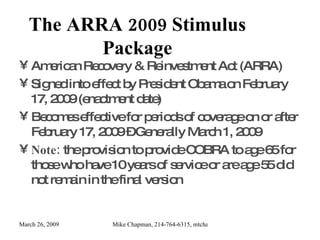

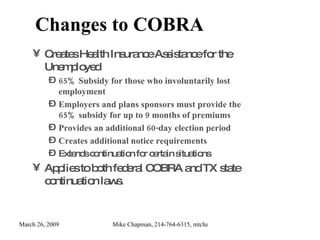

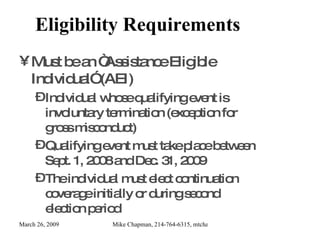

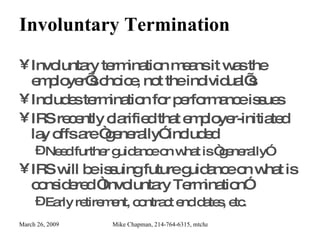

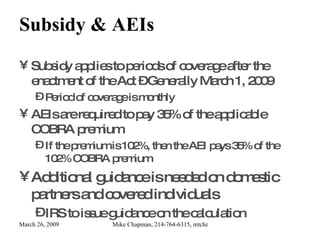

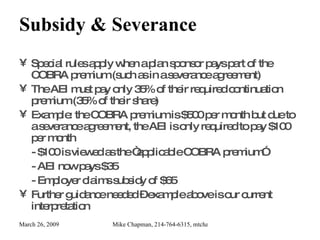

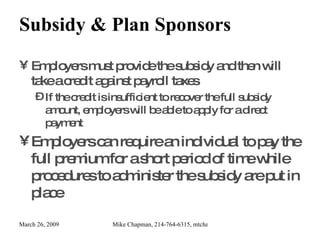

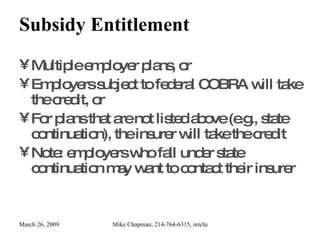

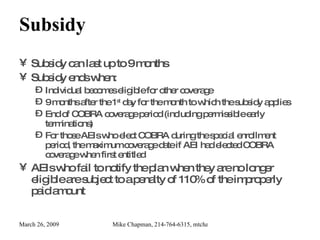

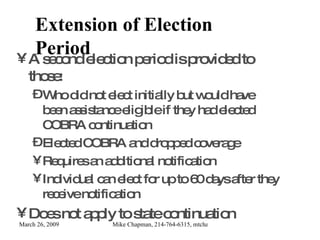

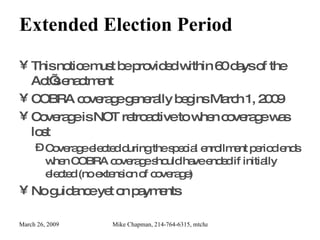

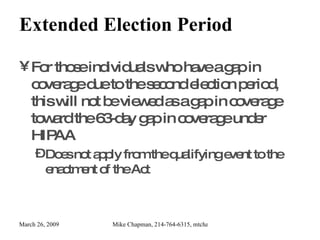

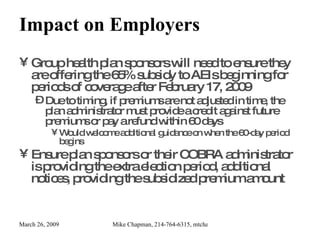

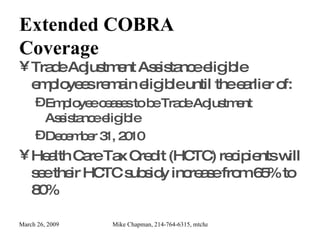

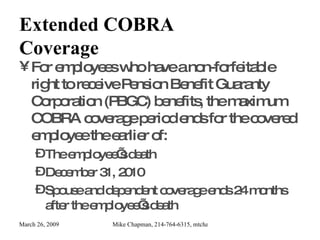

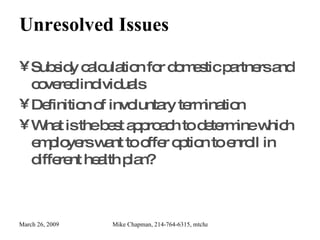

The American Recovery and Reinvestment Act (ARRA) of 2009 provides a 65% COBRA premium subsidy for unemployed individuals who involuntarily lose their employment, effective from March 1, 2009, for up to nine months. Eligibility requires individuals to have experienced a qualifying event between September 1, 2008, and December 31, 2009, and they must elect for COBRA coverage during a specific enrollment period. Employers are responsible for administering the subsidy and can take a tax credit to recover costs, while additional guidance is anticipated on various aspects, including domestic partners and involuntary termination definitions.

![Brought to you as a public service for Texans by: Mike Chapman Endeavor Group COBRABusters.com: My ministry that explains health care options for the unemployed. EndeavorGroup.net: Health and life insurance for individuals and Families GroupBenefitsAdvisors.com : An employee benefits consultant and group health insurance broker for Texas based companies Contact Info: 214-764-6315, [email_address]](https://image.slidesharecdn.com/cobrasubsidyinformationfortexans-090326150459-phpapp01/85/Cobra-Subsidy-Information-For-Texans-2-320.jpg)