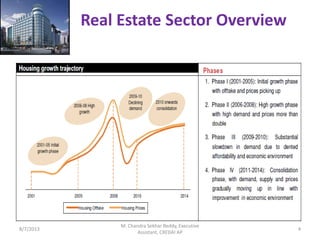

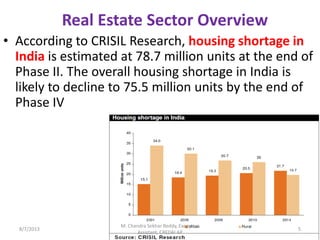

The real estate sector in India has traditionally been dominated by small regional players with low levels of expertise and transparency. It has witnessed significant growth in recent years due to factors like rising incomes, population growth, and migration to urban areas. There remains a huge housing shortage estimated at 78.7 million units. While the global financial crisis temporarily slowed growth, the sector has since recovered and is expected to become a $180 billion industry by 2020. The government has introduced several initiatives to boost the sector through increased funding, regulatory reforms, and incentives for development.