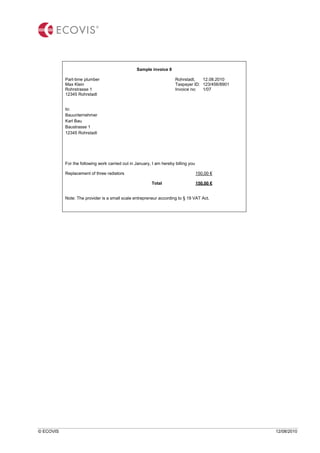

This document summarizes VAT regulations for proper invoice writing in Germany. It provides details on the required and optional information that must be included on invoices, such as supplier and recipient information, invoice numbers, dates, tax rates, and breakdown of items. It also covers special cases like intra-Community deliveries and minimum amount invoices. Recipients are advised to check invoices for completeness to ensure VAT deductions can be claimed.