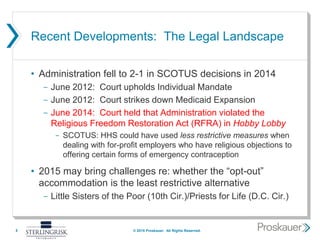

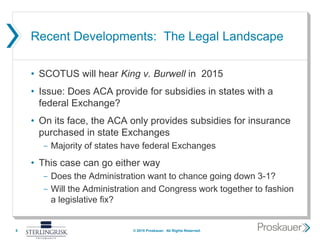

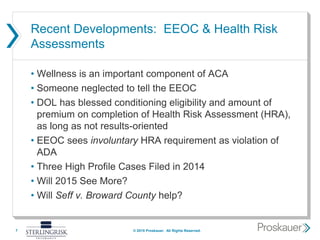

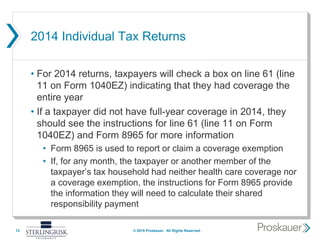

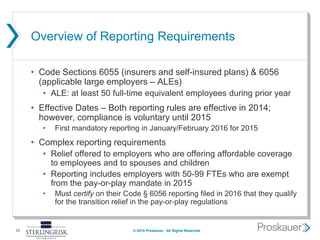

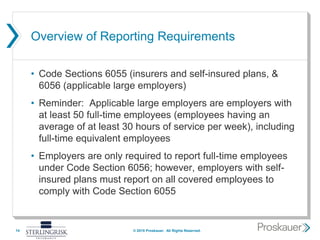

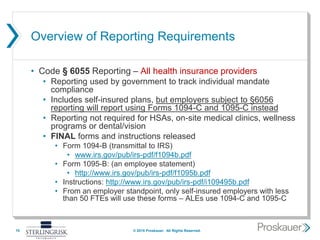

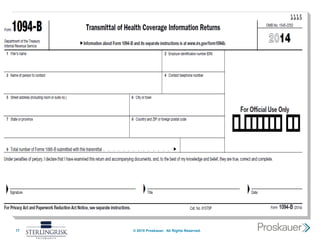

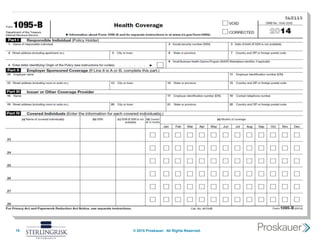

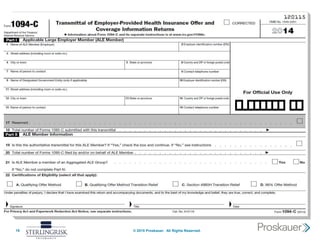

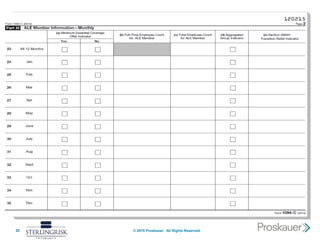

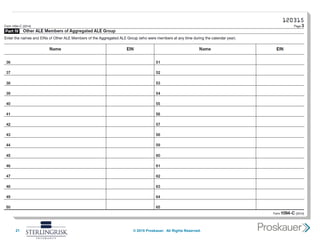

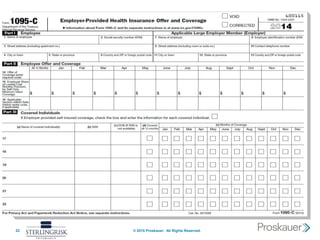

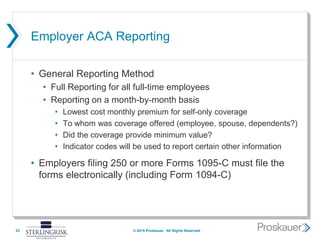

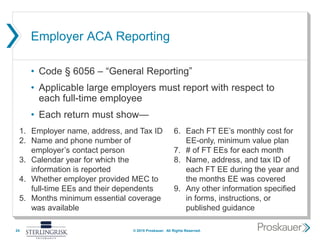

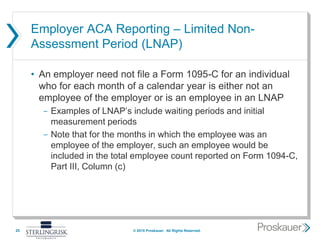

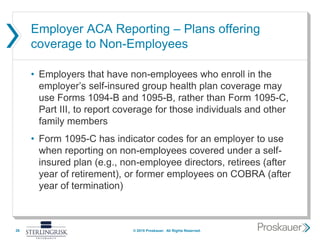

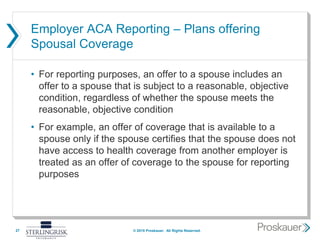

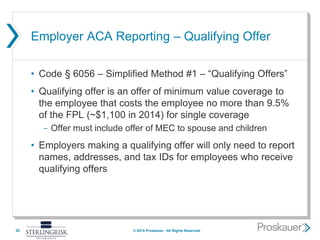

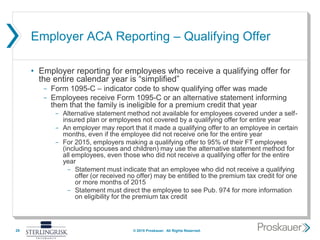

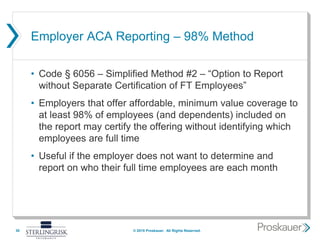

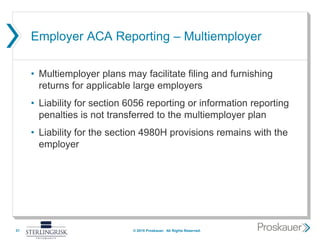

This document summarizes a webinar about the Affordable Care Act's (ACA) employer and provider reporting requirements. It discusses recent legal developments impacting the ACA, an overview of Code Sections 6055 and 6056 which establish reporting for health insurance providers and applicable large employers. It also outlines the general reporting methods required, simplified reporting options, handling of qualifying offers, multiemployer plans, and penalty relief for 2015.