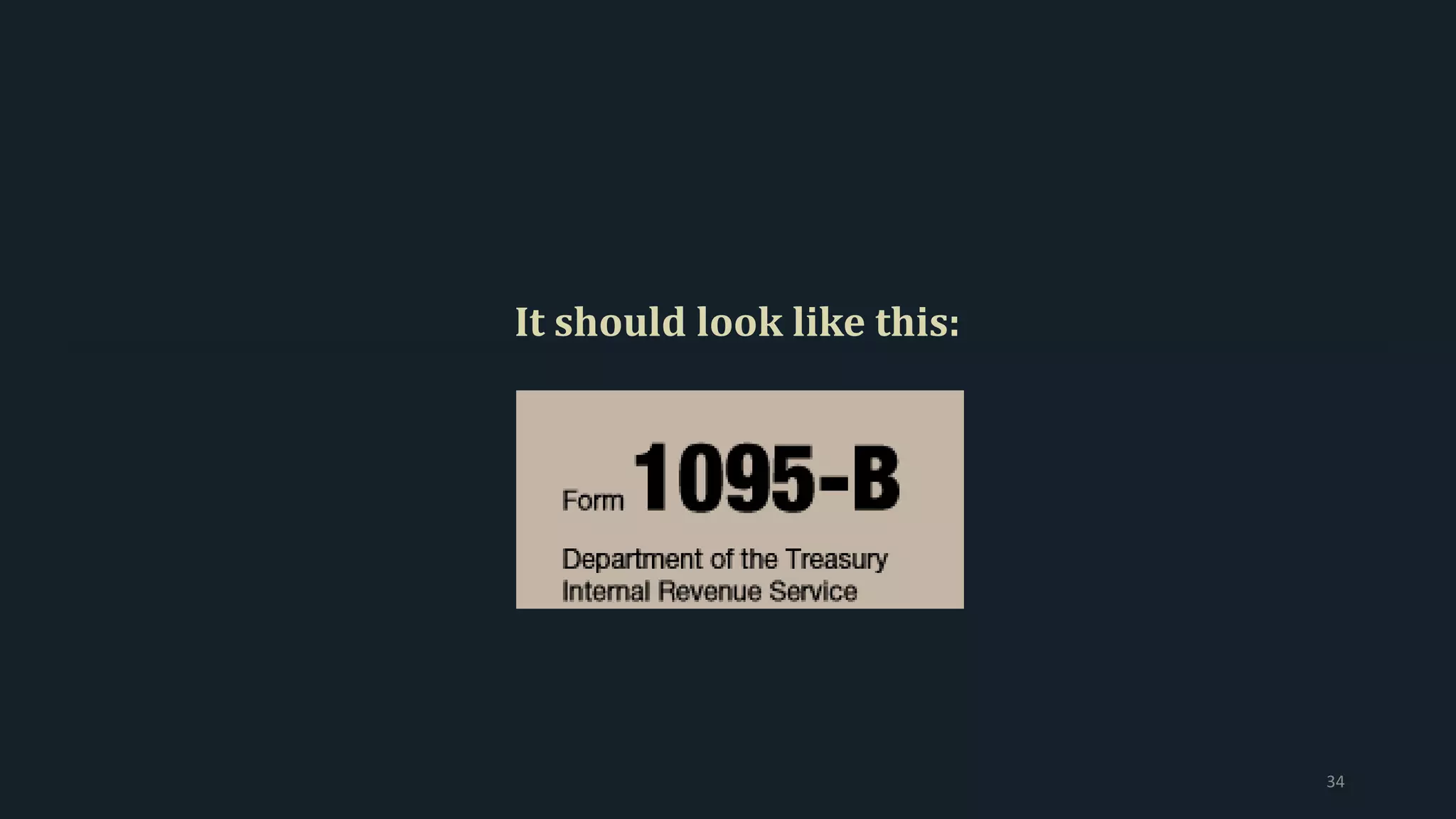

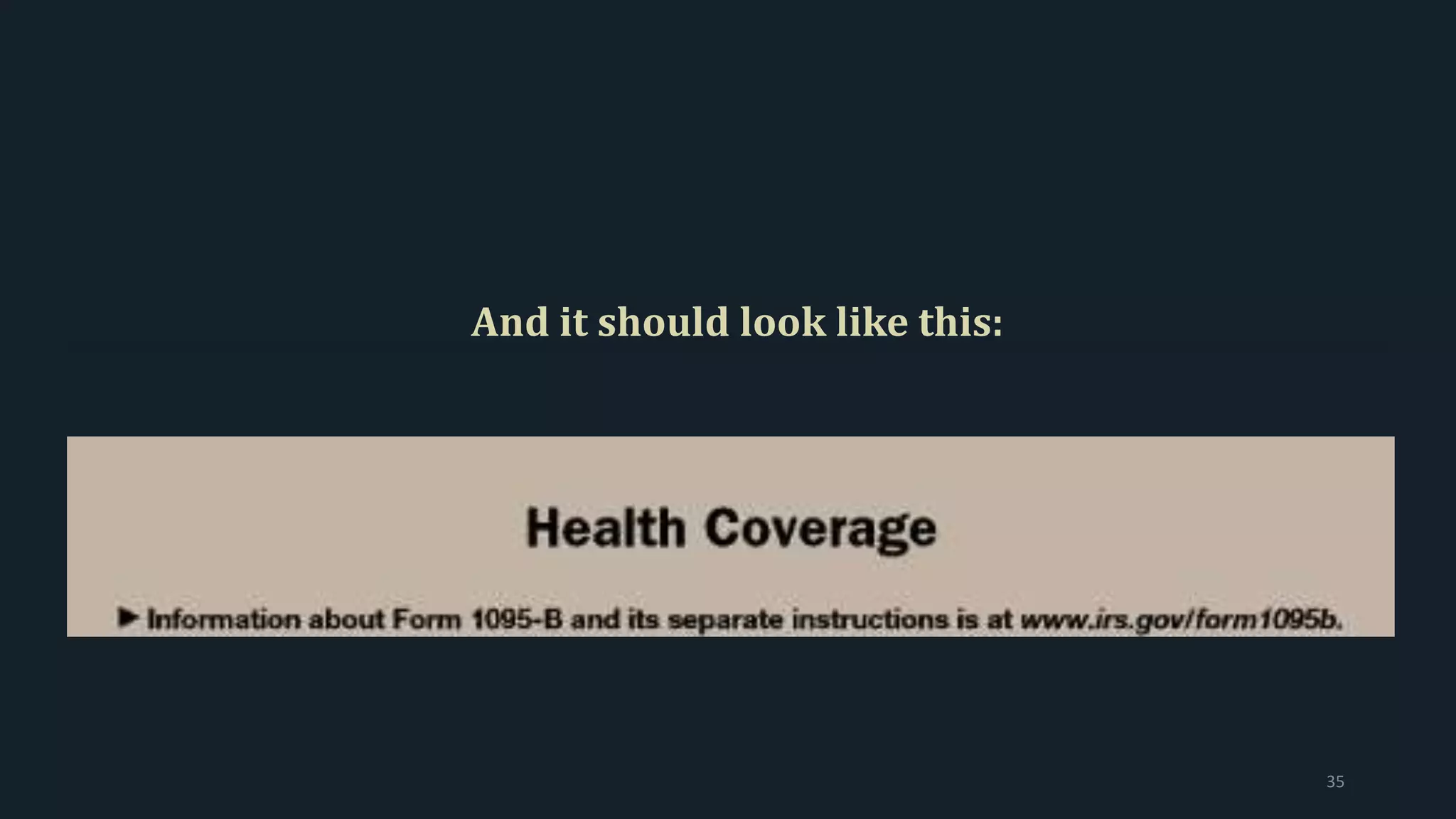

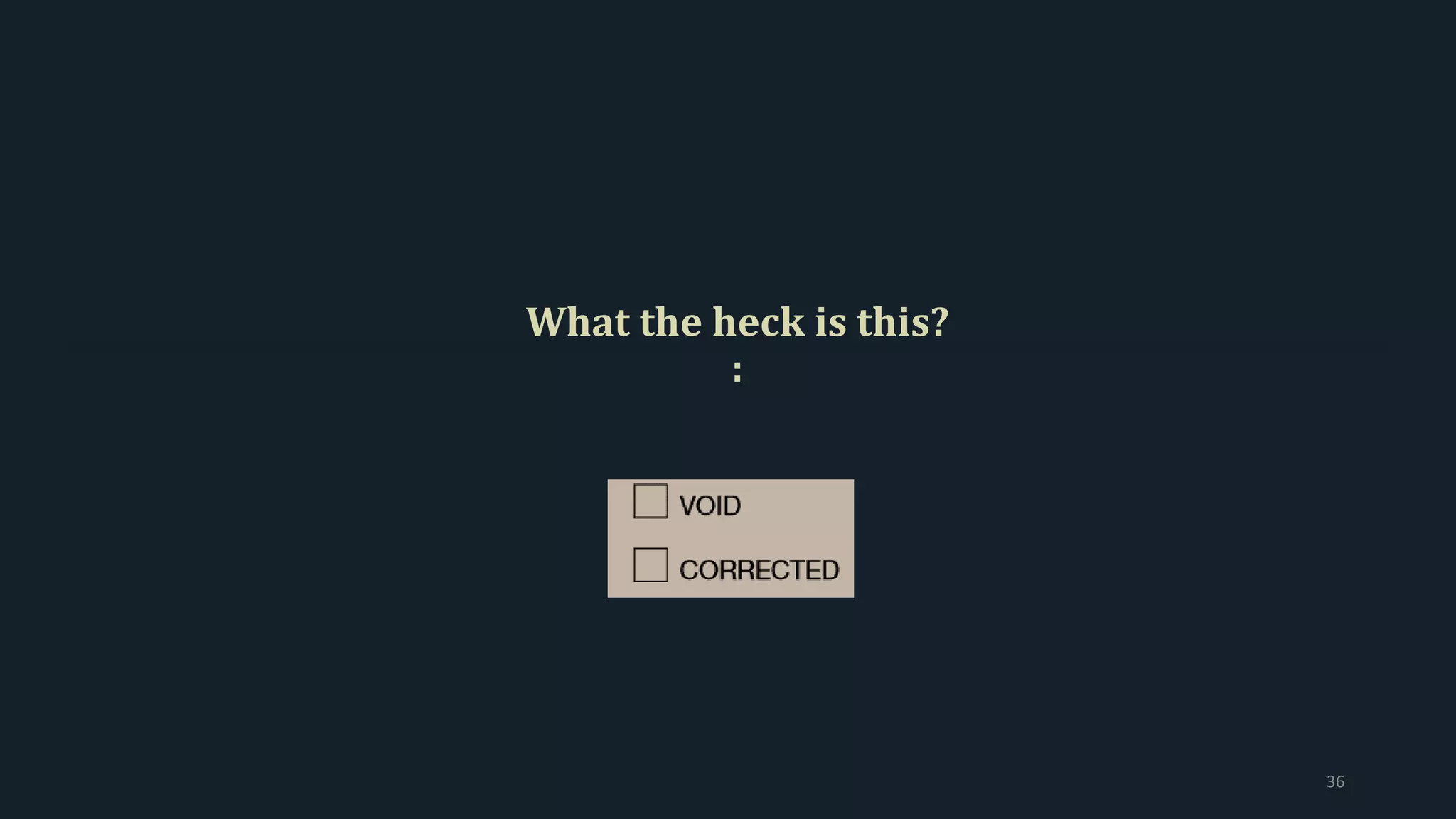

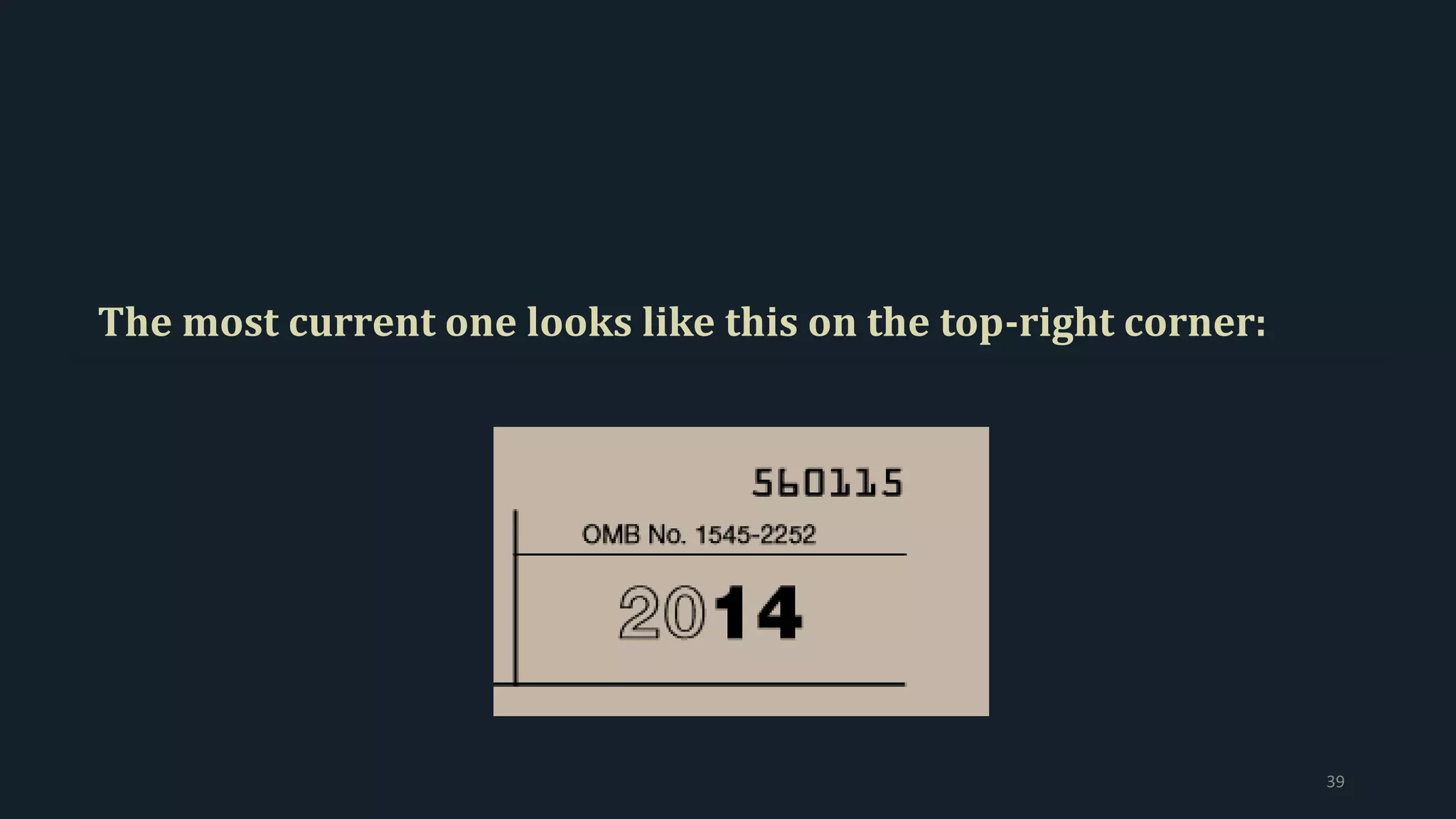

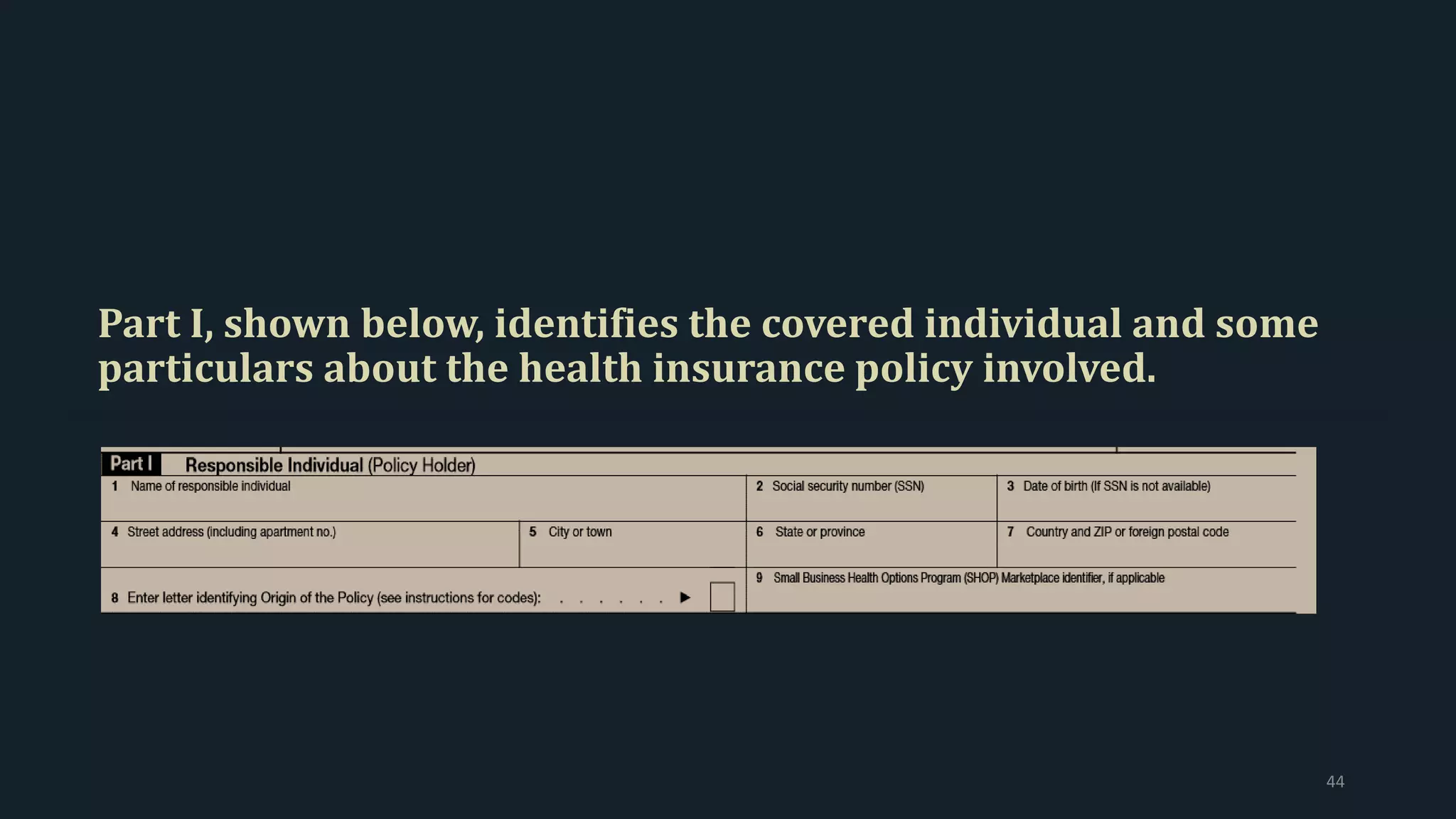

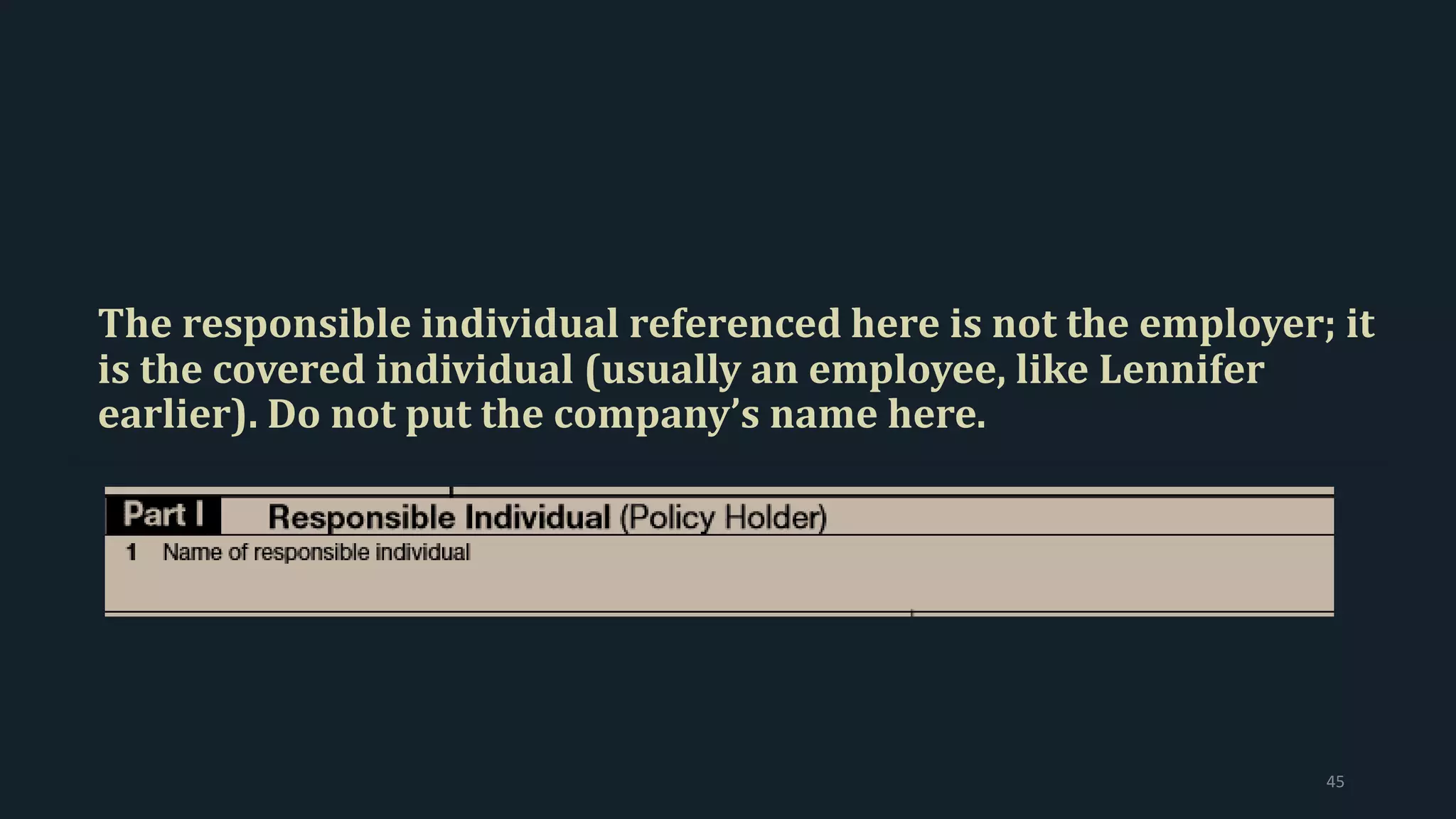

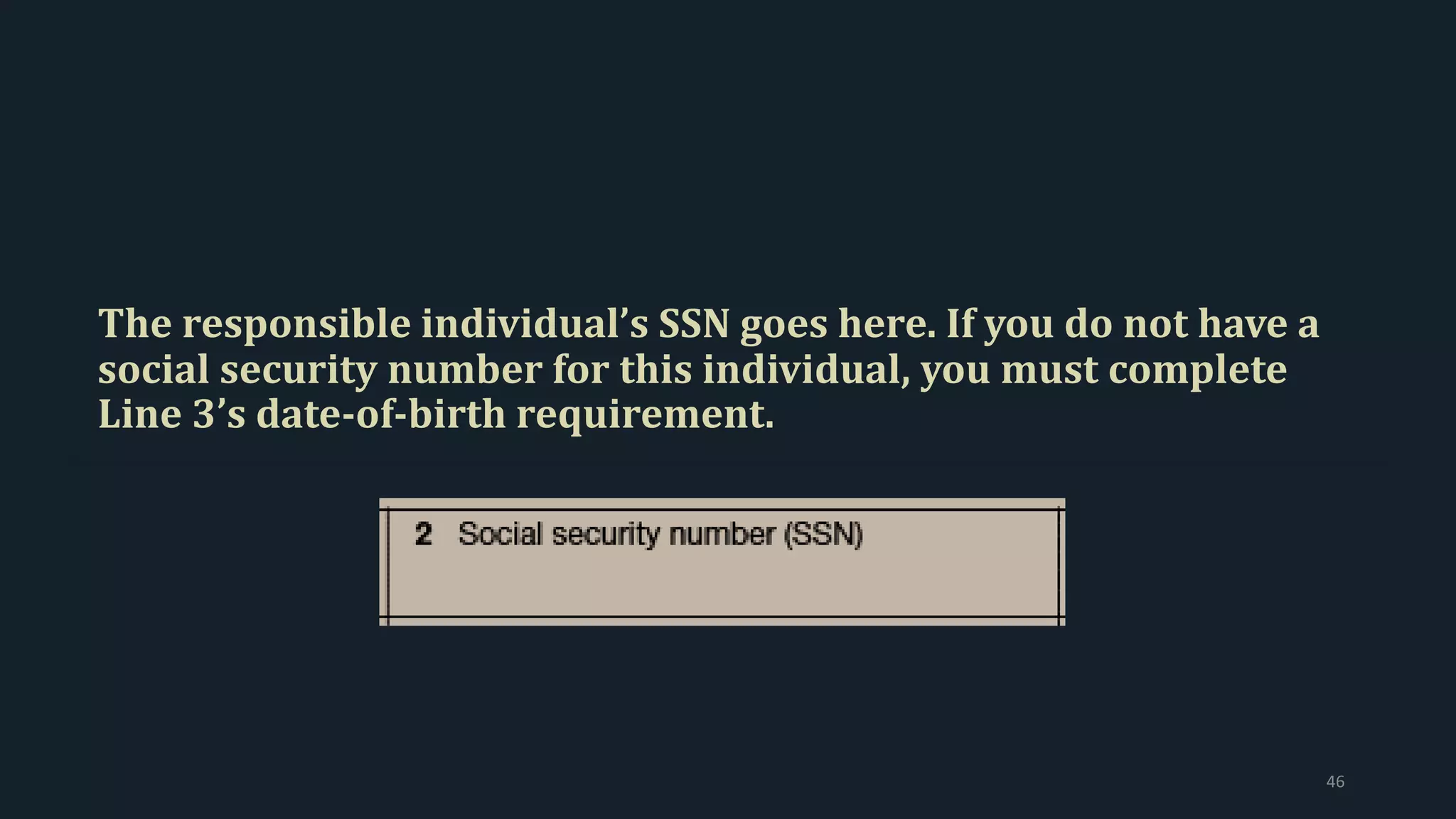

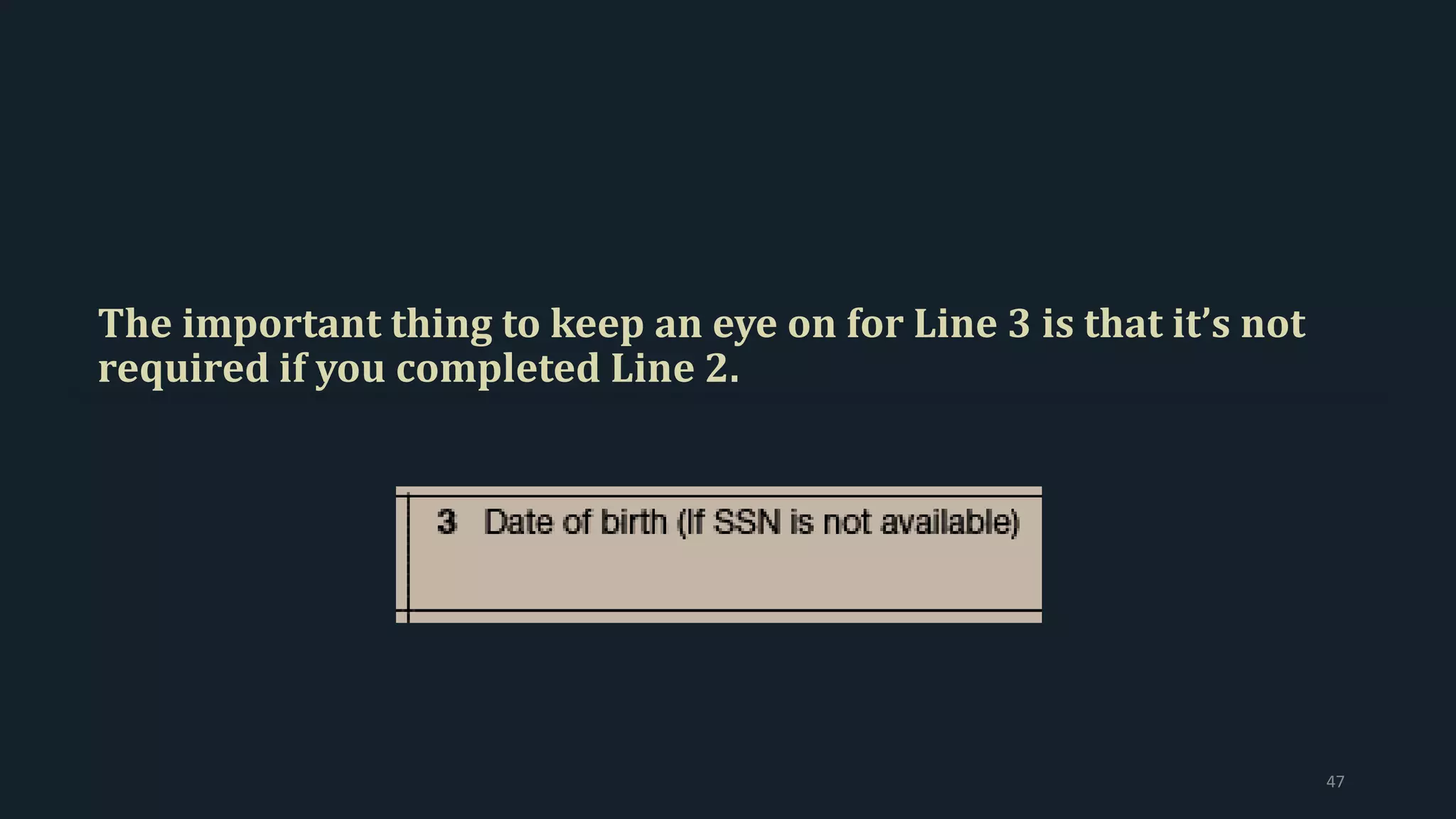

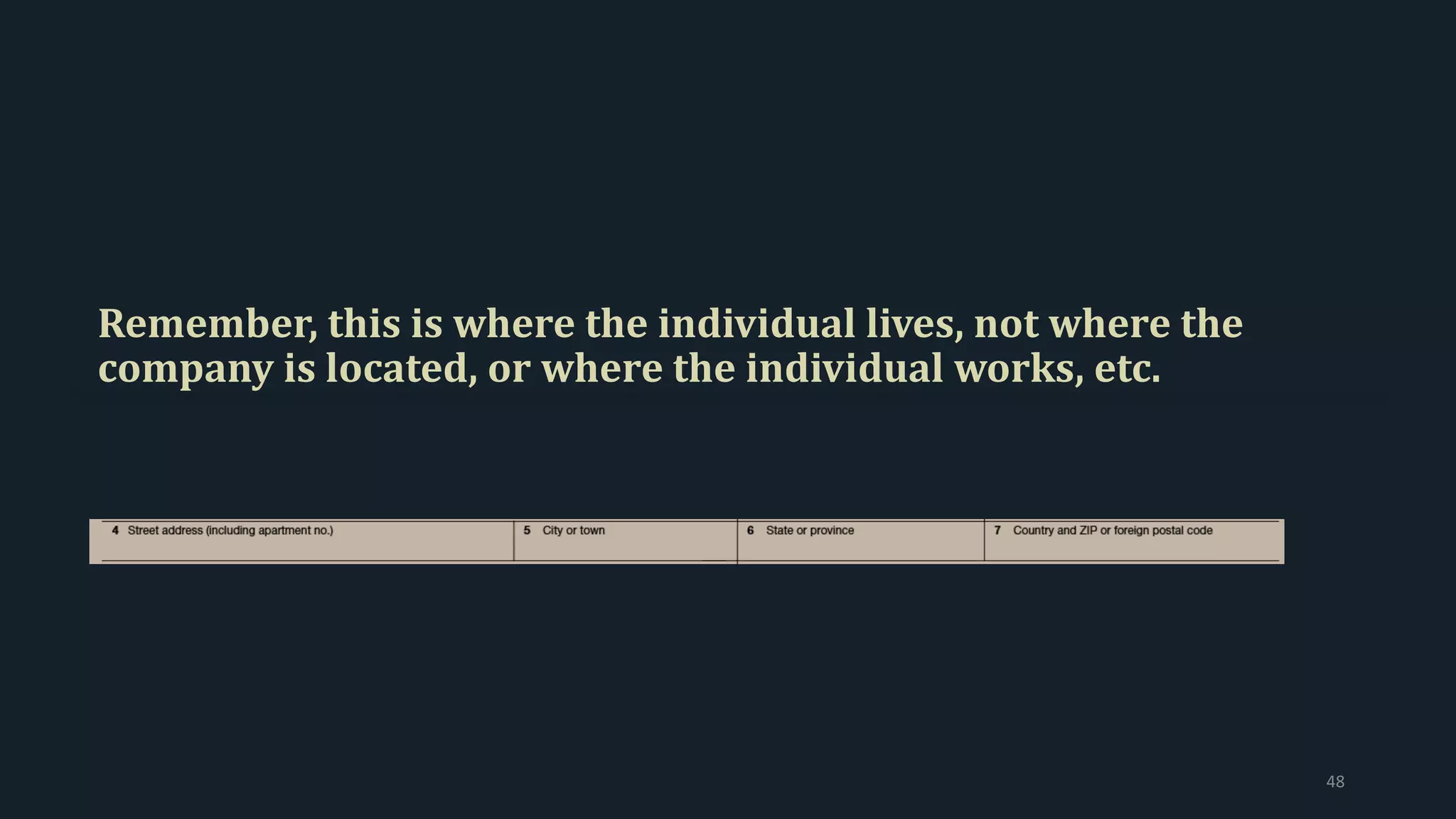

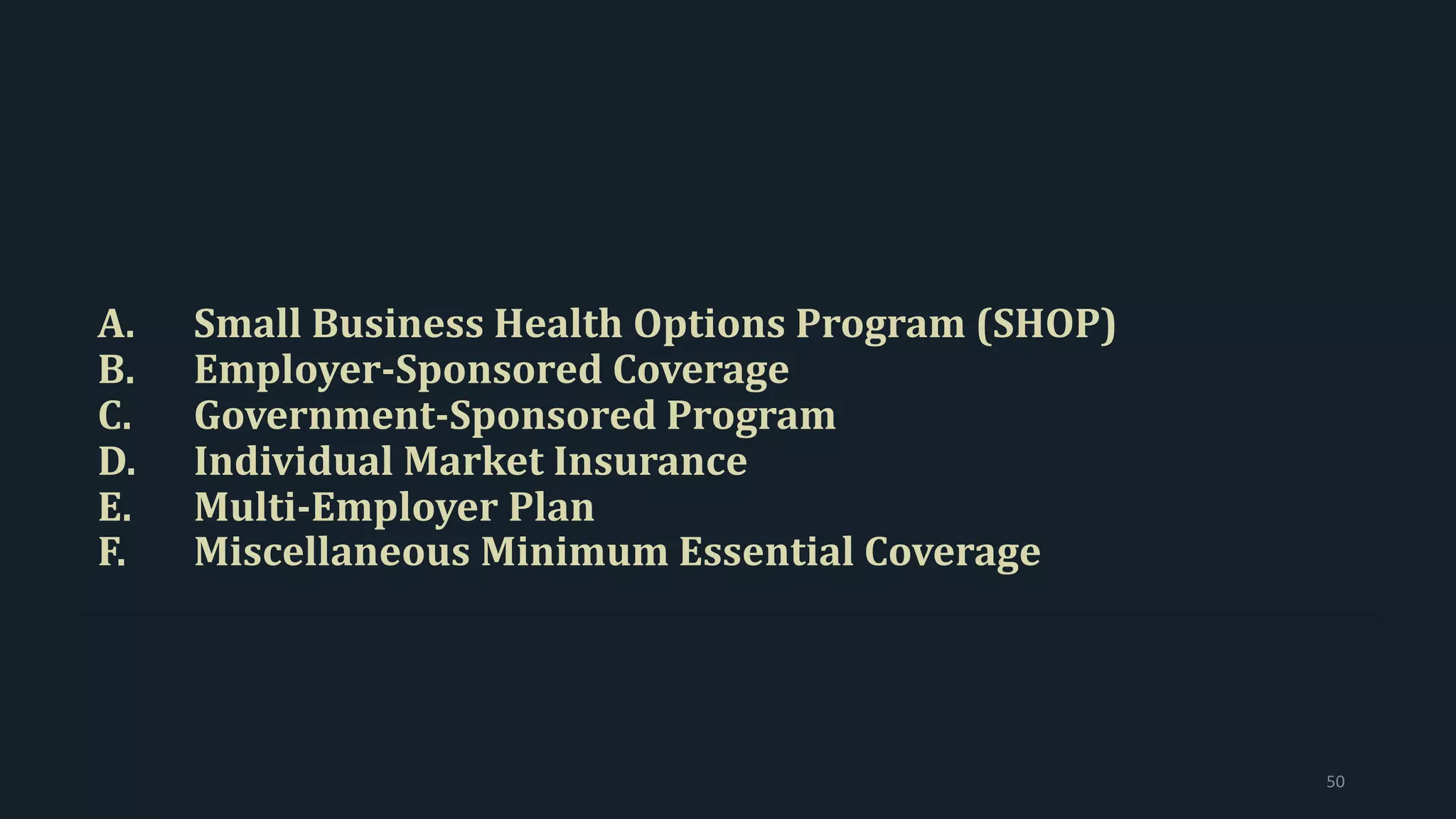

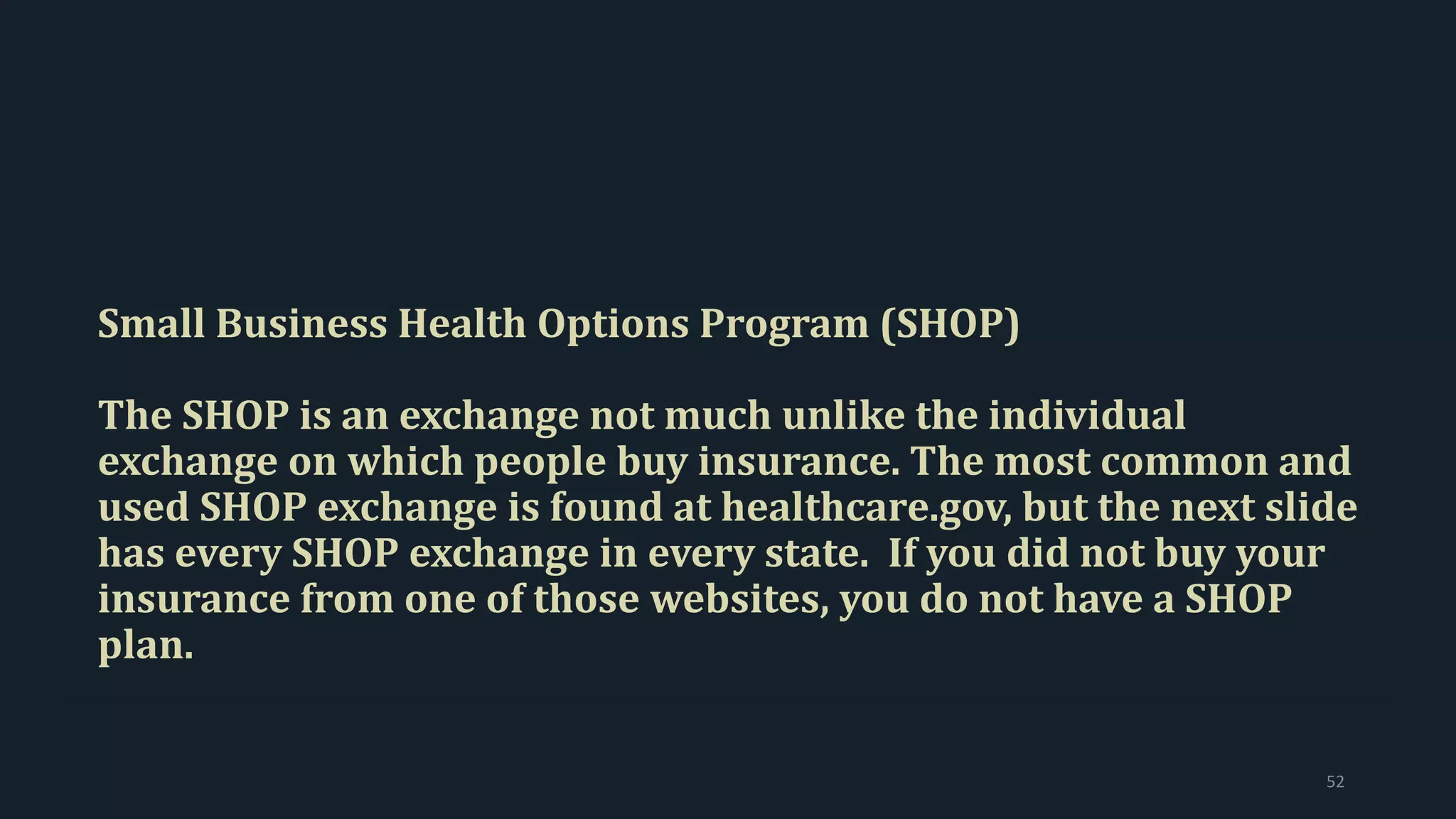

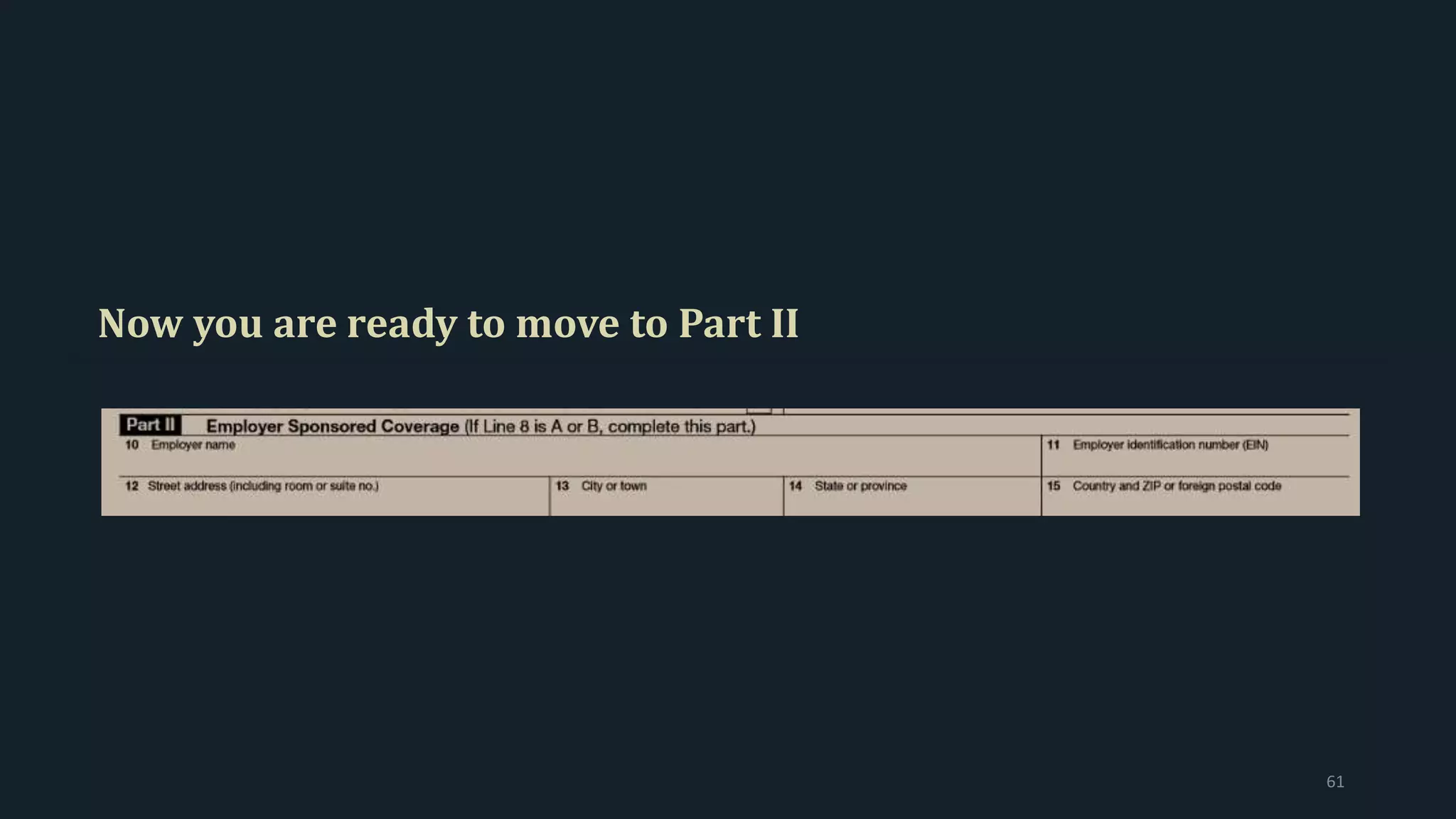

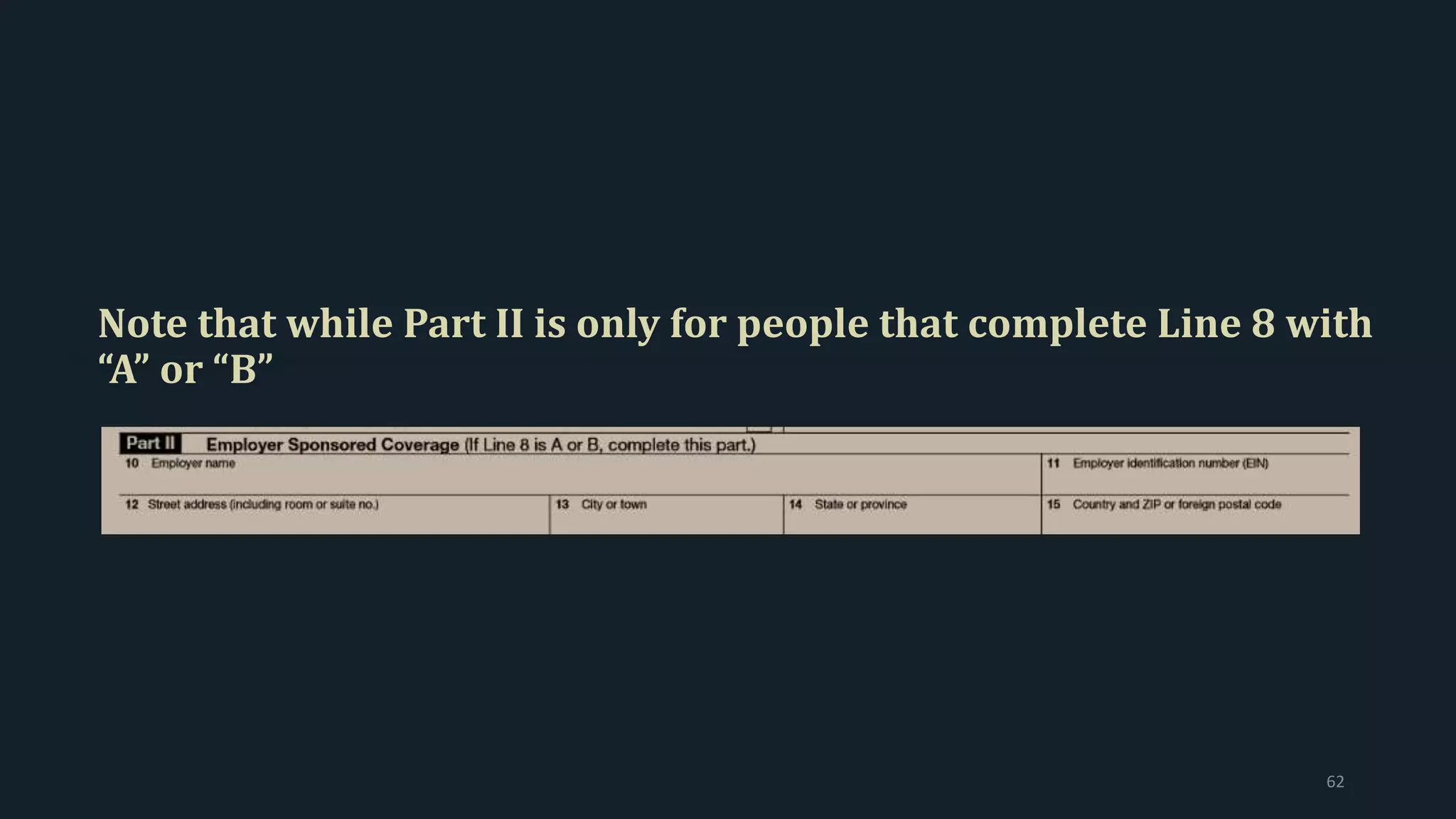

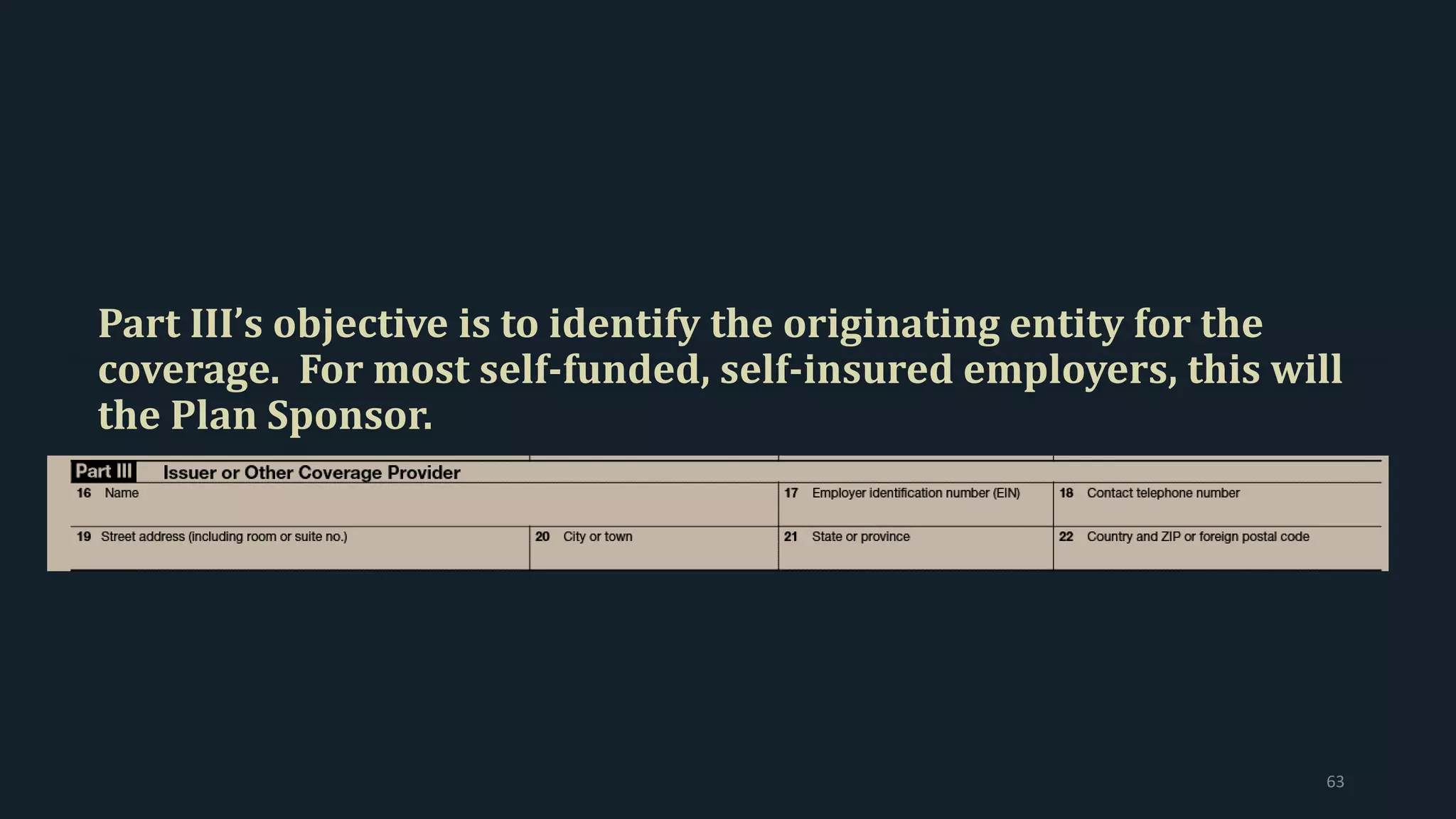

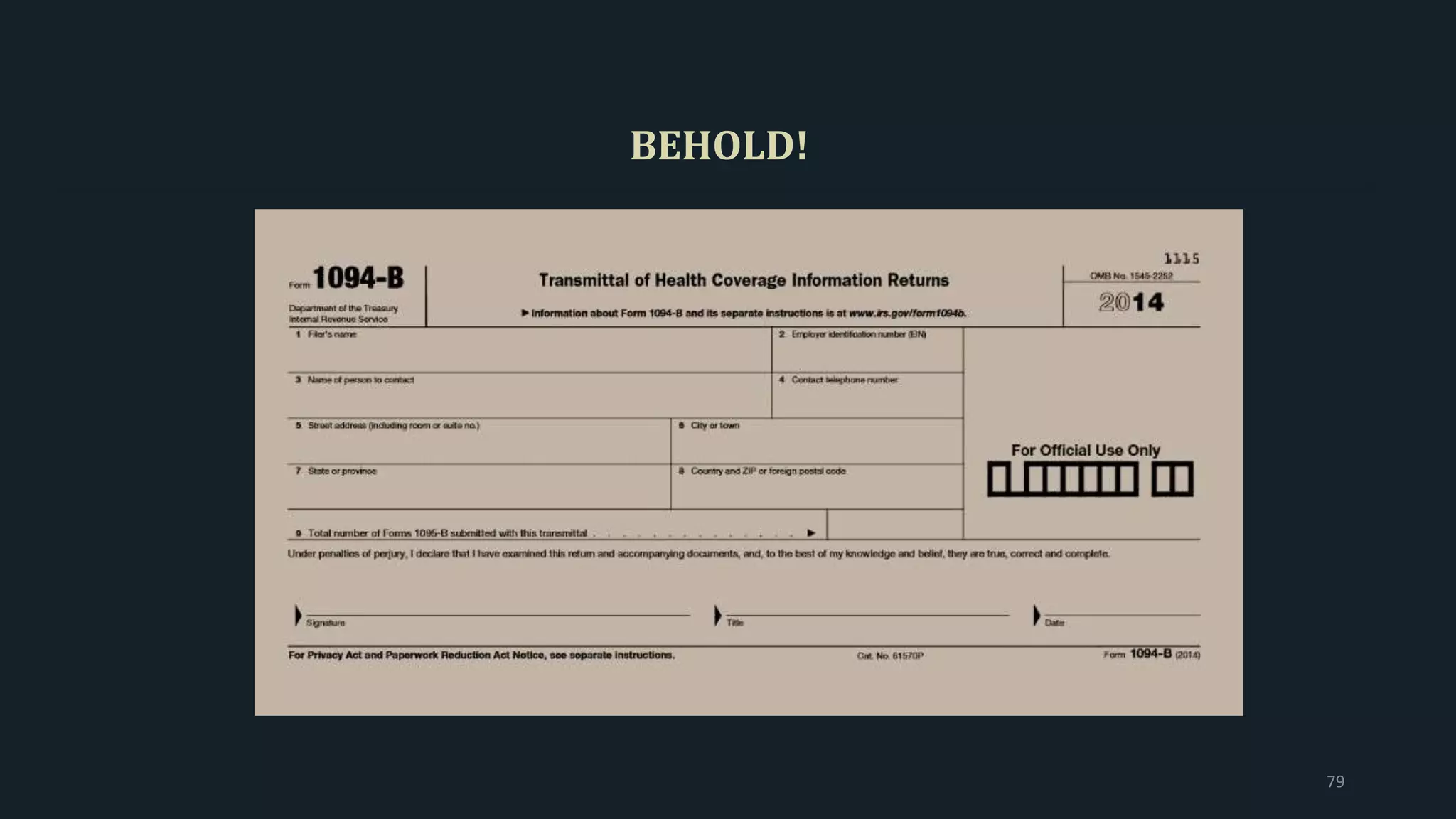

This document provides a step-by-step guide to completing Forms 1095-B and 1094-B for reporting health insurance coverage information to the IRS under the Affordable Care Act. It explains the purpose of the forms is to verify which individuals had health insurance coverage to avoid penalties. It outlines how to fill out each section of the forms including covered individuals' identifying information and months of coverage. Employers that are self-insured will report using Form 1095-B that gets sent to covered individuals and to the IRS, along with a transmittal Form 1094-B coversheet stating the number of 1095-B forms.