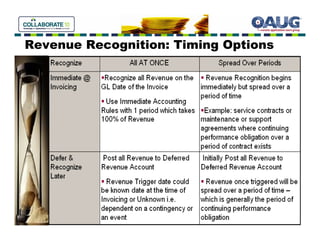

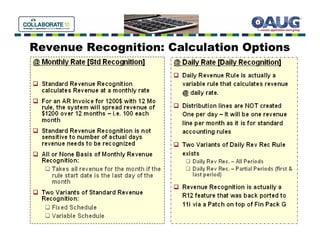

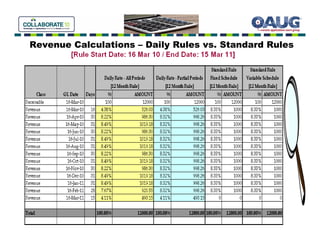

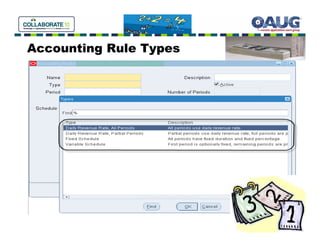

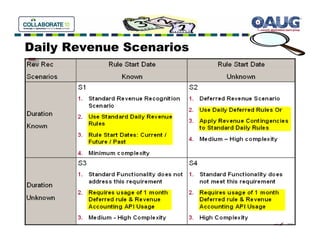

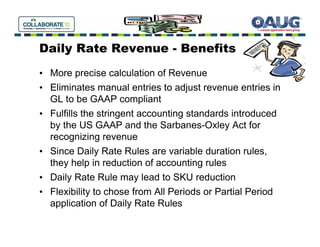

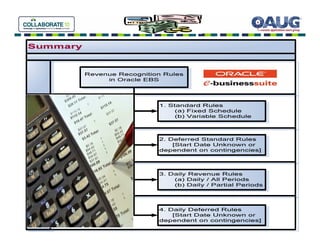

The document discusses daily revenue recognition options in Oracle Receivables, focusing on the features, configuration, and challenges related to implementing these options. It outlines GAAP revenue recognition criteria and compares daily revenue calculations for both full and partial periods, highlighting the benefits of reduced manual entries and improved compliance. The session aims to provide detailed insights into scenarios and methodologies for effective revenue accounting within Oracle EBS.

![Record Revenue @ Daily Rate

[A Deep Dive into Daily Revenue Recognition

Options in Oracle Receivables]

Presenter:

Anil Madhireddy

VeriSign Inc

Key Contributors:

Rajendra Sathe

Gautam Ramakrishna

VeriSign Inc](https://image.slidesharecdn.com/recordrevenuedailyratepresentation-12720037373418-phpapp01/75/Record-Revenue-Daily-Rate-Presentation-1-2048.jpg)

![Daily Revenue – Flavors

• Daily Revenue Rate, All Periods

• Delivers the most precise revenue recognition schedule

possible

• Revenue for all months calculated at Daily Rate

• Revenue Amount = [# of days in the period / Total # of days] *

Total Revenue Amount

• Daily Revenue Rate, Partial Periods

• Delivers the most precise revenue recognition schedule for the

partial periods – first and last period

• Revenue for partial periods calculated at Daily Rate

• First & Last Period:

– Revenue Amount = [# of days in the period / Total # of

days] * Total Revenue Amount

• Remaining Period:

– Remaining Revenue evenly spread on remaining periods](https://image.slidesharecdn.com/recordrevenuedailyratepresentation-12720037373418-phpapp01/85/Record-Revenue-Daily-Rate-Presentation-7-320.jpg)

![S1 – Rule Start Date & Duration Known

• Daily [Non-Deferred] Revenue Recognition Rules

apply

Daily All Periods or Daily Partial Periods

• Start Date Scenarios

a) Rule Start Date in the Past

Revenue Recognition begin in current period - AR will catch

up revenue for the past periods in the current period

(assuming the prior periods are closed)

b) Rule Start Date in the current period

Revenue Recognition begins in the current period (standard

scenario)

c) Rule Start Date in the future period

Revenue Recognition happens on the given future date](https://image.slidesharecdn.com/recordrevenuedailyratepresentation-12720037373418-phpapp01/85/Record-Revenue-Daily-Rate-Presentation-15-320.jpg)

![S2 – Rule Start Unknown & Duration Known

• Use Deferred Revenue Recognition Rules

Daily All Periods / Daily Partial Periods

Check Deferred Revenue checkbox

• Alternatively, Use Revenue Contingencies

• Time Based (Refund Policy)

• Event Based (Customer Acceptance, Cash Payment)

• Use Revenue Accounting Form

Manually Trigger revenue using Revenue Accounting Form

Use original GL Date on Invoice or Provide new GL date at

the time of triggering revenue

• Revenue Accounting API

Automated way of triggering revenue [Details in Appendix B

of White Paper]](https://image.slidesharecdn.com/recordrevenuedailyratepresentation-12720037373418-phpapp01/85/Record-Revenue-Daily-Rate-Presentation-16-320.jpg)

![Revenue Accounting Form

[Find Transactions]

NAV: Receivables -> Control -> Accounting -> Revenue Accounting](https://image.slidesharecdn.com/recordrevenuedailyratepresentation-12720037373418-phpapp01/85/Record-Revenue-Daily-Rate-Presentation-17-320.jpg)

![Revenue Accounting Form

[Manage Revenue]](https://image.slidesharecdn.com/recordrevenuedailyratepresentation-12720037373418-phpapp01/85/Record-Revenue-Daily-Rate-Presentation-18-320.jpg)

![Revenue Accounting Form

[Schedule Revenue]](https://image.slidesharecdn.com/recordrevenuedailyratepresentation-12720037373418-phpapp01/85/Record-Revenue-Daily-Rate-Presentation-19-320.jpg)

![Revenue Accounting Form

[Enter Amount / GL Date]](https://image.slidesharecdn.com/recordrevenuedailyratepresentation-12720037373418-phpapp01/85/Record-Revenue-Daily-Rate-Presentation-20-320.jpg)

![Revenue Accounting Form

[Review & Save]](https://image.slidesharecdn.com/recordrevenuedailyratepresentation-12720037373418-phpapp01/85/Record-Revenue-Daily-Rate-Presentation-21-320.jpg)

![References:

• Record Revenue @ Daily Rate [Whitepaper]

– Appendix A & B provide case studies & technical details on

Revenue Accounting API

• Complying with SOP 97-2: Utilizing Daily Revenue

Recognition in Oracle EBS 11.5.10 and Beyond

– By Mike Ivers

• Revenue Management Enhancement: Daily Revenue

[Metalink Note: ID 401000.1]

• For COGS Deferrals: EBS Cost Management Data

Flow in Sub Ledger Accounting & Deferring COGS

– By Dharmalingam Kandampalayam (Dharma)](https://image.slidesharecdn.com/recordrevenuedailyratepresentation-12720037373418-phpapp01/85/Record-Revenue-Daily-Rate-Presentation-25-320.jpg)