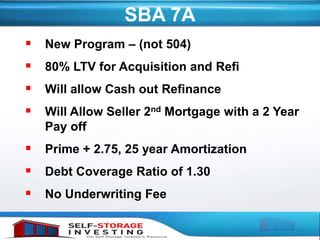

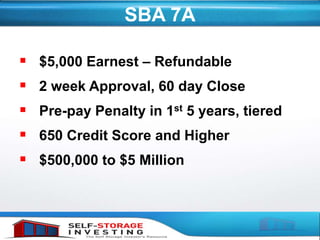

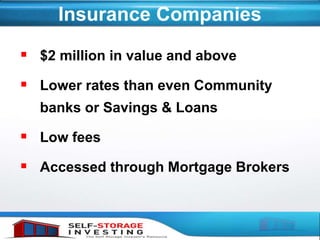

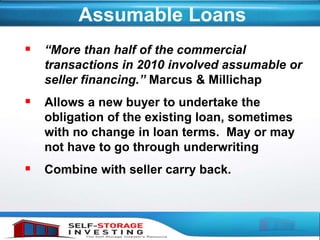

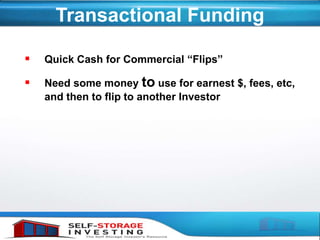

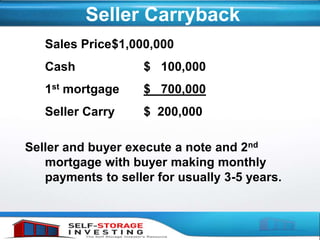

This document discusses various options for funding self storage facility purchases and deals, including: mortgage brokers, community banks, SBA 7A loans, insurance companies, assumable loans, transactional funding, hedge funds, credit lines, equity in other properties, refinancing existing properties, seller carrybacks, selling existing or personal properties, borrowing against insurance, mezzanine lenders, bringing in a partner, and forming a syndicate. It emphasizes doing deals that still cash flow after funding and exploring many potential sources of capital.