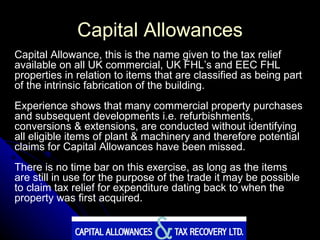

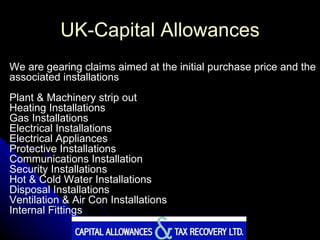

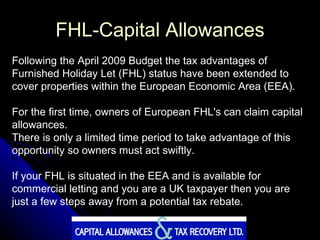

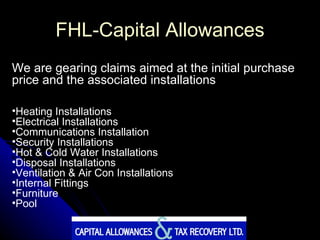

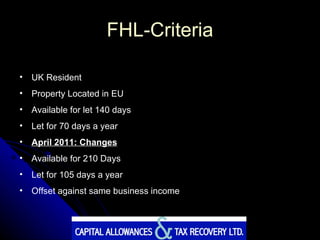

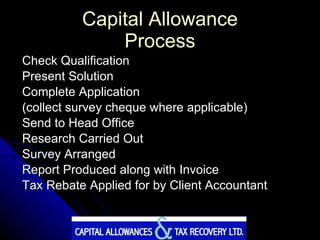

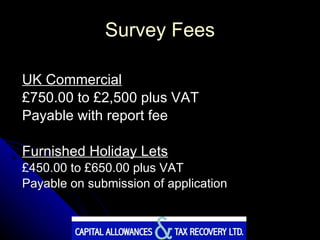

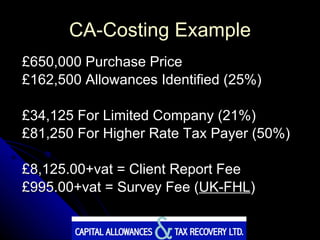

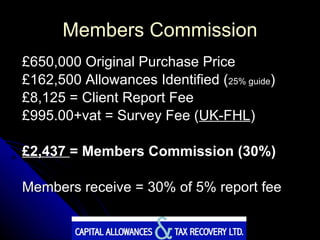

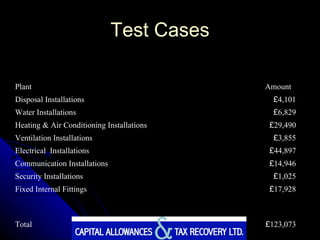

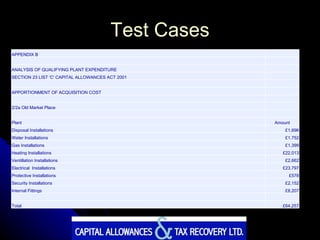

The document provides information about capital allowances for commercial and furnished holiday let properties in the UK and EU. Capital allowances provide tax relief for eligible capital expenditures. The document outlines what expenditures may qualify, how to determine eligibility, and the process for completing an application to claim capital allowances. Survey fees for identifying qualifying expenditures range from £450-£2,500 depending on the type and size of property. Case studies provide examples of capital expenditures identified in past property surveys and potential tax savings calculated from claiming capital allowances.

![Processing Cases Send to: CAATRL 2 Old Market Place Altrincham Cheshire WA14 4NP 0161 928 9961 – 0161 850 1750 [email_address] www.caatrl.com](https://image.slidesharecdn.com/capitalallowances-13062554076223-phpapp02-110524114419-phpapp02/85/Capital-Allowances-27-320.jpg)