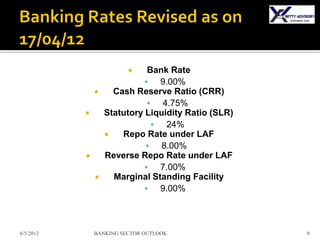

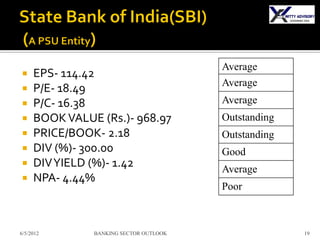

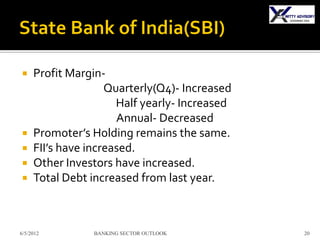

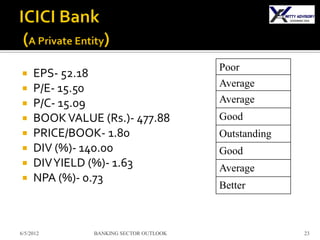

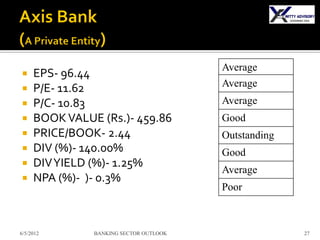

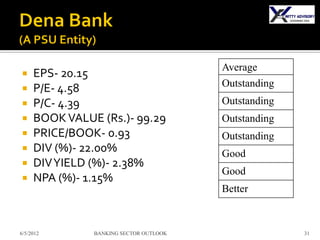

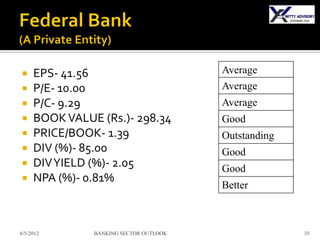

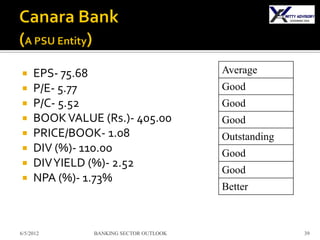

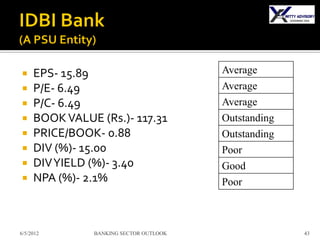

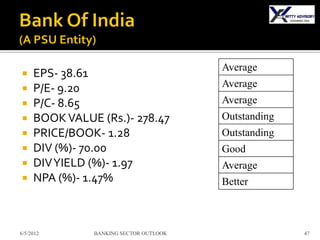

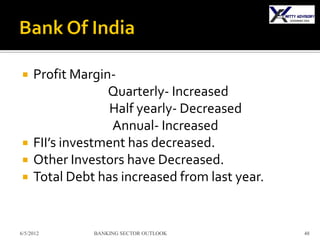

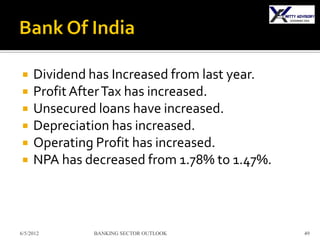

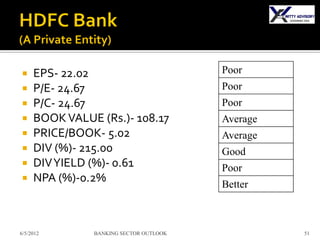

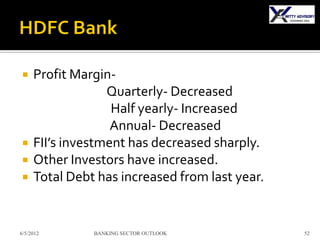

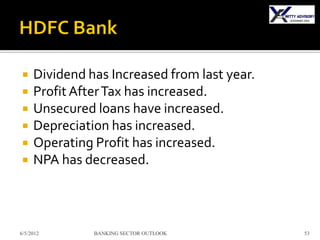

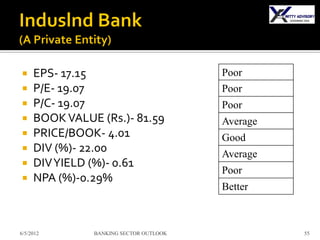

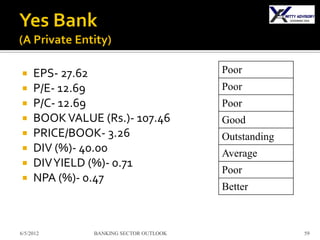

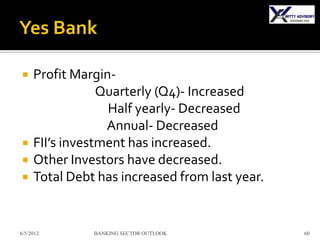

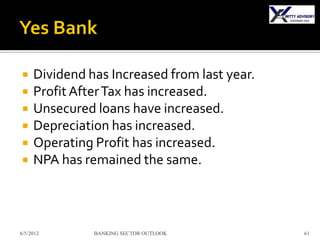

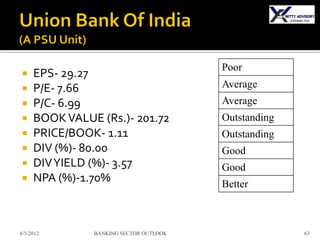

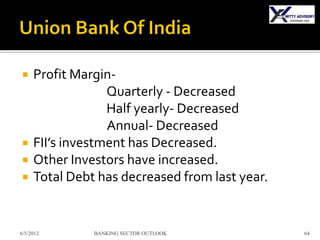

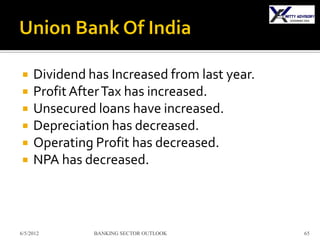

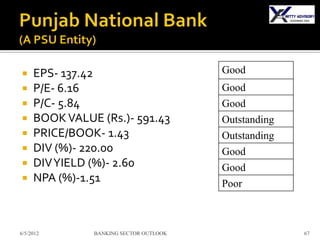

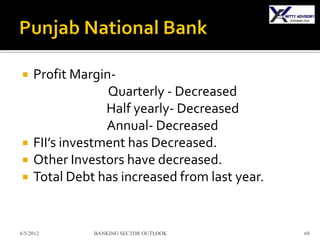

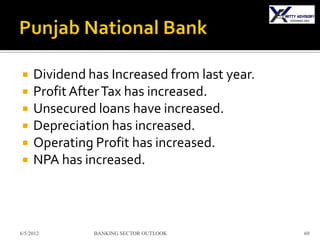

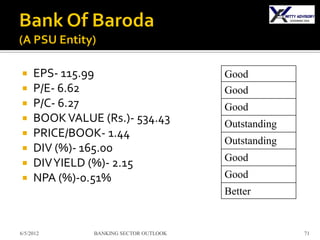

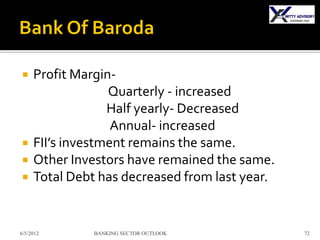

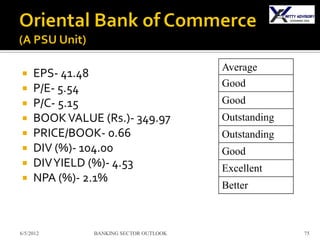

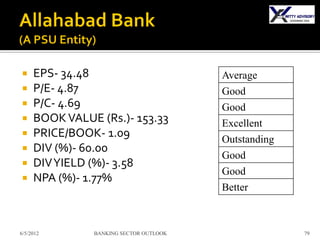

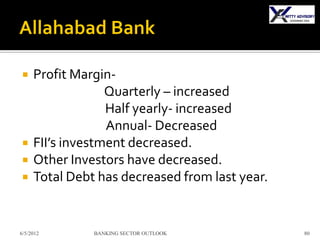

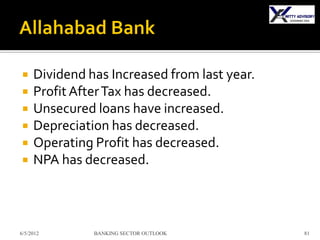

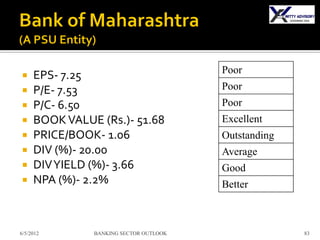

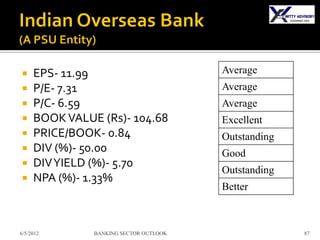

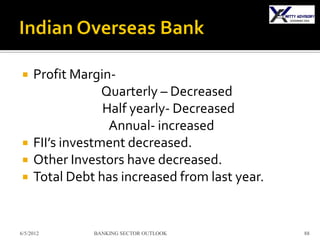

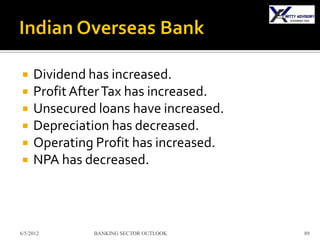

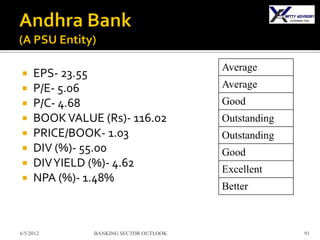

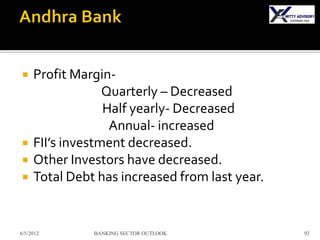

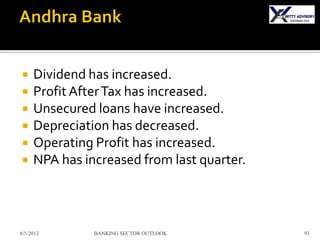

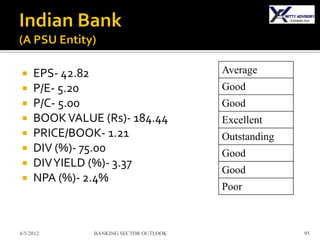

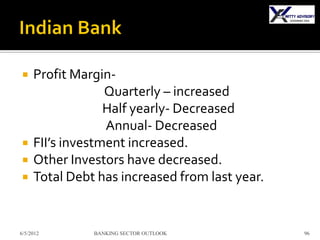

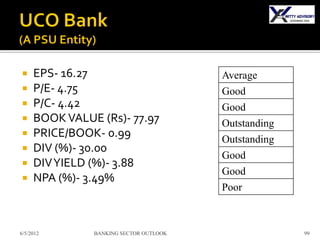

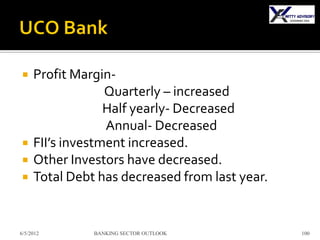

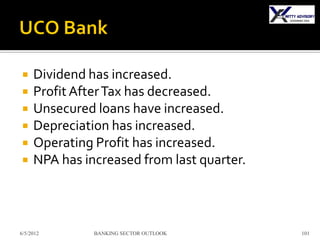

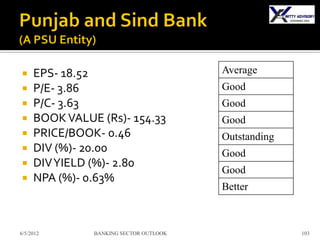

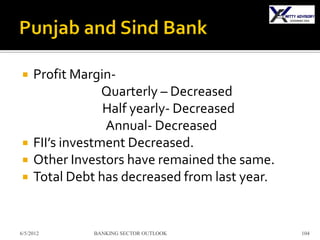

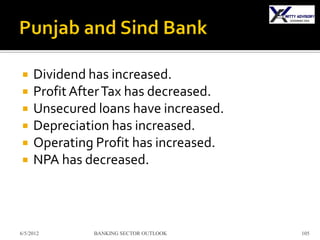

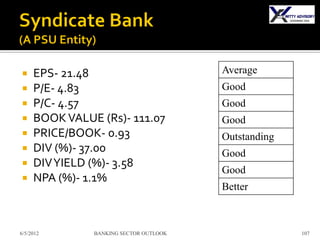

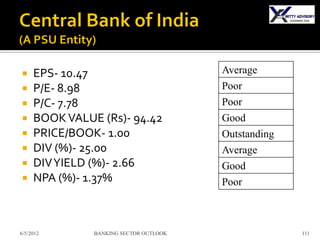

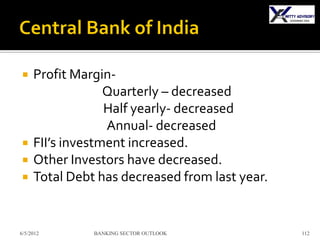

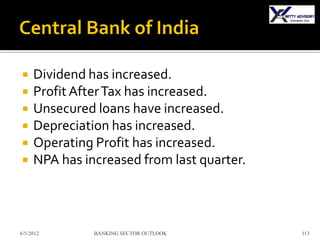

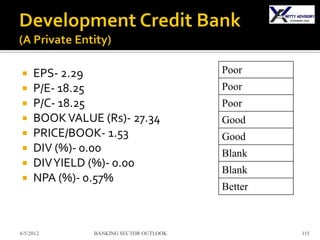

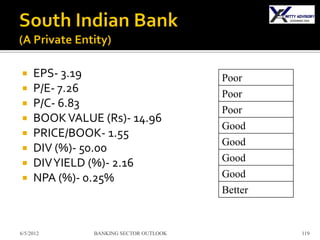

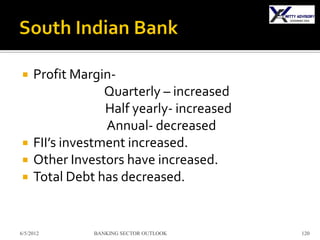

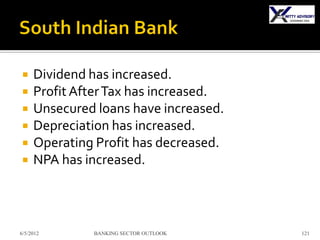

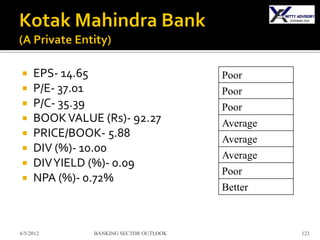

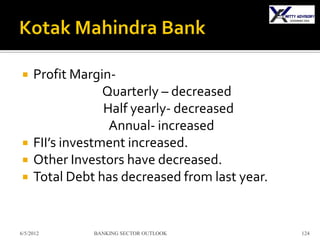

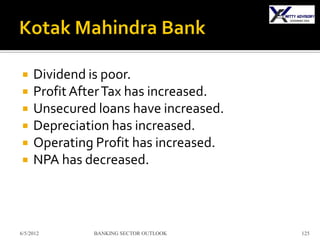

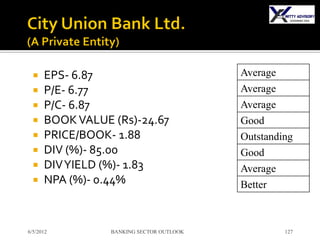

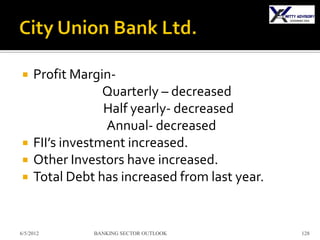

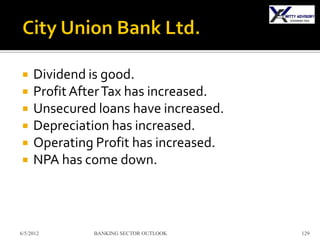

The document provides an analysis and outlook of the Indian banking sector as of June 5th, 2012 by Witty Advisory. It discusses key parameters like earnings per share, price-to-earnings ratio, revised banking rates, ratio analysis terms, and an outlook on major banks. Overall, it finds the banking sector has been relatively insulated from the global financial crisis but notes signs of slowing economic growth. It provides performance metrics and commentary on several large banks and concludes with a short-term outperforming outlook for the sector overall in the long-term.