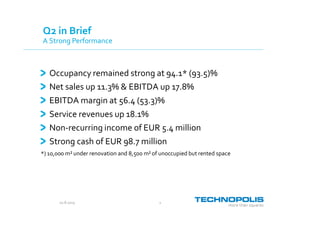

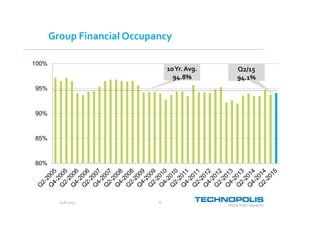

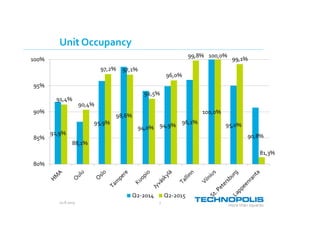

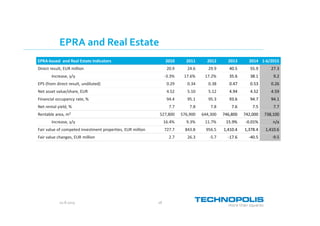

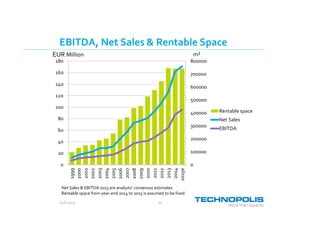

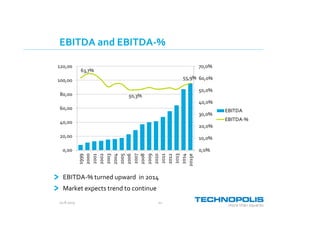

- The company had a strong second quarter performance in 2015 with occupancy remaining high at 94.1%, net sales up 11.3% and EBITDA up 17.8%.

- Non-recurring income provided an additional EUR 5.4 million from early lease terminations.

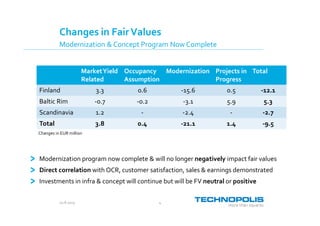

- The modernization program is now complete and will no longer negatively impact property values, with investments in concepts and infrastructure continuing.

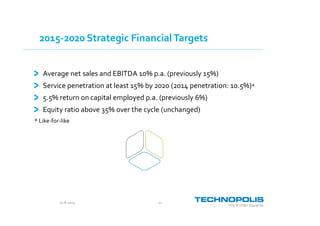

- The company is sticking to its 2015 guidance for 4-6% net sales growth and 5-7% EBITDA growth.