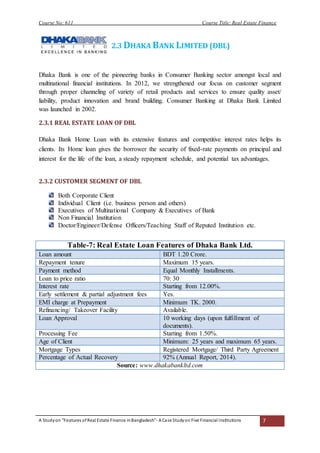

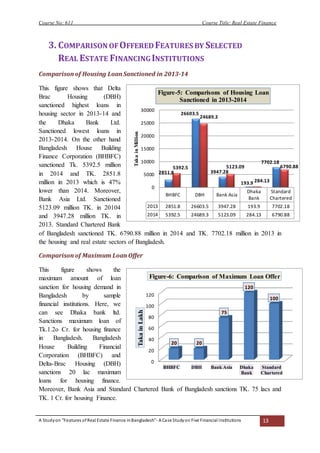

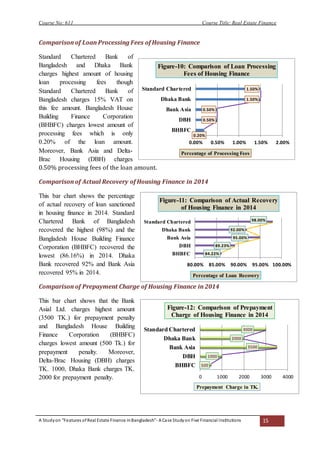

This document discusses real estate financing in Bangladesh, focusing on features of loans from 5 financial institutions - Bangladesh House Building Finance Corporation (BHBFC), Delta Brac Housing Finance Corporation (DBH), Dhaka Bank Limited (DBL), Bank Asia Limited, and Standard Chartered Bank of Bangladesh. It provides details on loan amounts, terms, interest rates, eligibility and documents required for each institution. BHBFC and DBH are specialized housing finance institutions that provide loans primarily to middle-income individuals. DBL also offers competitive home loans to both individual and corporate clients.

![Course No: 611 Course Title: Real Estate Finance

A Studyon “Features ofReal Estate Finance inBangladesh”- A Case Studyon Five Financial Institutions 17

References

Website:

Bangladesh House Building Finance Corporation (BHBFC)-www.bhbfc.gov.bd [Accessed

December 18, 2015].

Bank Asia Limited-www.bankasia-bd.com.[Accessed December 20, 2015].

Dhaka Bank Limited-www.dhakabankltd.com. [Accessed December 18,2015].

Delta Brac Housing Finance Corporation Ltd. (DBH)-www.deltabrac.com [Accessed

December 19, 2015].

Standard Chartered Bank -www.sc.com/bd-Standard.[Accessed December 18,2015].](https://image.slidesharecdn.com/29689fe0-33c7-48a1-80a2-be0a9166016e-160113182438/85/Real-Estate-17-320.jpg)