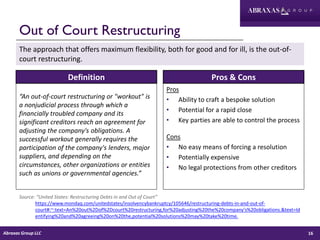

The document discusses the challenges facing small and mid-sized businesses in the wake of a significant global economic downturn, which is projected to be three times worse than the 2008-2009 financial crisis. It highlights the importance of restructuring as a means for companies to buy time and align creditor interests while addressing the disparities in sentiment among business leaders. Various restructuring methods, including Chapter 11 bankruptcy, assignments for the benefit of creditors, and out-of-court workouts are reviewed, emphasizing the need for understanding stakeholder perspectives and securing adequate funding.