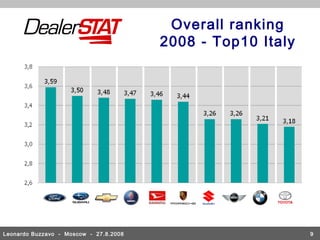

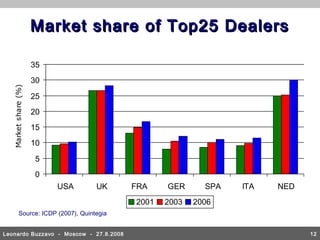

The document discusses the automotive dealer landscape in Europe, highlighting trends such as increased manufacturer control, the need for a broader business mix, and a heightened focus on customer satisfaction. It also addresses regulatory changes affecting franchise contracts and anticipates future competition dynamics in the industry. Key performance indicators and business management practices are emphasized as critical for dealer success in a saturated market.