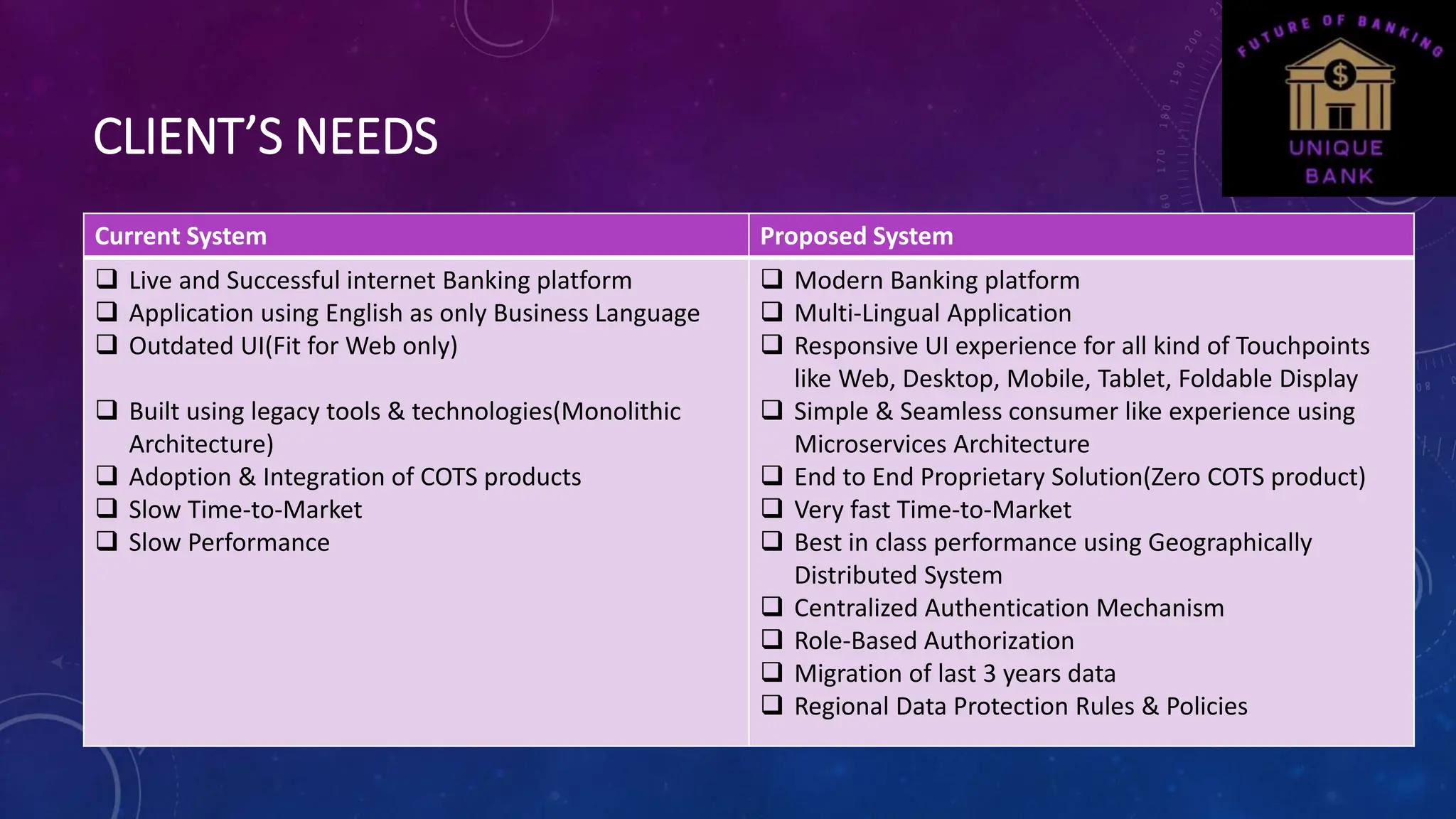

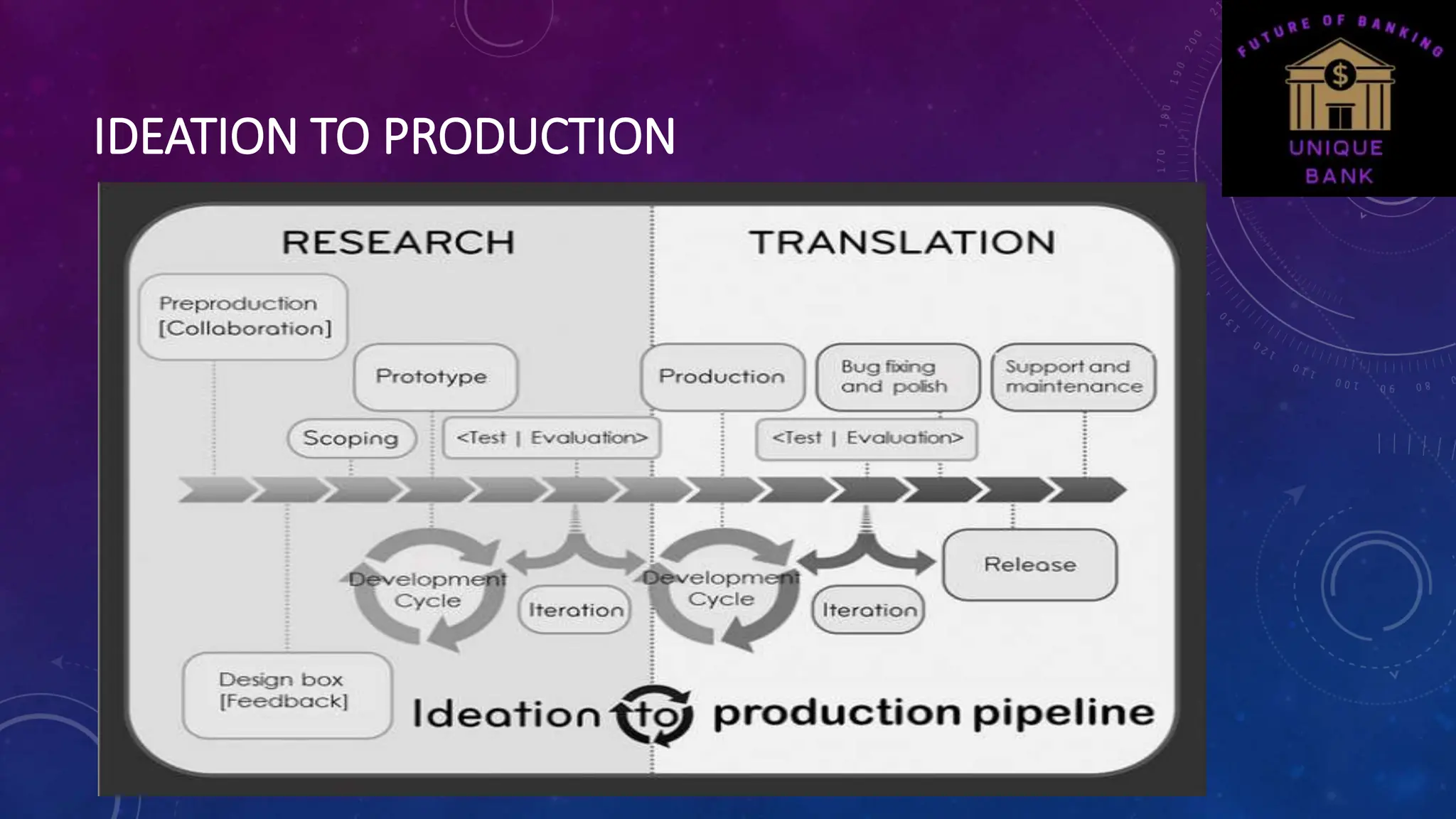

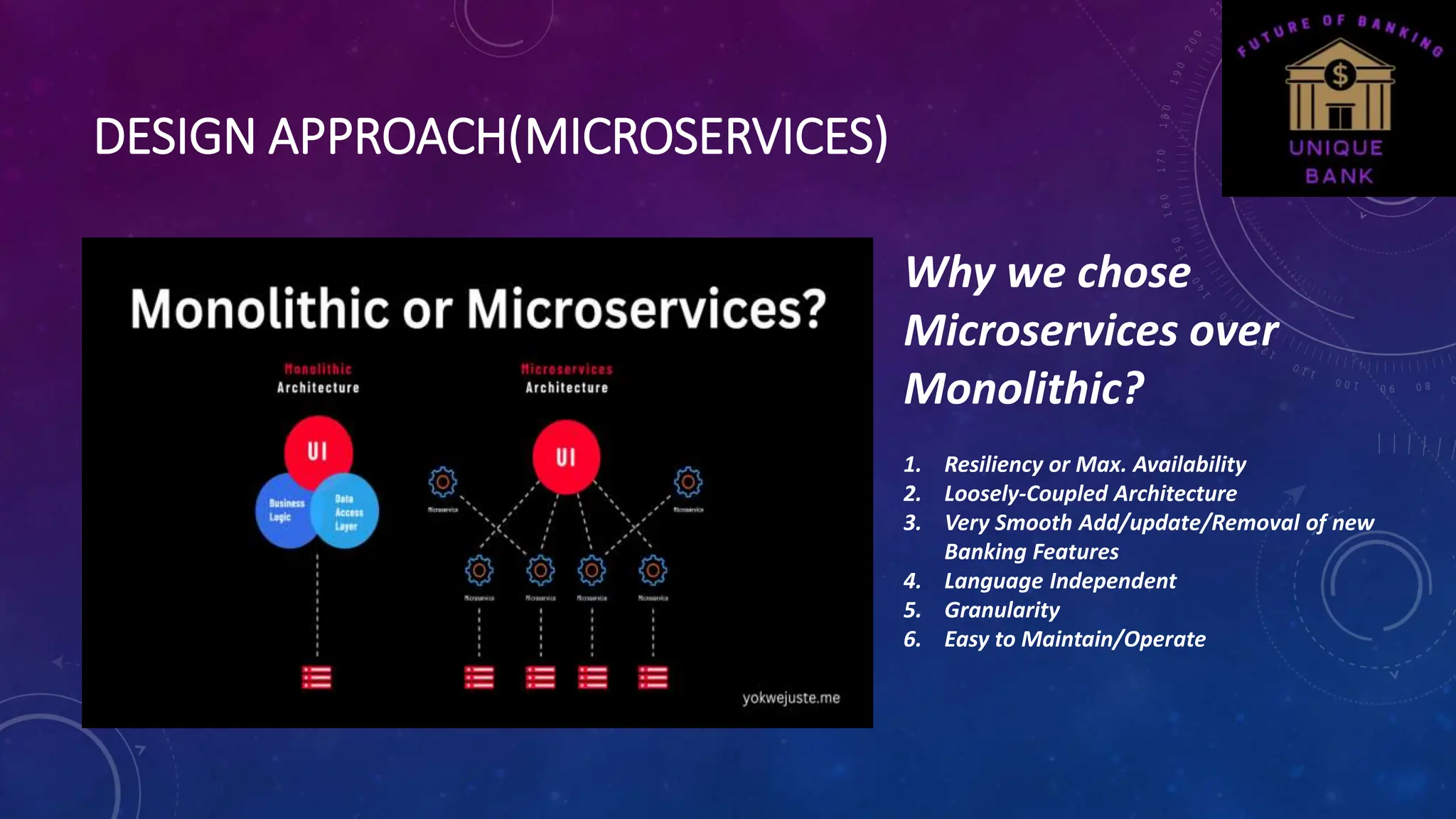

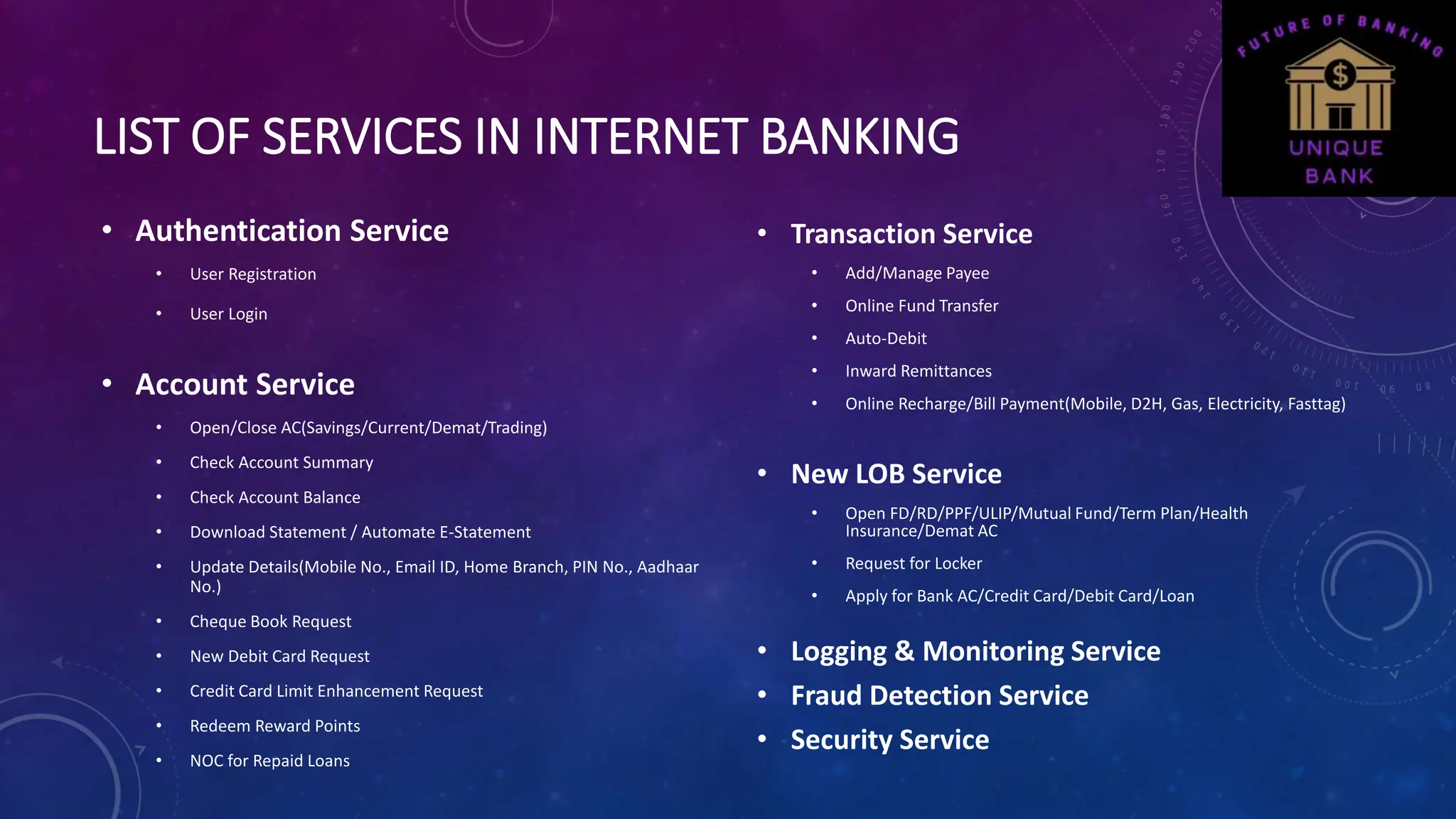

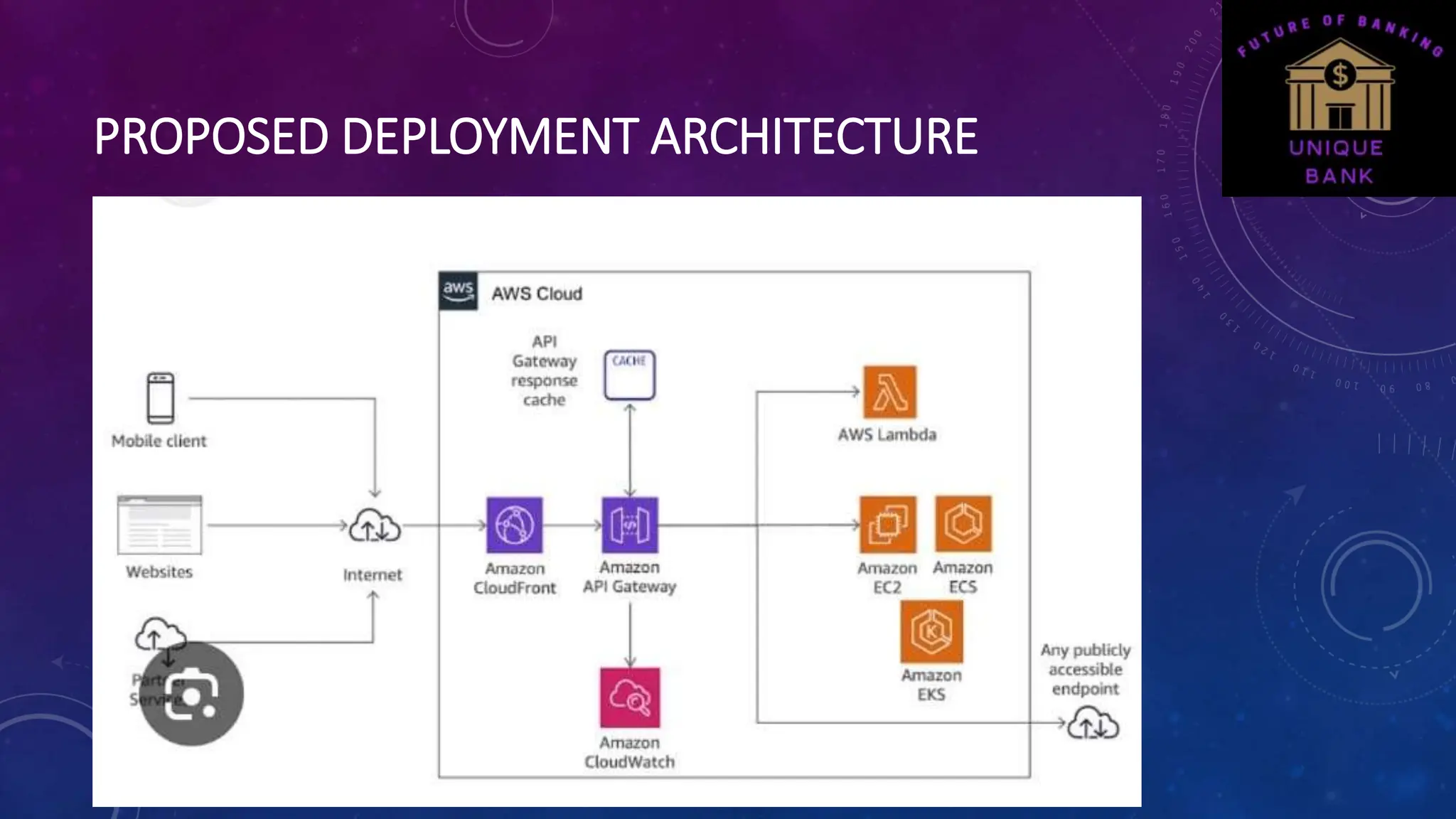

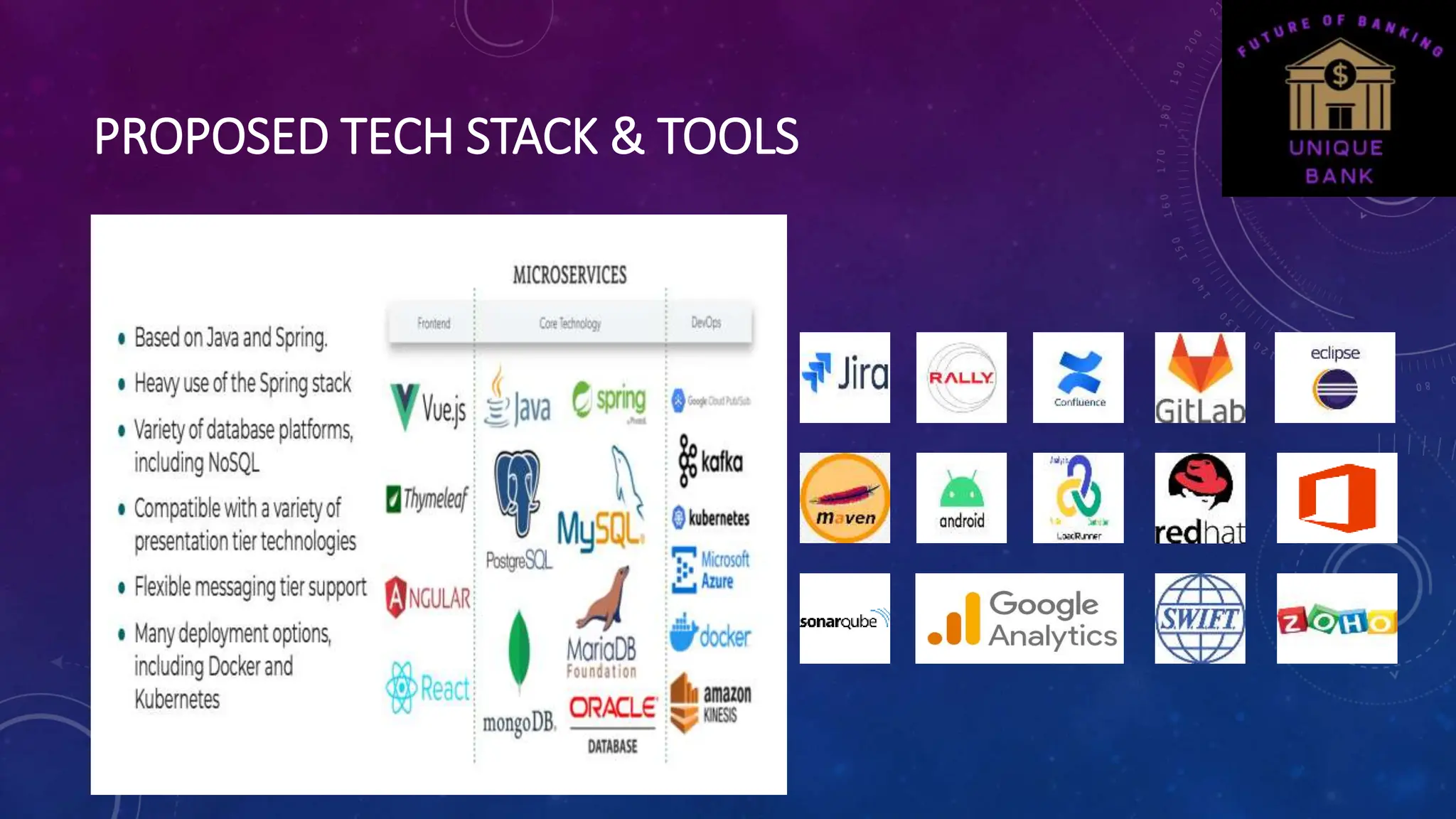

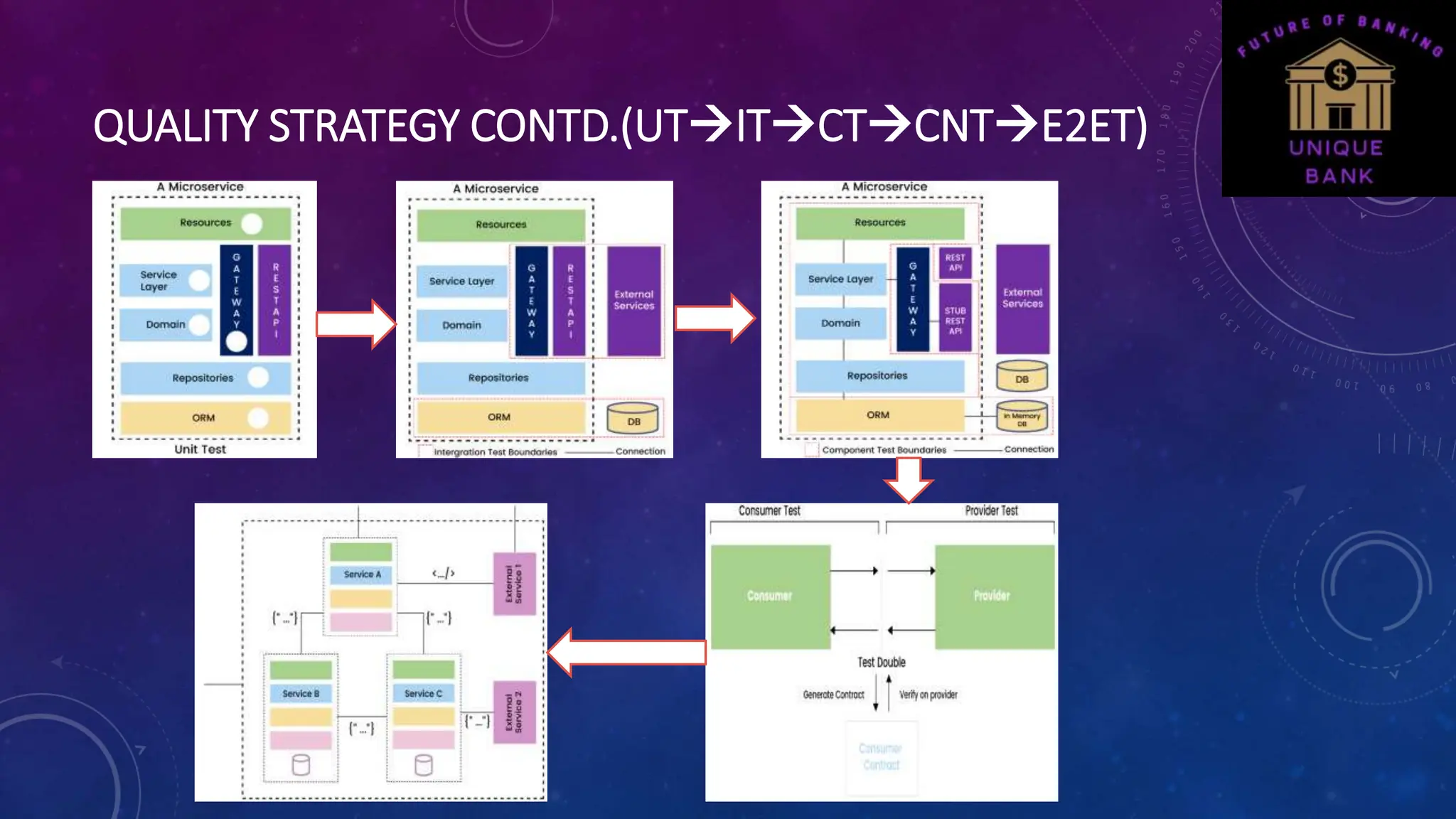

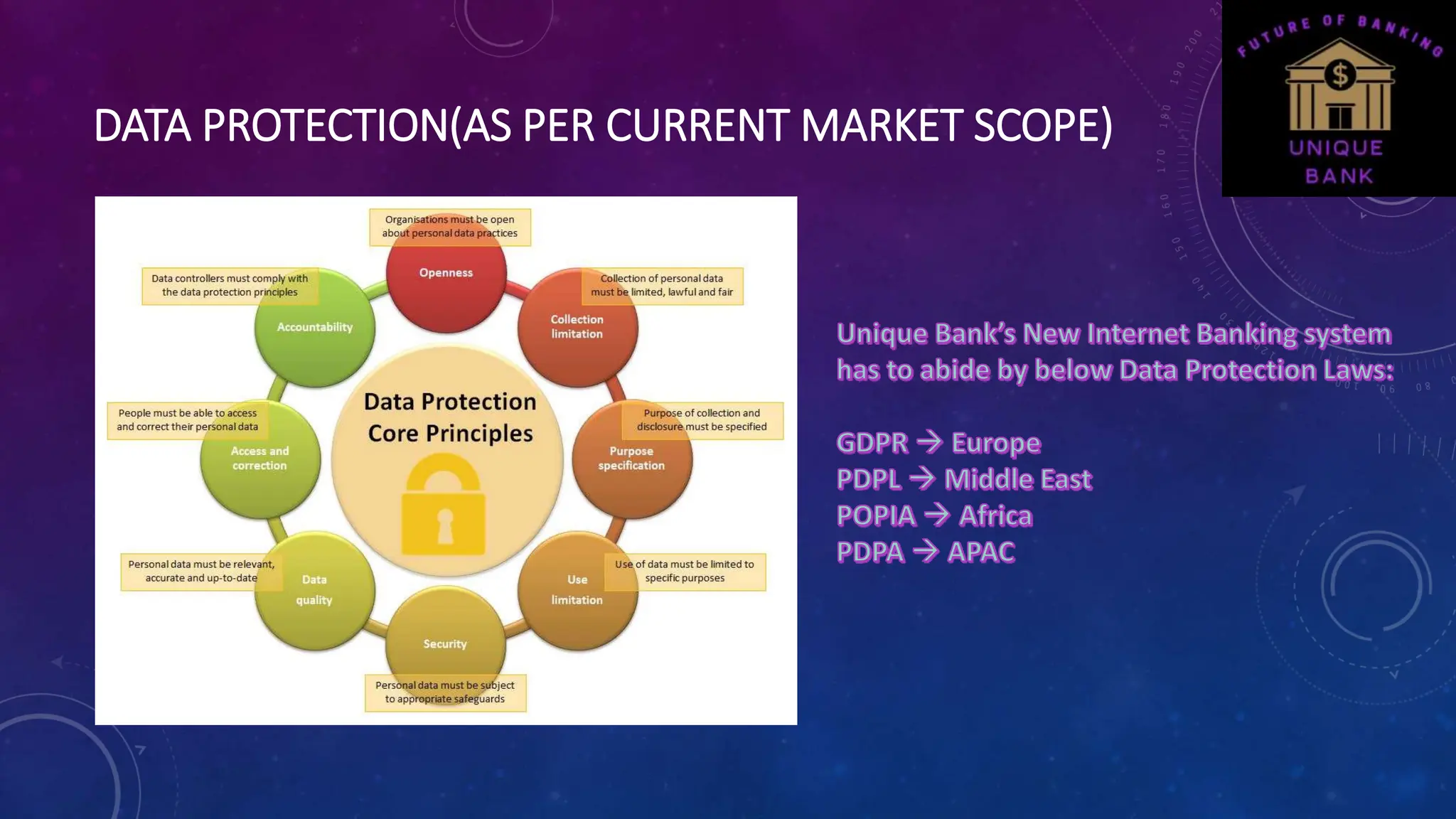

Unique Bank seeks to modernize its internet banking platform by replacing the existing system with a custom software solution that enhances user experience and supports mobile compatibility. The project involves migrating data from the last three years, implementing a microservices architecture for improved performance, and ensuring a centralized authentication mechanism. Key challenges include managing risks related to budget, schedule, and data protection compliance, while maintaining client engagement for successful prioritization of business objectives.