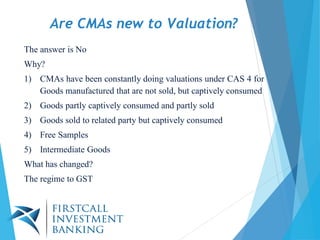

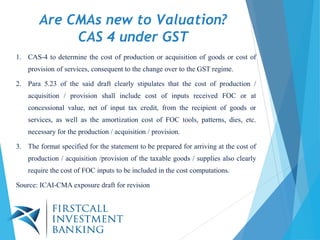

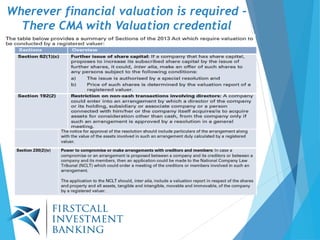

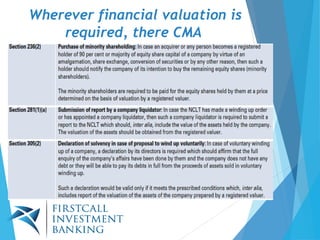

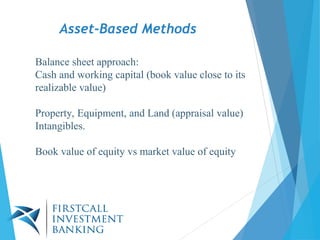

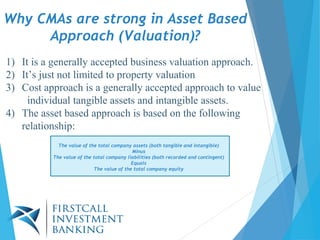

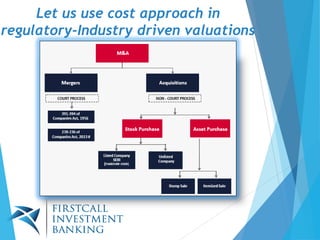

The document discusses the valuation framework for cost approaches by CMAs, emphasizing their established role in asset-based valuations under GST regulations. It explores various valuation approaches and highlights the CMA's strength in the asset-based approach, asserting that CMAs can lead in financial valuation by redefining their framework. Additionally, it notes the peculiarities of valuing Indian digital retail and e-commerce companies using metrics like Gross Merchandise Value (GMV), which may not accurately reflect true revenues.