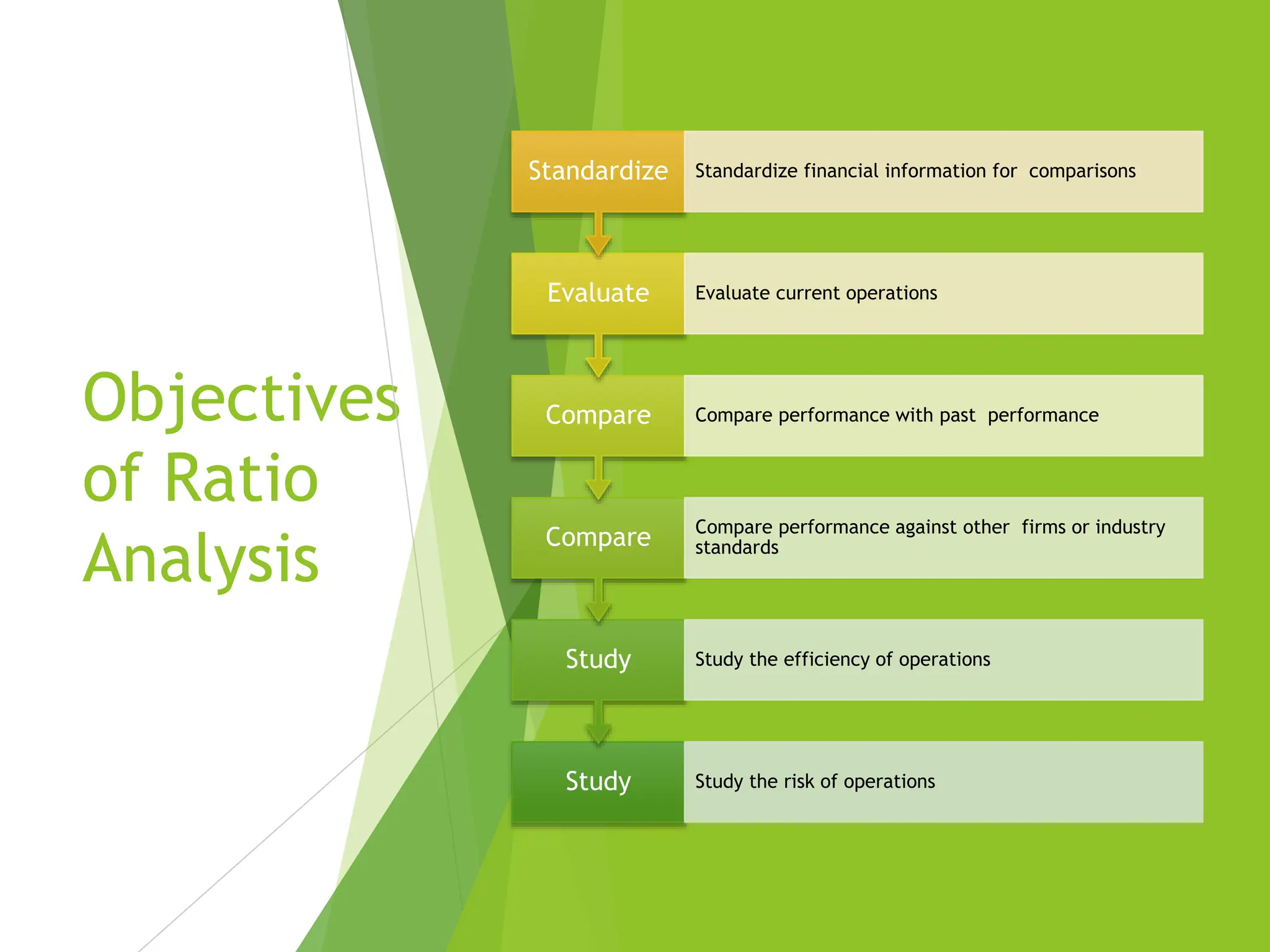

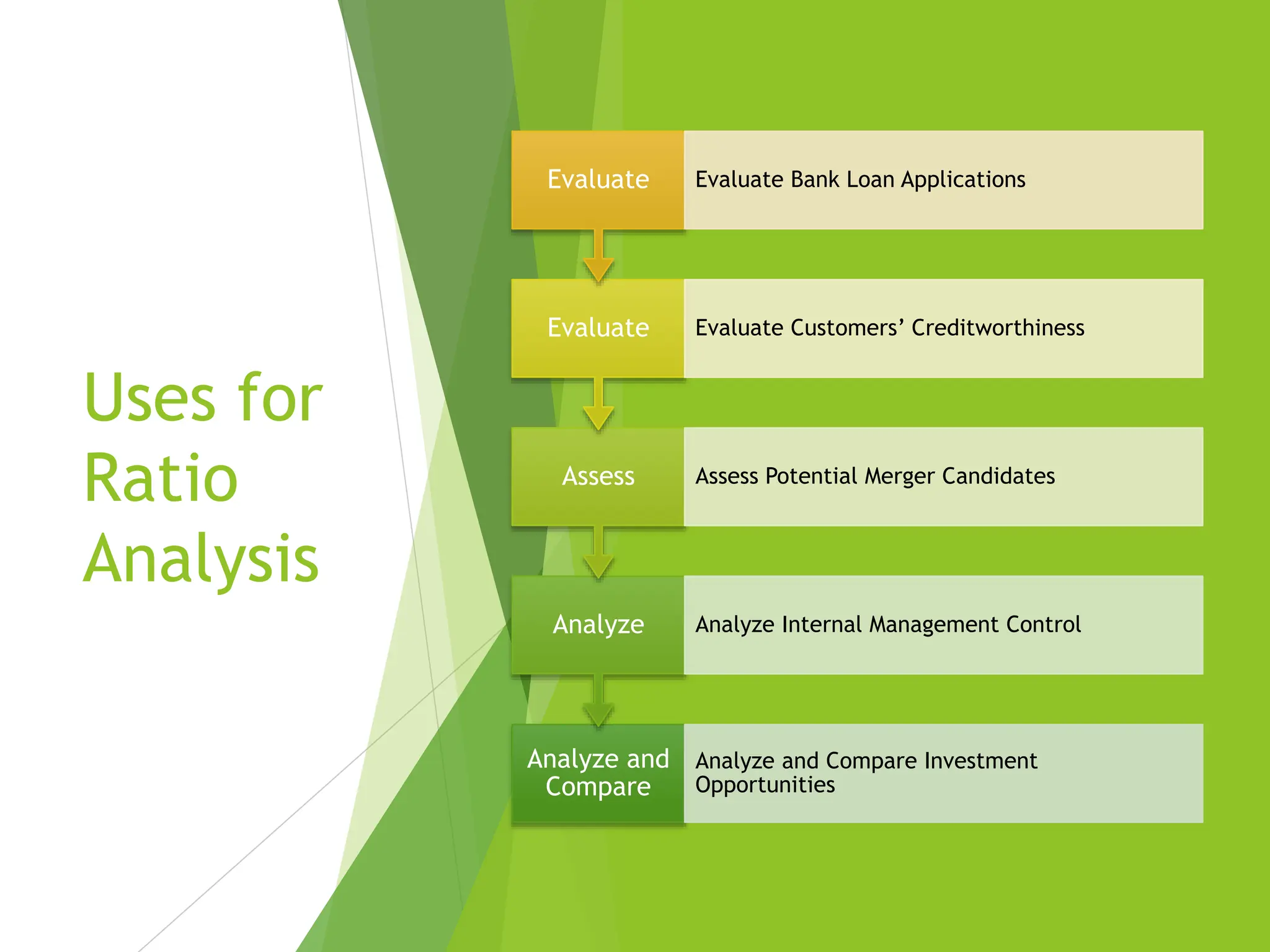

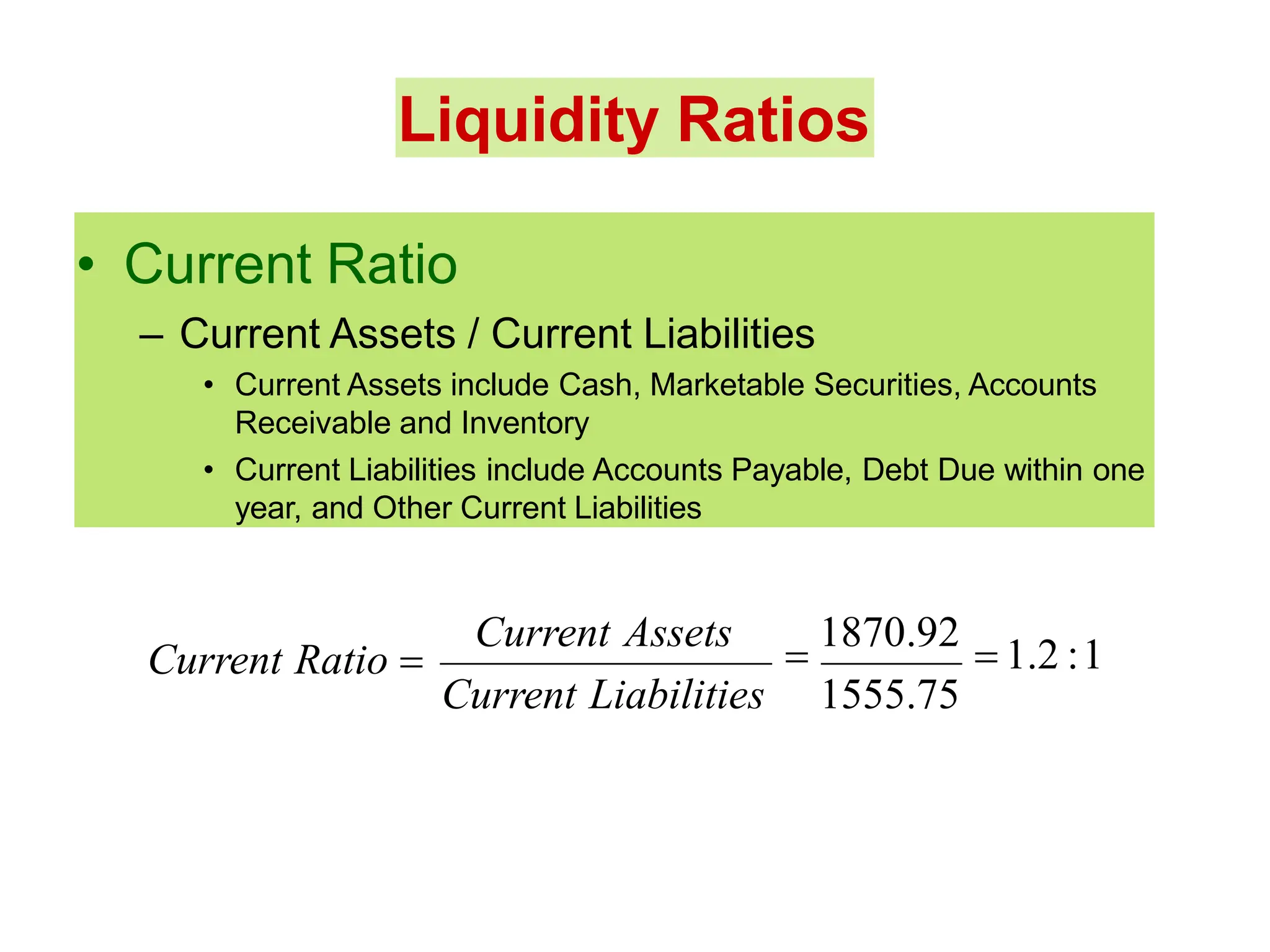

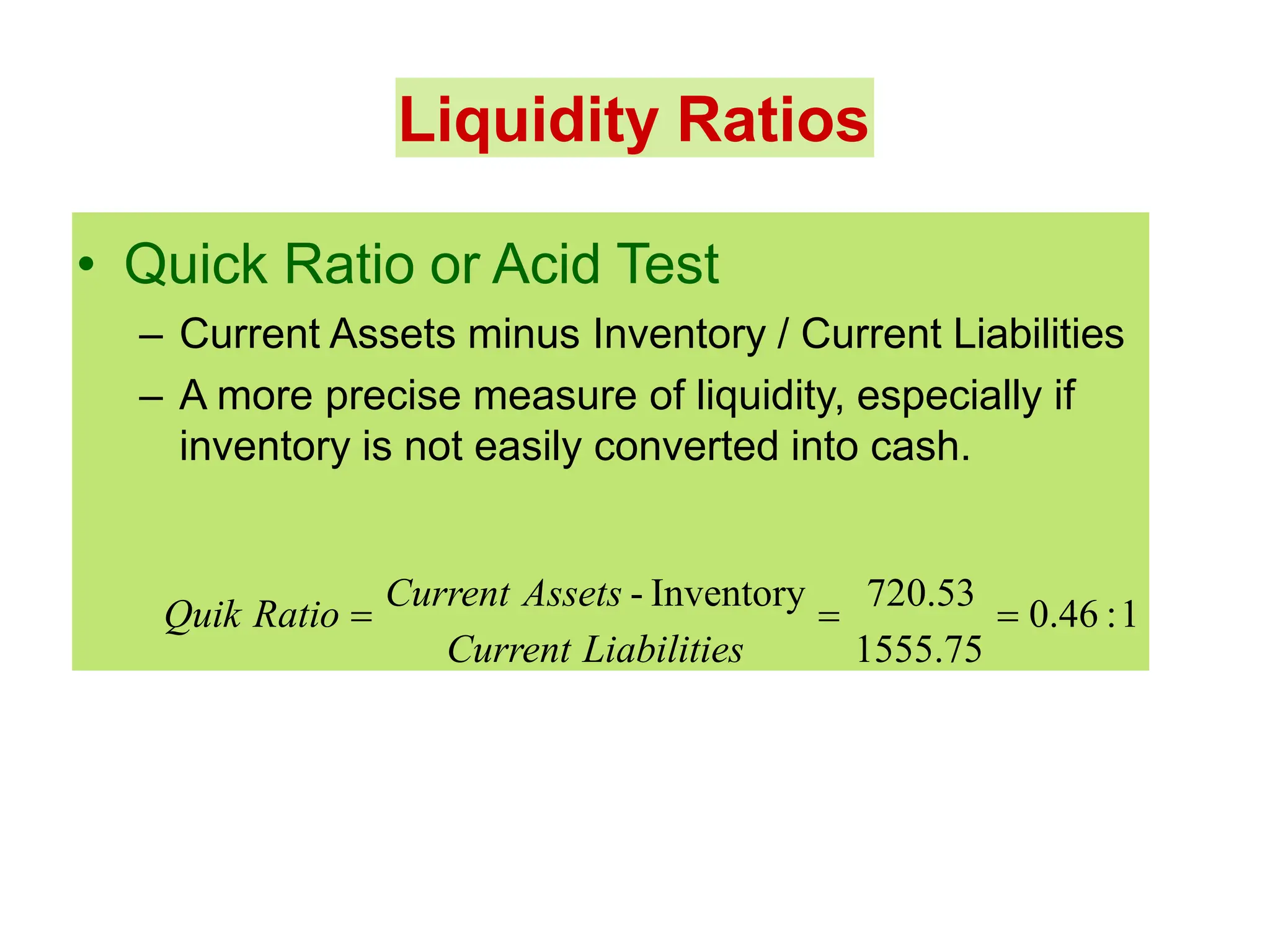

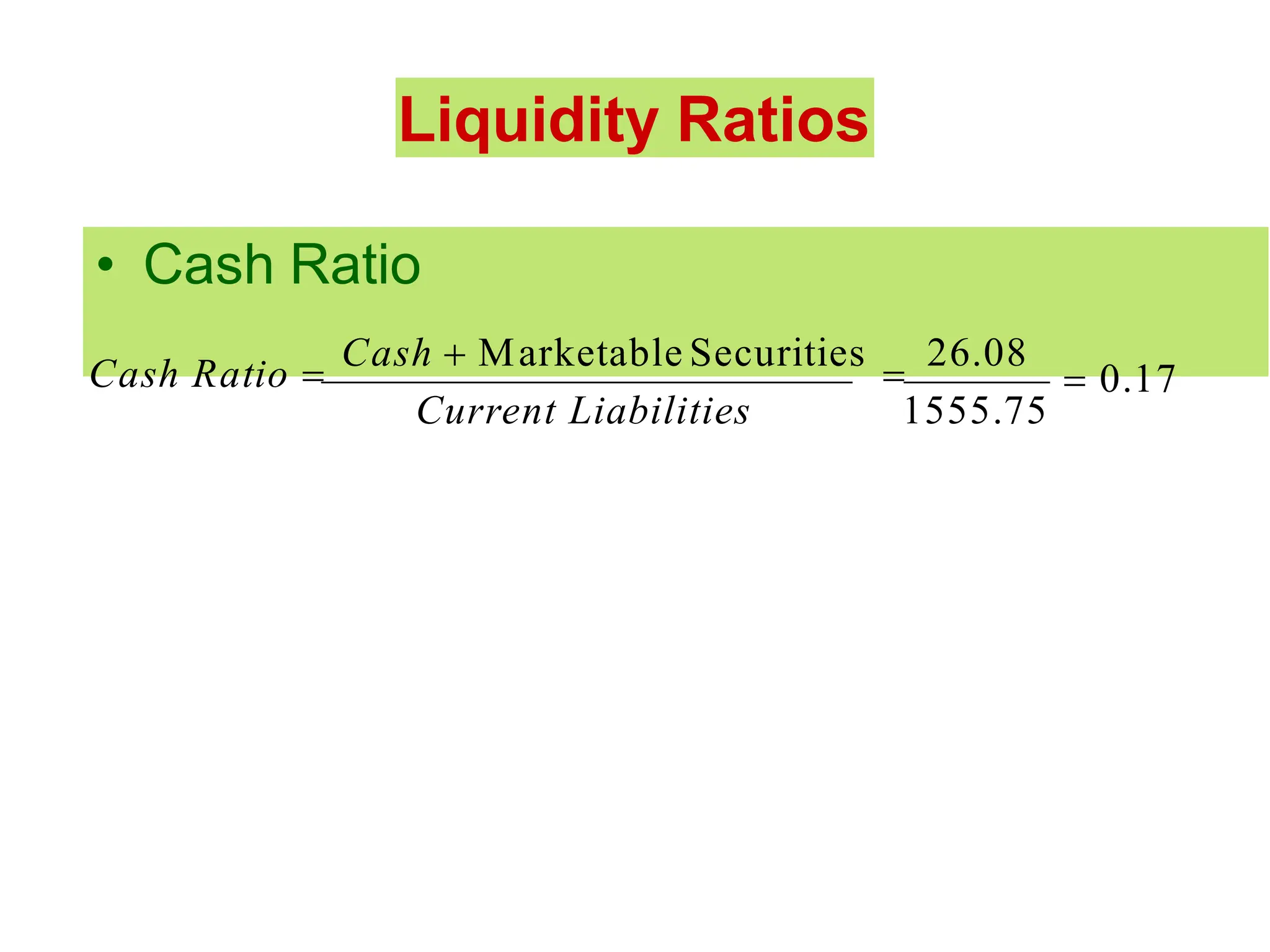

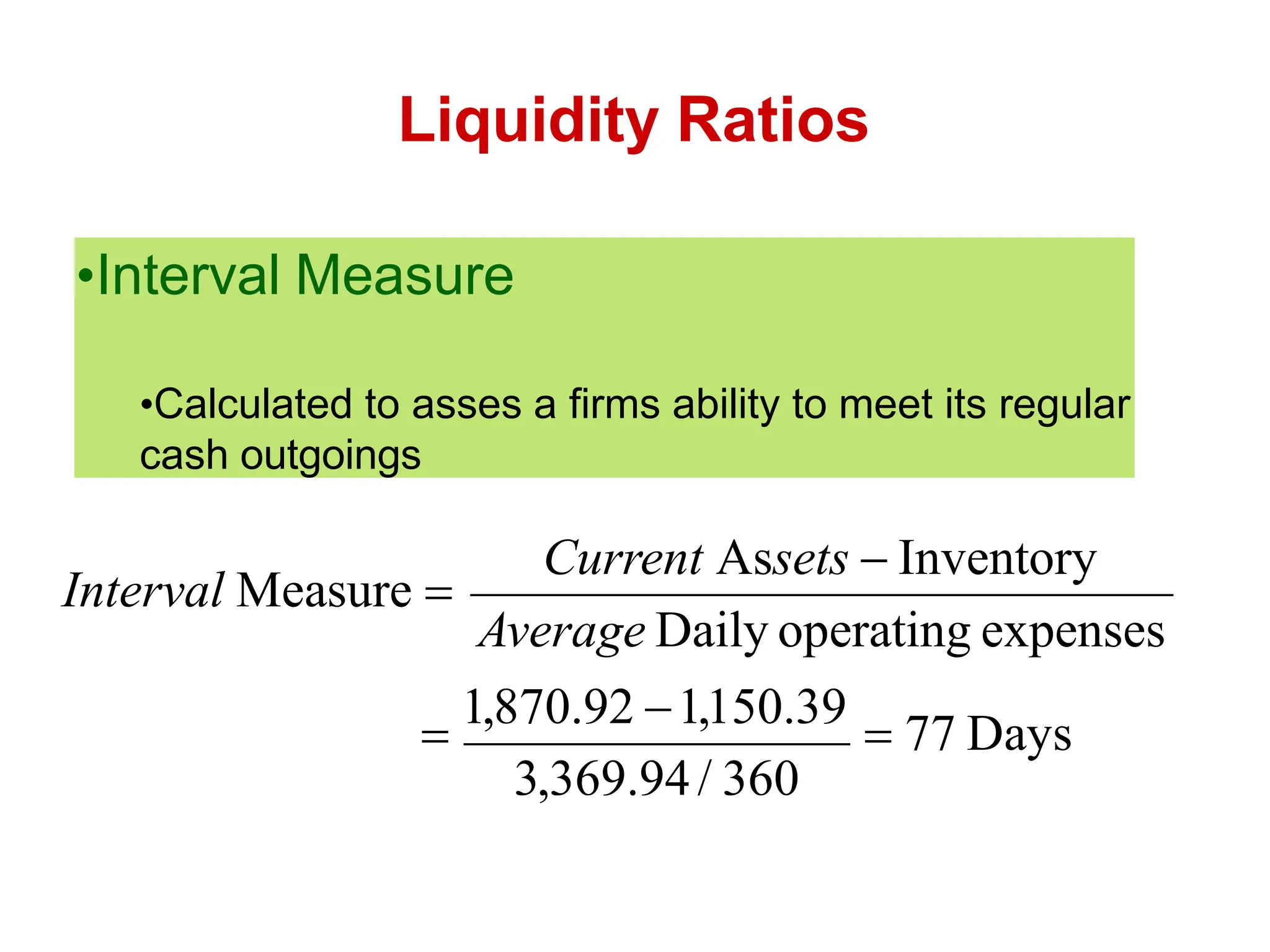

Financial statement analysis is done to assess a firm's past, present, and future financial conditions by identifying strengths and weaknesses. It uses financial statements and ratio analysis, which compares ratios over time, against industry standards, and between firms. Ratio analysis has several uses, including evaluating investment opportunities, internal management control, merger candidates, creditworthiness, and loan applications. Key ratios include liquidity ratios like the current ratio and quick ratio, leverage ratios, activity ratios, and profitability ratios.