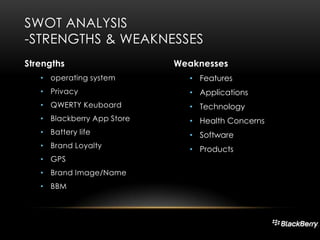

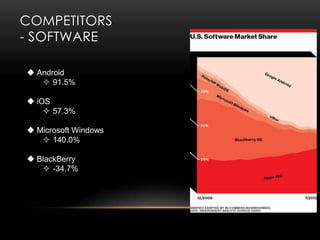

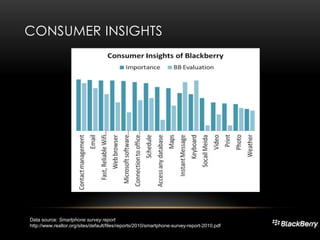

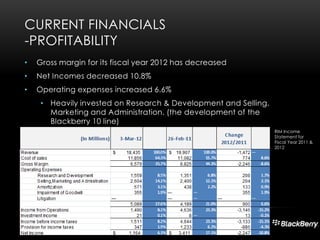

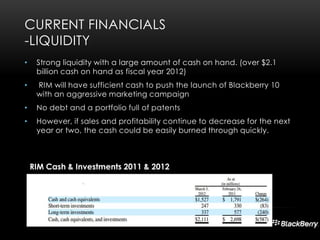

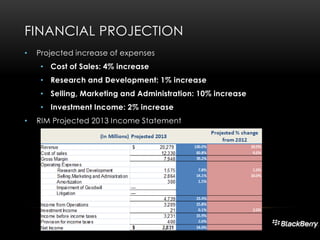

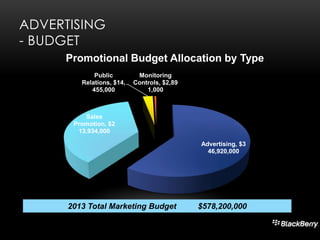

Research In Motion (RIM) is a Canadian company known for developing the BlackBerry smartphone. The document discusses RIM's products, market trends showing increasing smartphone usage, a SWOT analysis and competitors. It outlines RIM's marketing objectives to increase awareness, distribution and market share through targeting younger professionals and consumers. Financial projections estimate 10% revenue growth and 55 million devices sold in 2013 with increased marketing expenses. The positioning focuses on BlackBerry providing efficiency for busy professionals.