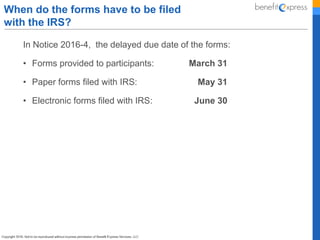

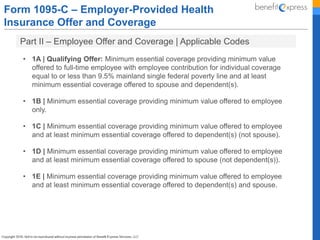

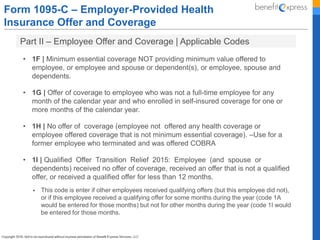

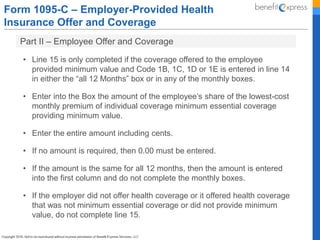

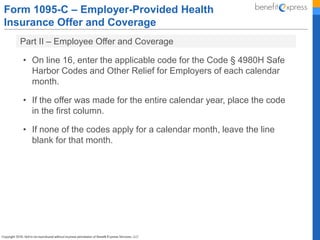

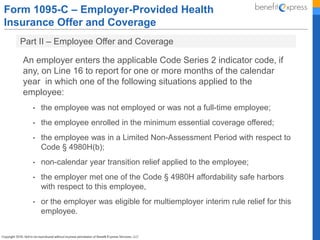

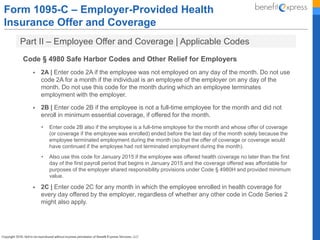

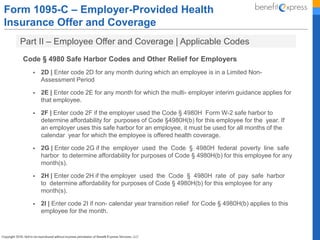

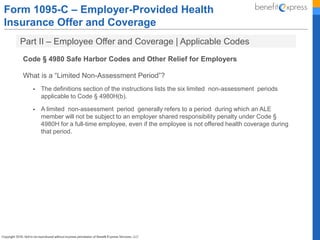

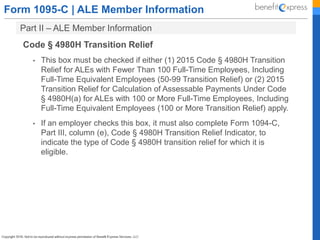

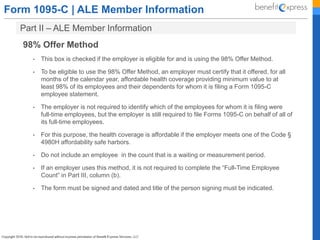

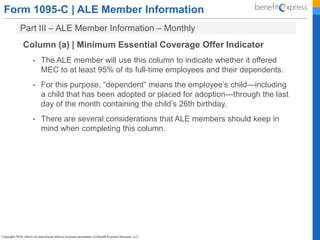

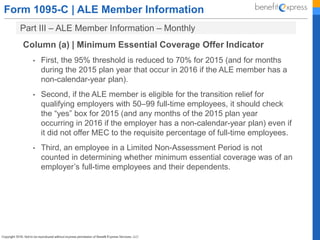

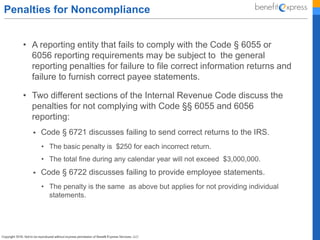

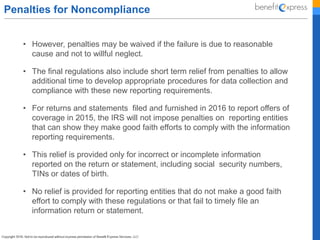

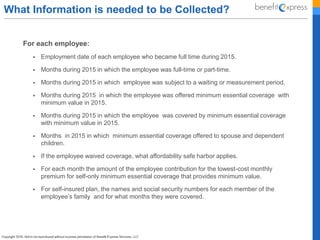

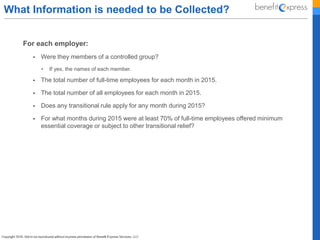

The Affordable Care Act established new reporting requirements under IRS Code §§ 6055 and 6056 for employers and entities providing minimum essential coverage (MEC). Applicable large employers (ALEs) must file specific forms to report health insurance coverage offered to their employees to the IRS, including forms 1095-B and 1095-C, with deadlines for filing and provision to employees specified. Extensions and relief measures for 2015 reporting are also outlined, including automatic deadlines for filing and the conditions under which individuals may not need to amend their tax returns if they receive their coverage forms late.