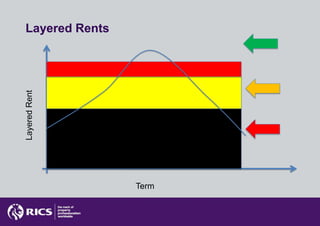

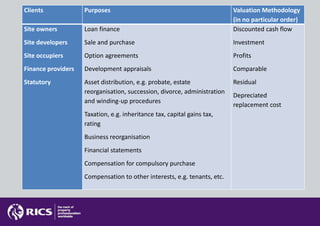

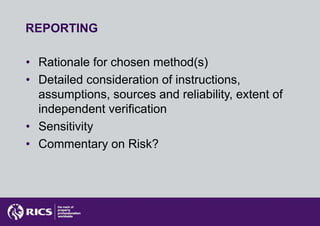

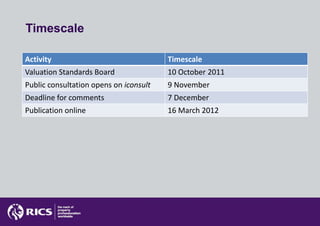

The document is a draft guidance note from RICS that outlines the valuation standards for renewable energy installations in the UK, addressing various valuation methods such as direct comparison, investment method, and discounted cash flow. It discusses the challenges and considerations involved in assessing both landlord and owner-operator interests, alongside market value and reporting requirements. The document also highlights the importance of understanding the purpose of valuation and the assumptions that must be made during the valuation process.