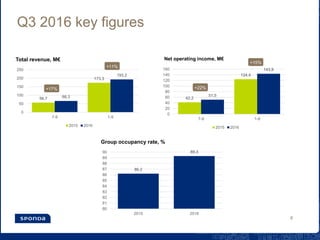

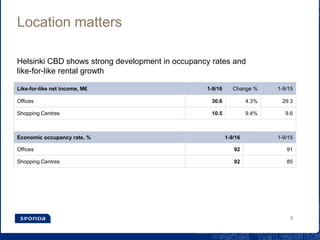

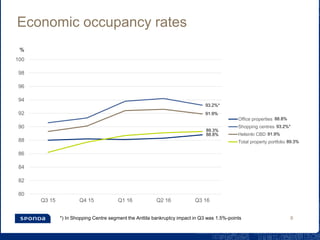

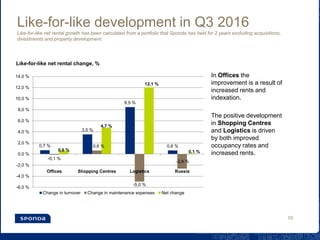

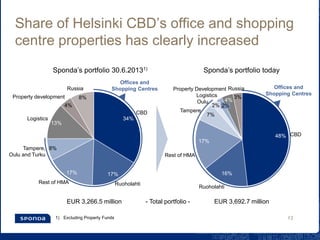

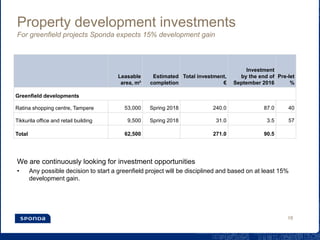

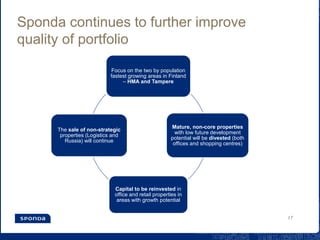

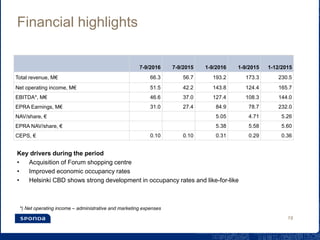

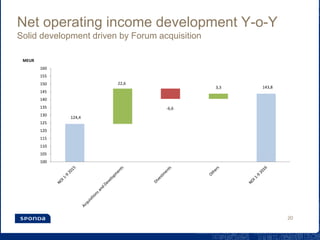

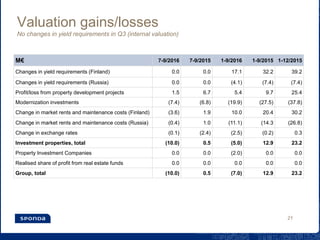

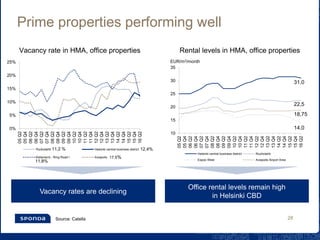

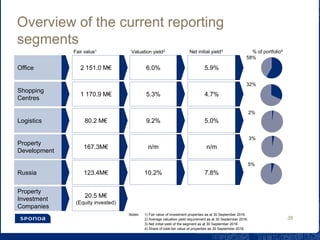

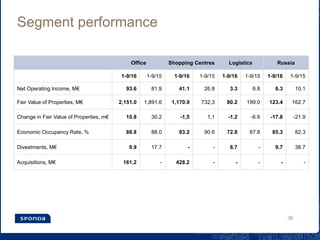

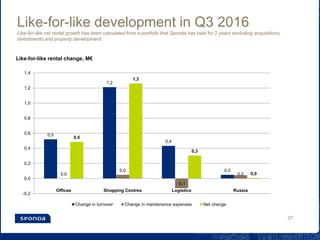

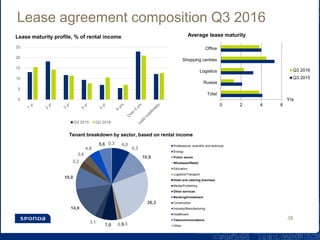

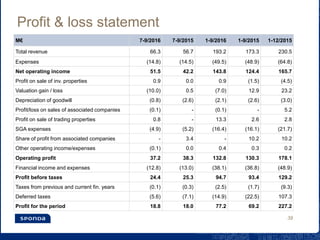

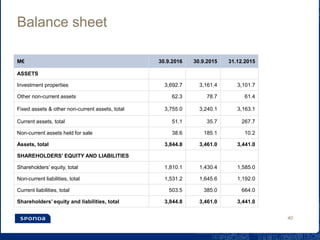

Sponda reported strong financial results for Q3 2016. Key highlights included continued positive performance in the shopping centre segment driven by like-for-like rental growth of 4.7% and occupancy increasing to 93.2%. Sponda largely completed its planned divestment of non-core assets, selling logistics properties and its remaining Russian portfolio. Business conditions in Finland remain positive with economic growth turning positive, record high real estate transaction volumes, and decreasing prime property yield requirements. Sponda is focused on further improving portfolio quality by investing in growth areas like Helsinki and Tampere and divesting mature properties with lower potential.