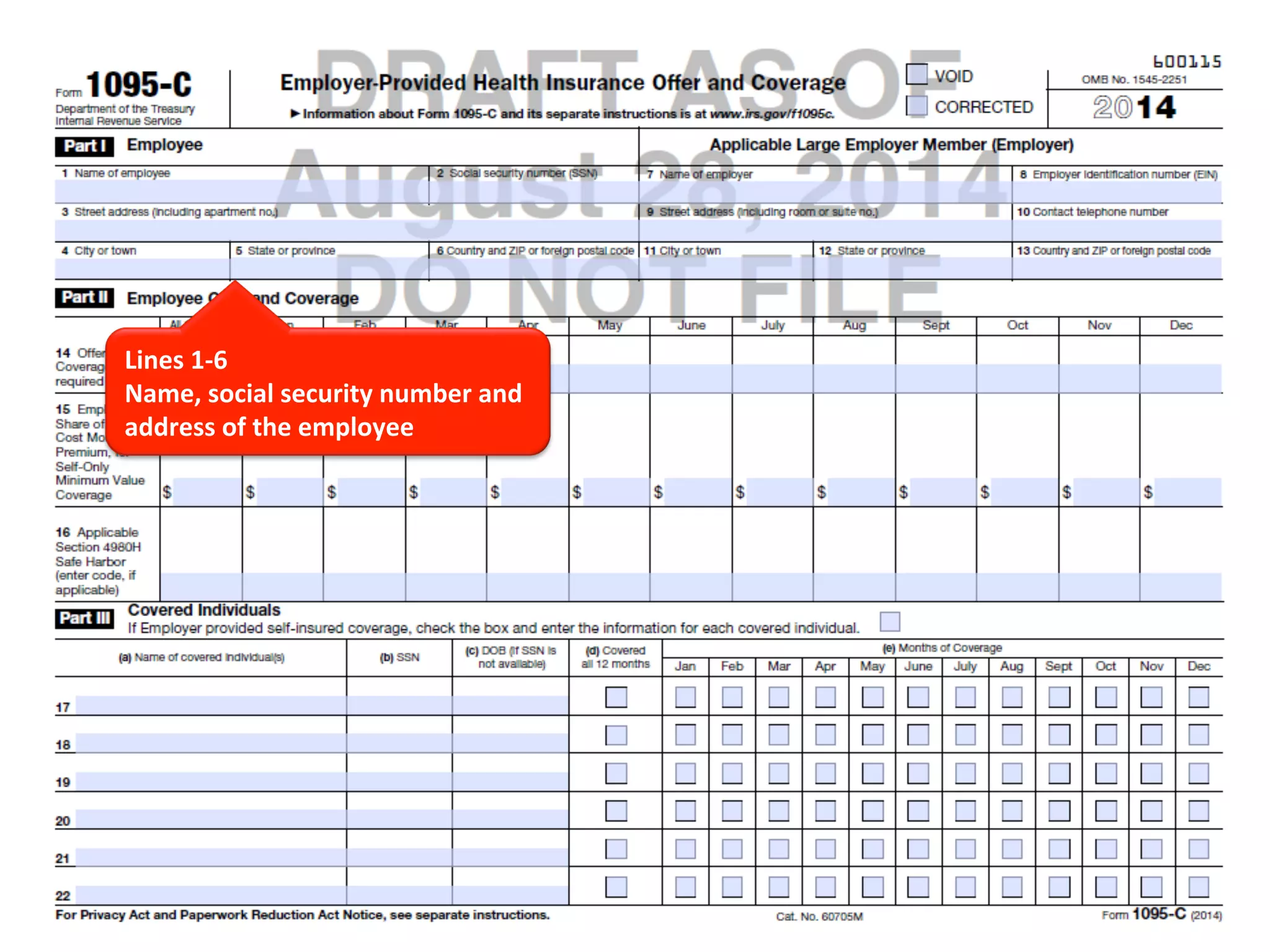

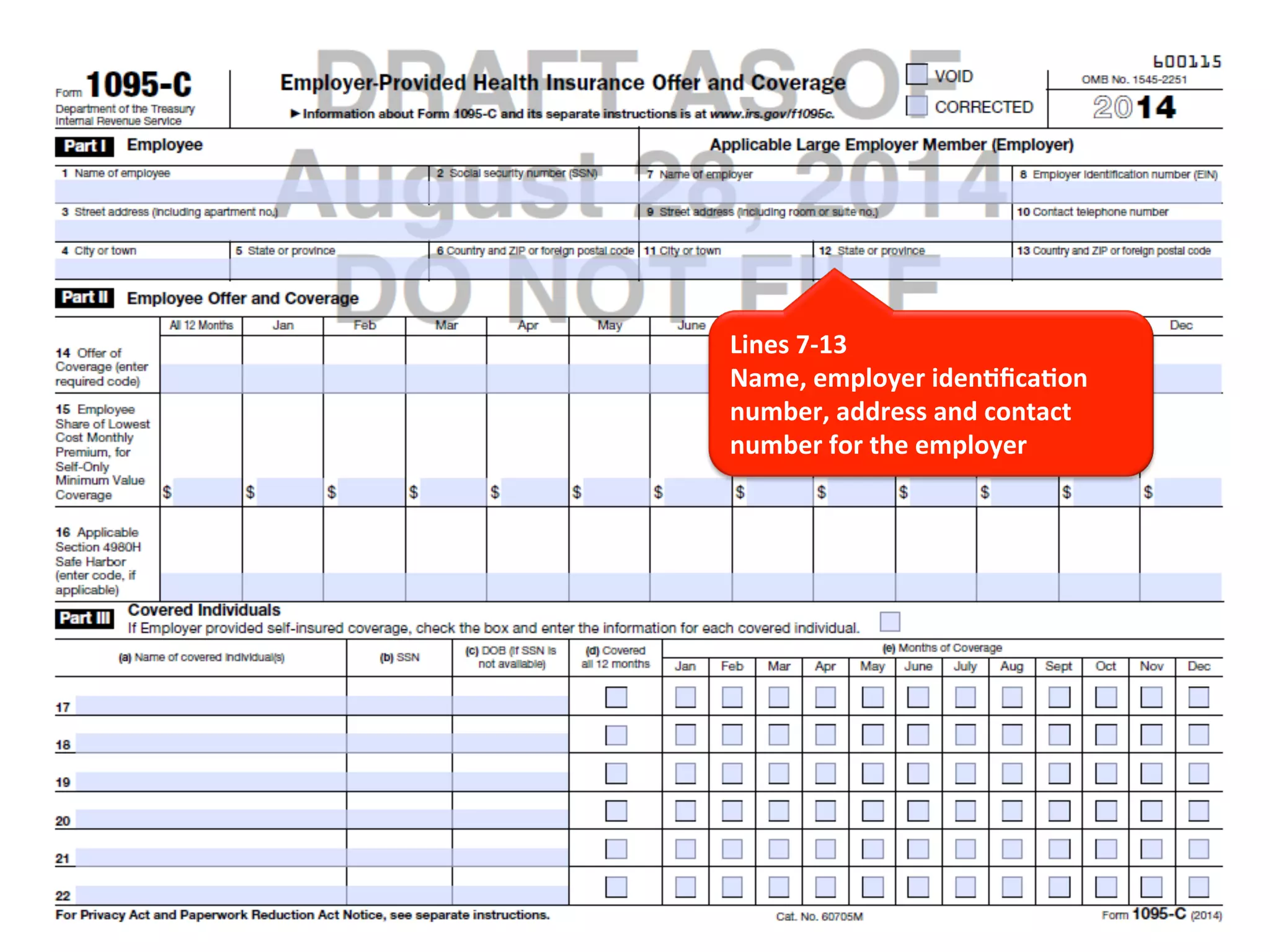

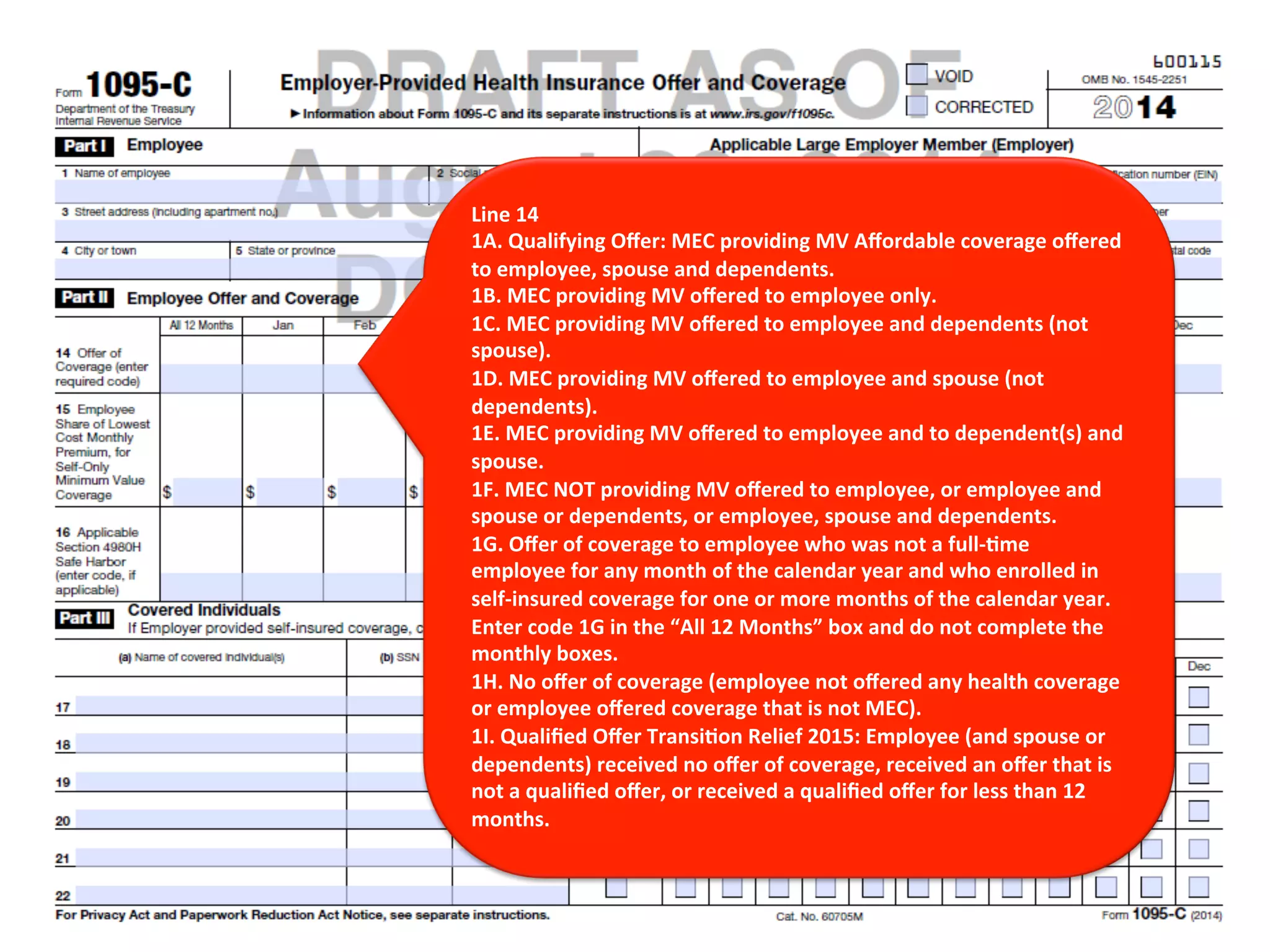

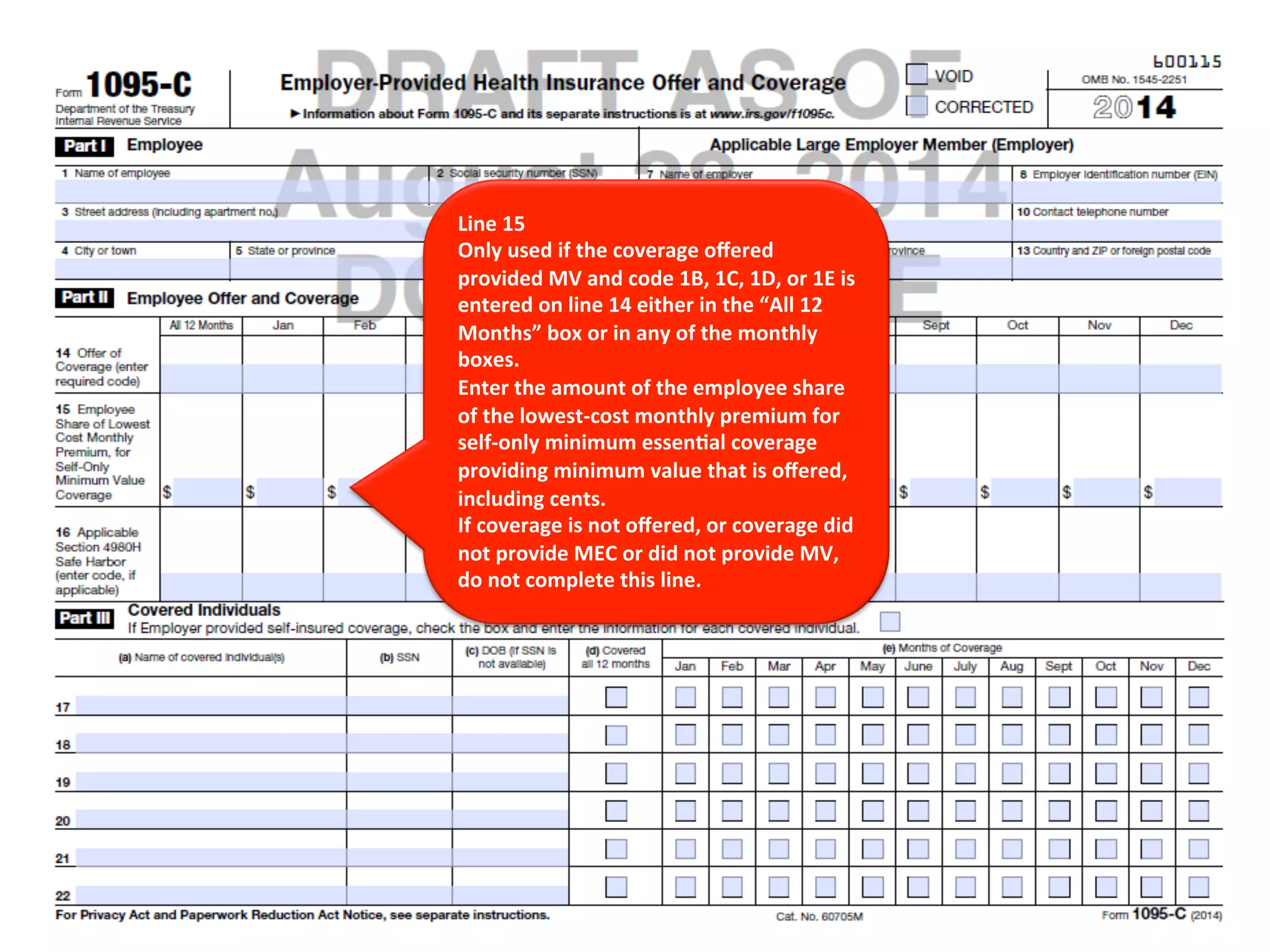

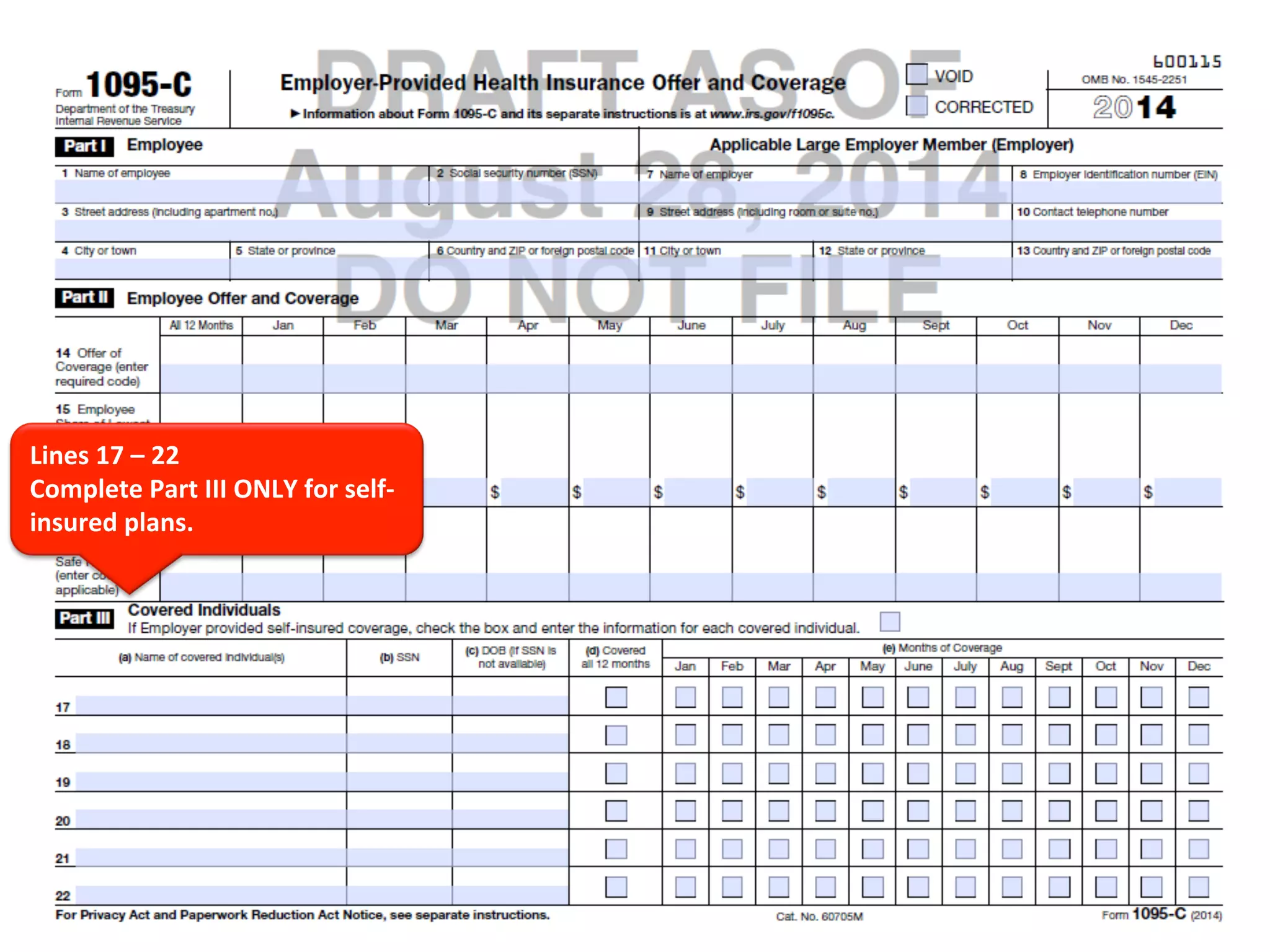

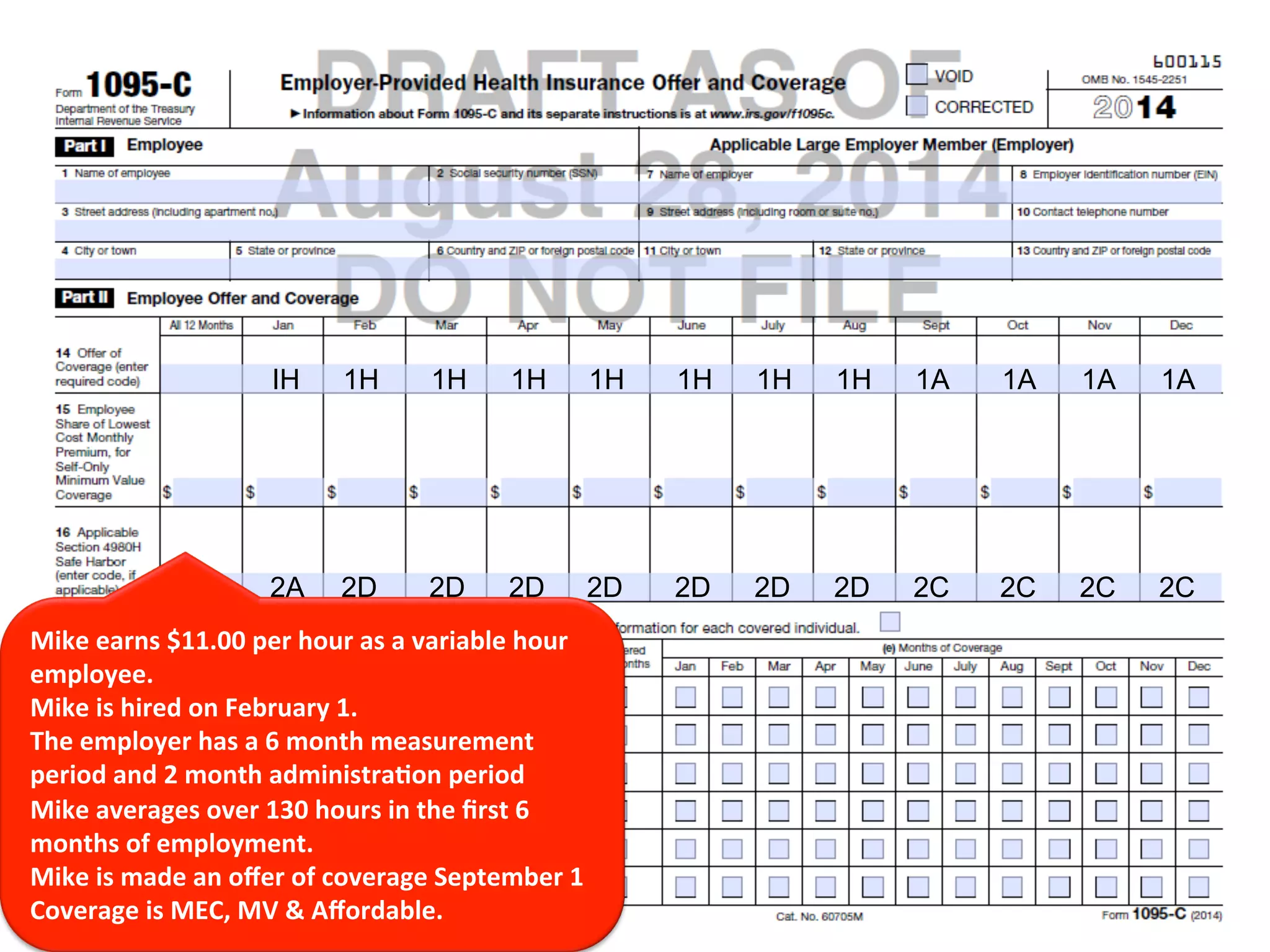

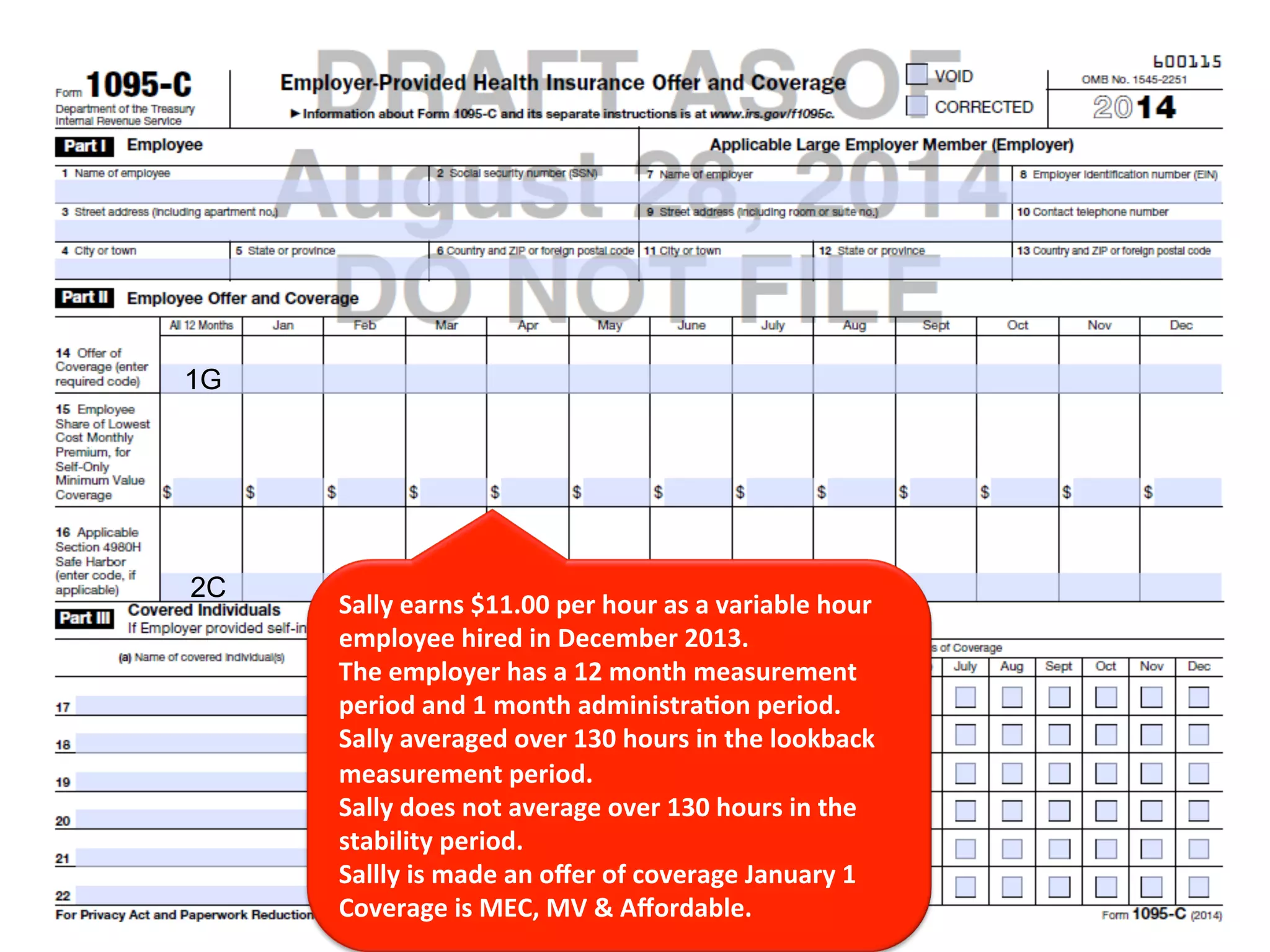

This document contains information for tracking Affordable Care Act (ACA) compliance. It includes sections for entering employee data like name, SSN, and address. Codes are provided for indicating the type of health coverage offered to employees, such as minimum essential coverage providing minimum value offered to the employee and dependents. Instructions are given for determining affordability safe harbors and reporting coverage for variable hour and seasonal employees. The document discusses ACA Track's ability to administer and track dependent information as required by regulations.