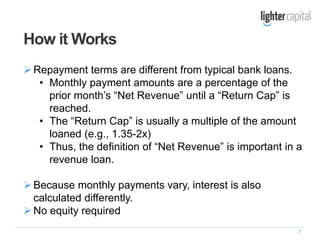

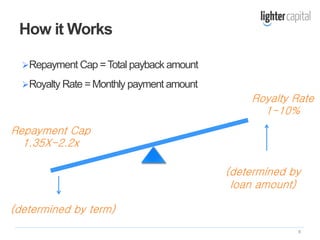

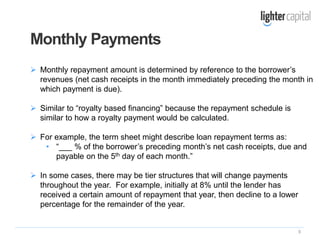

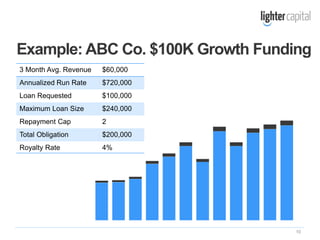

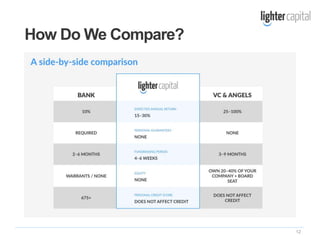

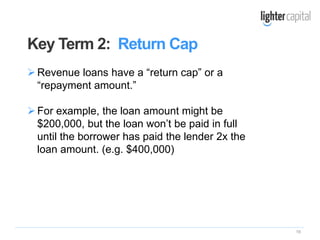

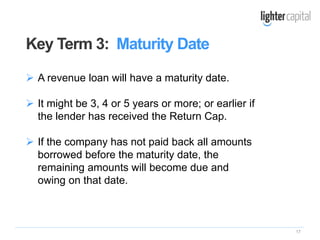

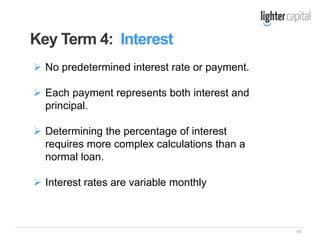

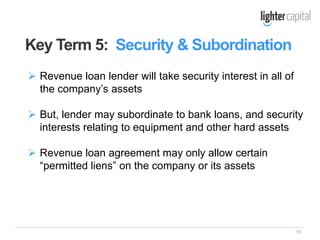

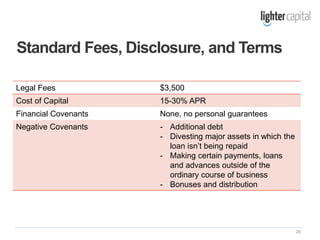

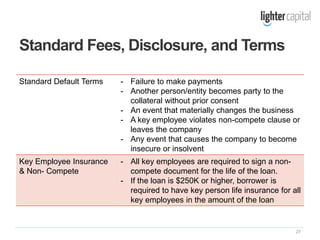

The document provides an overview of revenue-based financing. It explains that revenue-based financing involves a lender loaning funds to a business and receiving repayments as a percentage of the business's ongoing gross revenue. The lender's payments vary based on the business's revenue, allowing the borrower flexibility. Key terms of revenue-based financing agreements include the repayment cap, royalty rate, definition of net revenue, interest calculations, security interests, and access to financial records. Revenue-based financing differs from traditional bank loans and equity financing by not requiring collateral, personal guarantees, or company equity while also aligning the interests of the borrower and lender.