The document discusses procedures for conducting redundancies, including:

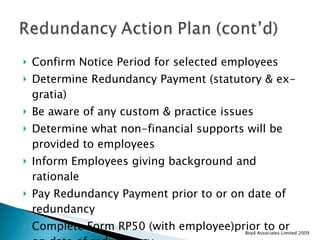

- Establishing legitimate reasons for redundancy based on business needs and applying selection criteria impartially.

- Considering alternatives to redundancy and documenting efforts.

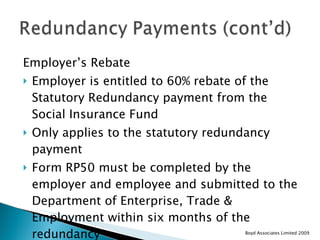

- Providing statutory notice and redundancy payments correctly.

- Supporting redundant employees during the process.

- Maintaining thorough records to defend against potential unfair dismissal claims.