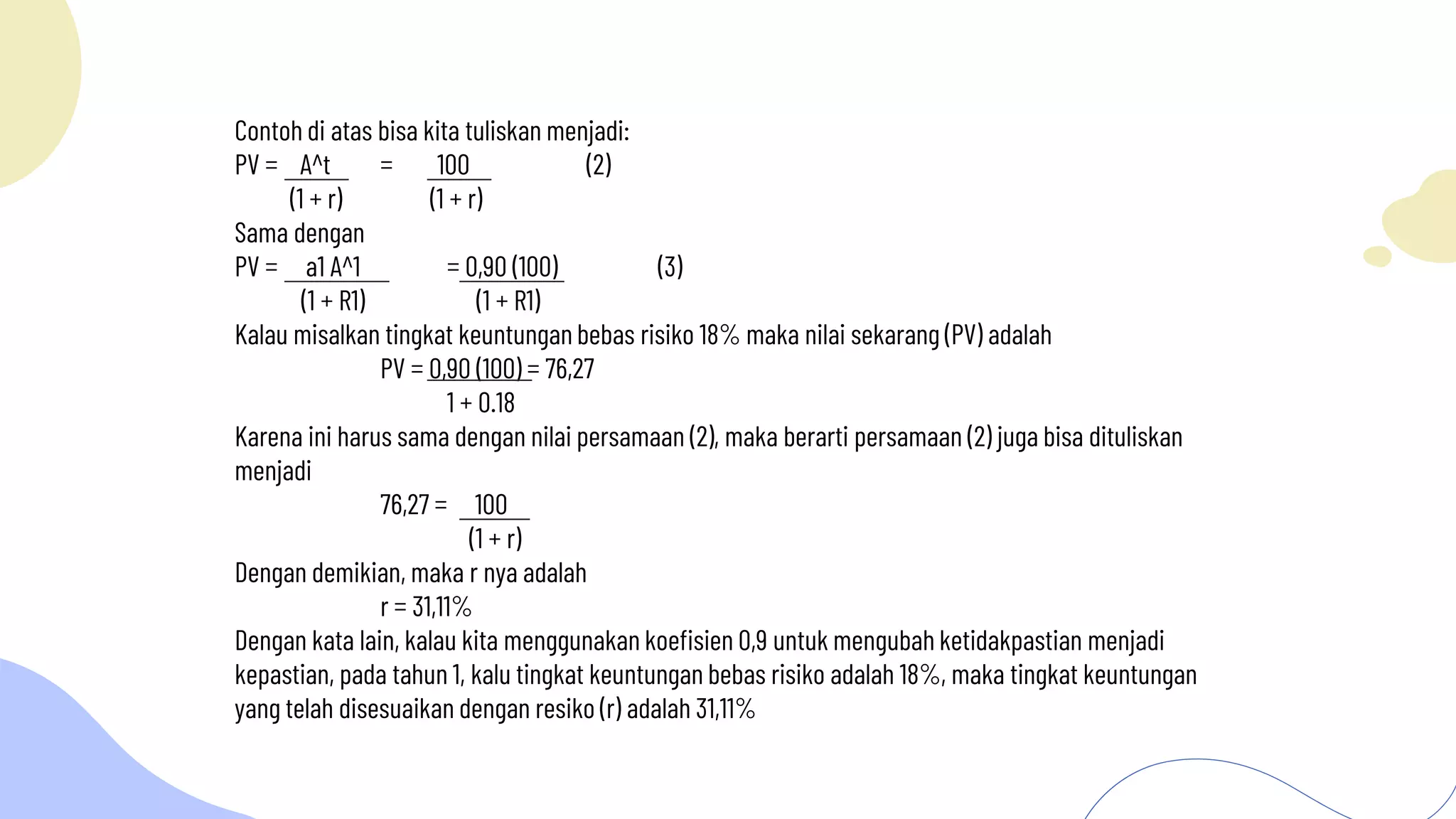

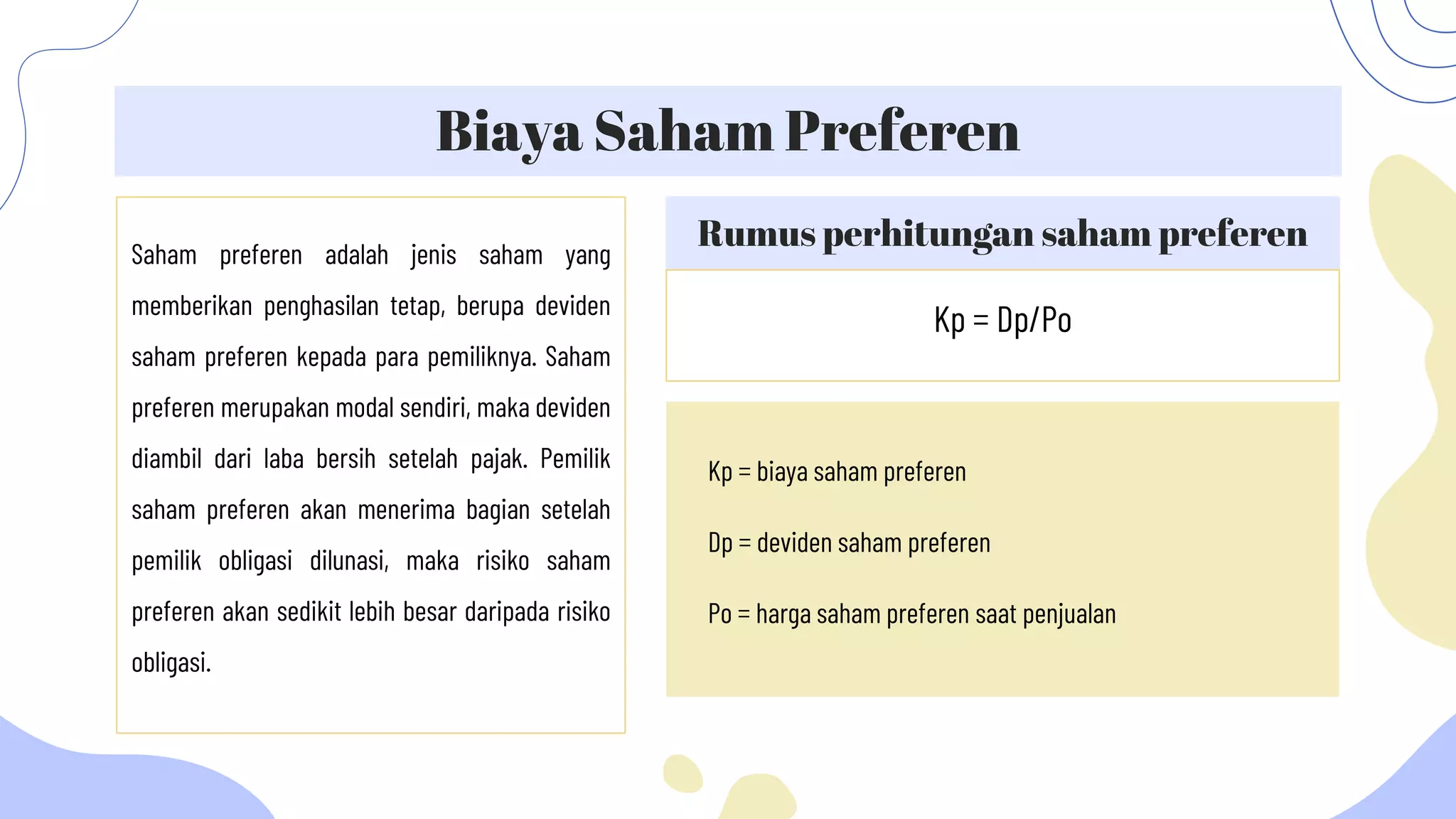

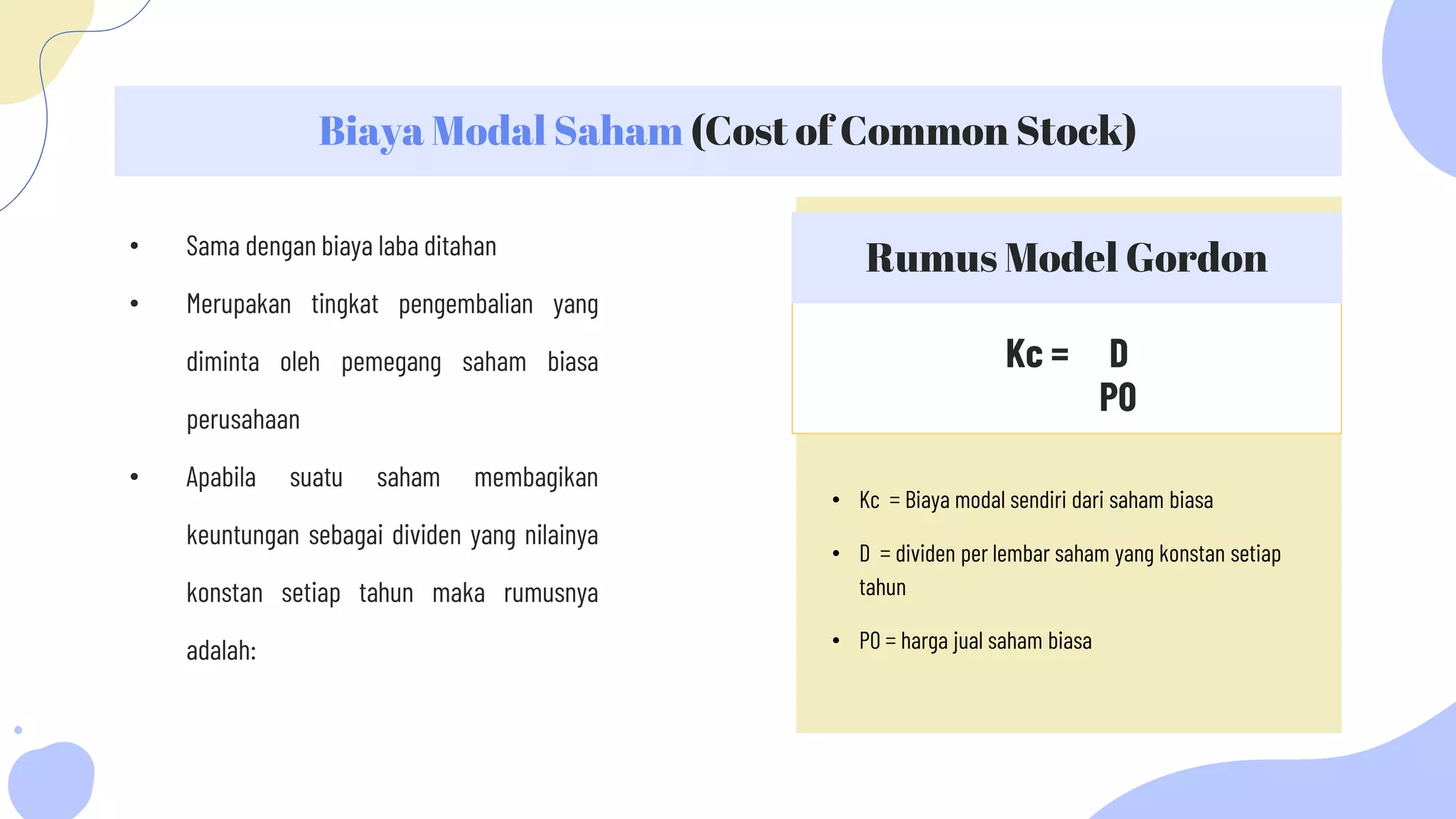

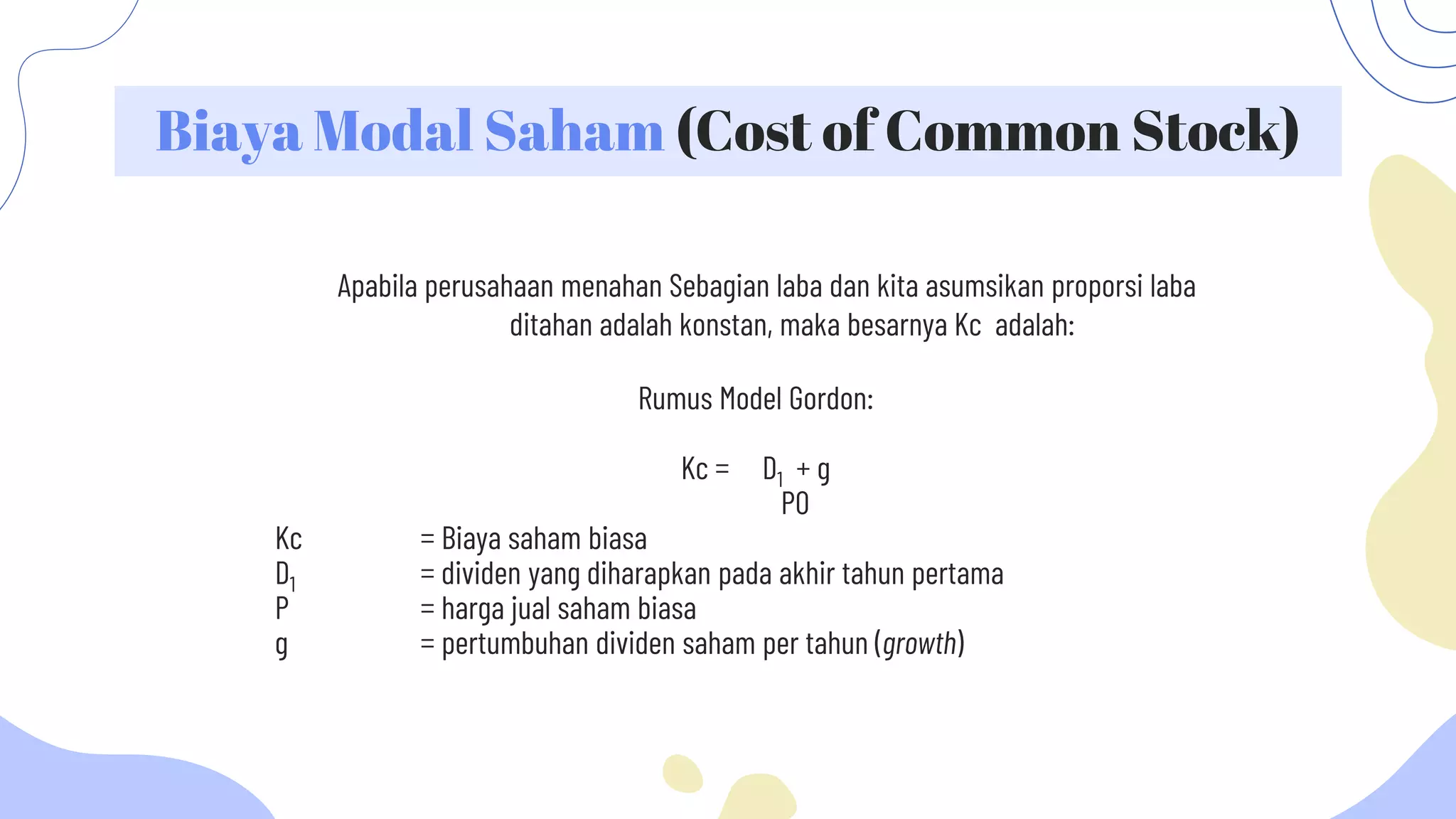

The document discusses the concepts of risk in investment, cost of capital, and business feasibility studies. It explains that higher risk investments require higher expected returns from capital owners. When evaluating investments using NPV, the relevant discount rate must be determined. The discount rate represents the return expected by capital owners and will be higher for riskier projects. It also discusses the capital asset pricing model and how risk is measured statistically. Cost of debt, equity, and weighted average cost of capital are defined to determine the appropriate discount rate.