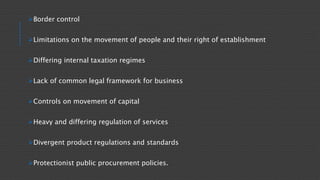

This document provides an overview of regional economic integration agreements. It discusses the objectives of economic integration such as strengthening political ties and improving bargaining power. It describes different levels of integration from free trade areas to economic unions. Examples of regional agreements discussed include the European Union, NAFTA, MERCOSUR, and ASEAN. The EU eliminated trade barriers and allowed free movement of goods, services, and factors of production. NAFTA achieved trade liberalization between the US, Canada, and Mexico. Regional agreements in Latin America and Southeast Asia aimed to accelerate economic development among developing countries.