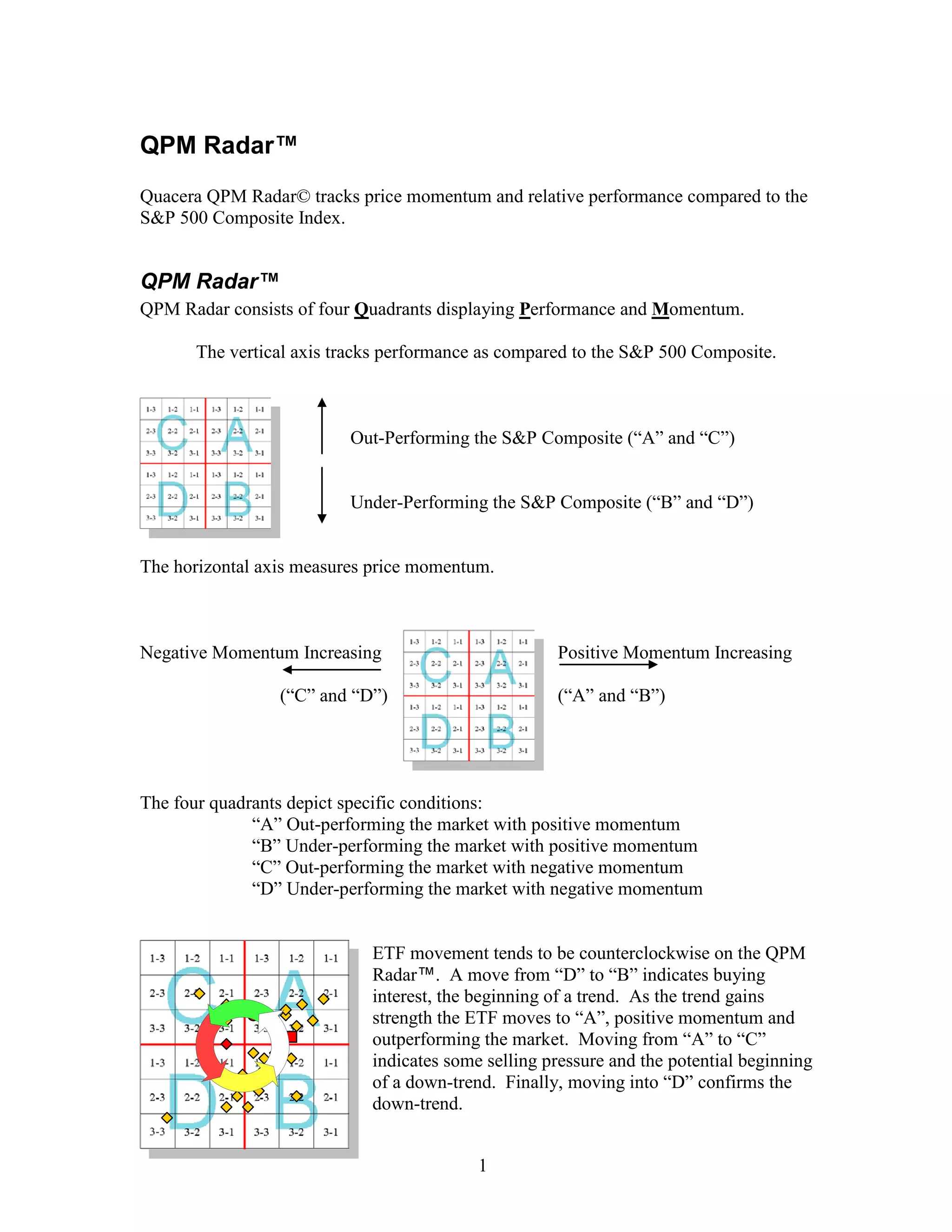

QPM Radar tracks the performance and momentum of ETFs compared to the S&P 500. It displays these metrics on a quadrant chart, with the vertical axis measuring performance relative to the S&P 500 and the horizontal axis measuring momentum. The four quadrants indicate whether an ETF is outperforming or underperforming the market, and whether its momentum is positive or negative. ETF movement on the chart tends to rotate counterclockwise, with transitions between quadrants signaling potential trends or changes in trends.