Reliance Petroleum Limited is an Indian petroleum and gas company that was founded in 2008 as a subsidiary of Reliance Industries Limited, one of India's largest private sector companies. RPL was formed to build a large, complex petroleum refinery and polypropylene plant in Gujarat. The refinery was completed ahead of schedule in 36 months and made Reliance one of the largest global refiners. In 2009, RPL merged with its parent company Reliance Industries Limited to create operational and financial synergies and consolidate its position as an integrated energy company.

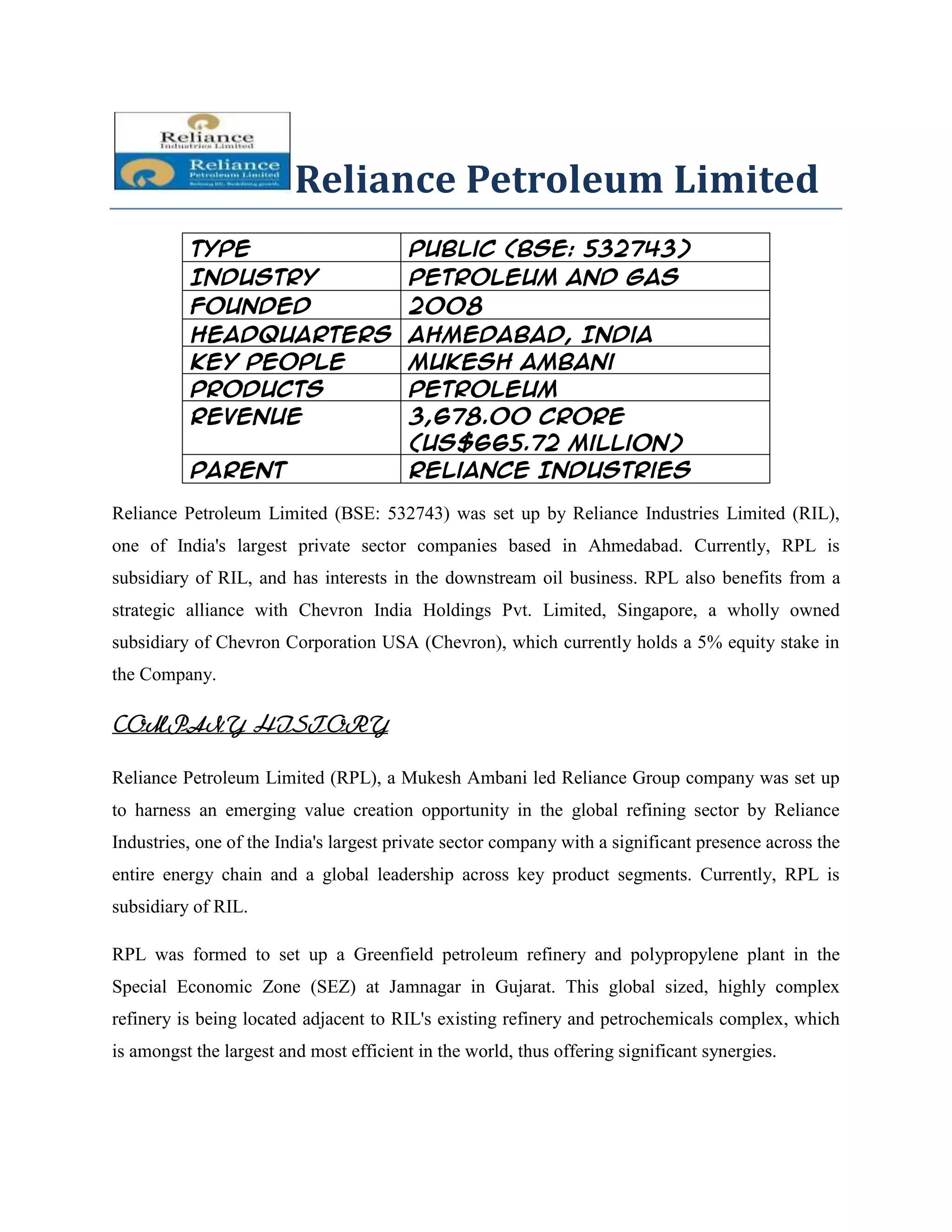

![Porter's 5 Forces Analysis

Threat of New Entrants. There is thousands of oil and oil services companies

throughout the world, but the barriers to enter this industry are enough to scare away all

but the serious companies. Barriers can vary depending on the area of the market in

which the company is situated. For example, some types of pumping trucks needed at

well sites cost more than $1 million each. Other areas of the oil business require highly

specialized workers to operate the equipment and to make key drilling decisions.

Companies in industries such as these have higher barriers to entry than ones that are

simply offering drilling services or support services. Having ample cash is another barrier

- a company had better have deep pockets to take on the existing oil companies.

Power of Suppliers. While there are plenty of oil companies in the world, much of the oil

and gas business is dominated by a small handful of powerful companies. The large

amounts of capital investment tend to weed out a lot of the suppliers of rigs, pipeline,

refining, etc. There isn't a lot of cut-throat competition between them, but they do have

significant power over smaller drilling and support companies. [Ibid]

Power of Buyers. The balance of power is shifting toward buyers. Oil is a commodity

and one company's oil or oil drilling services are not that much different from another's.

This leads buyers to seek lower prices and better contract terms. [Ibid]

Availability of Substitutes. Substitutes for the oil industry in general include alternative

fuels such as coal, gas, solar power, wind power, hydroelectricity and even nuclear

energy. Remember, oil is used for more than just running our vehicles, it is also used in](https://image.slidesharecdn.com/reliancepetroleumlimited-120913061512-phpapp02/85/Reliance-petroleum-limited-5-320.jpg)