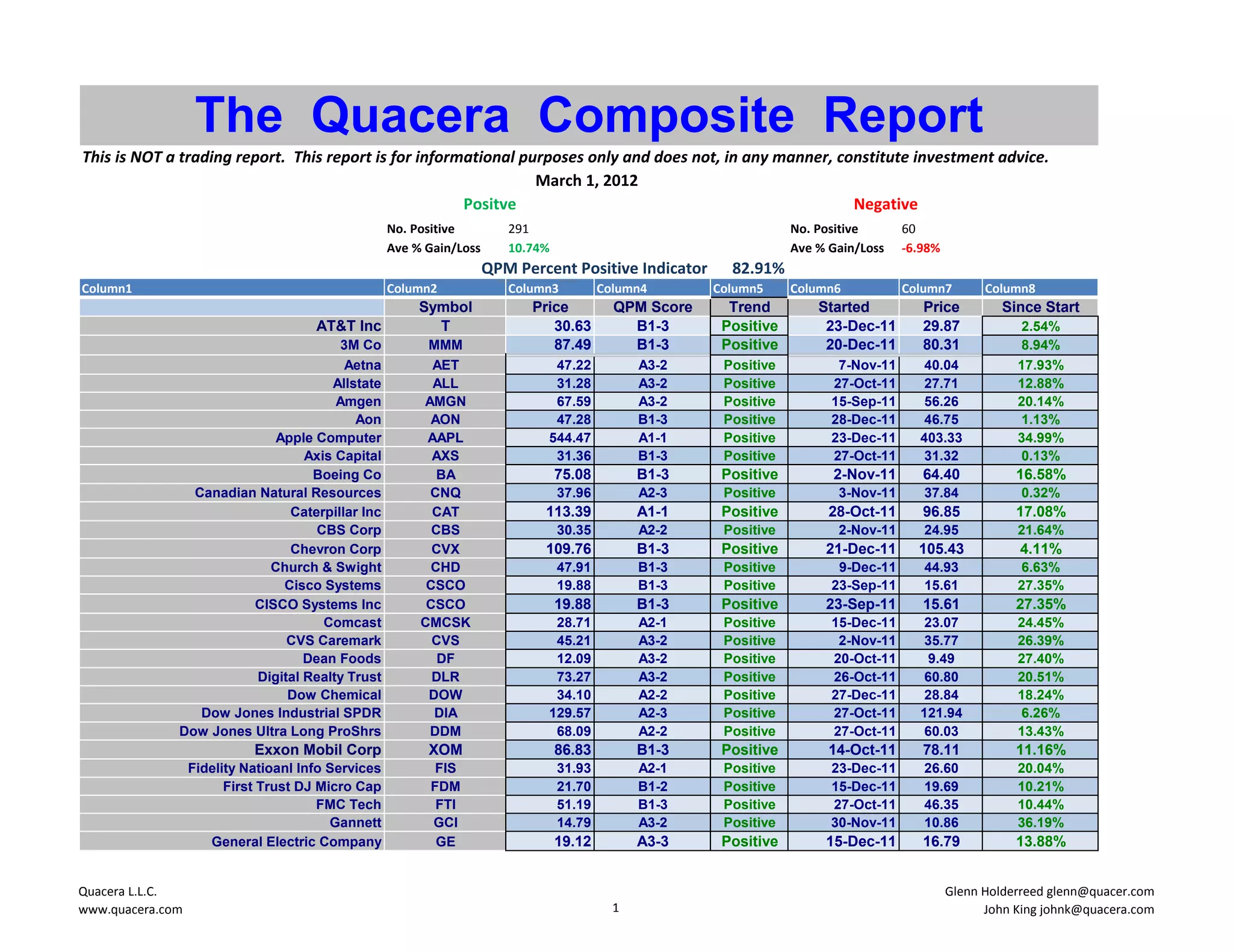

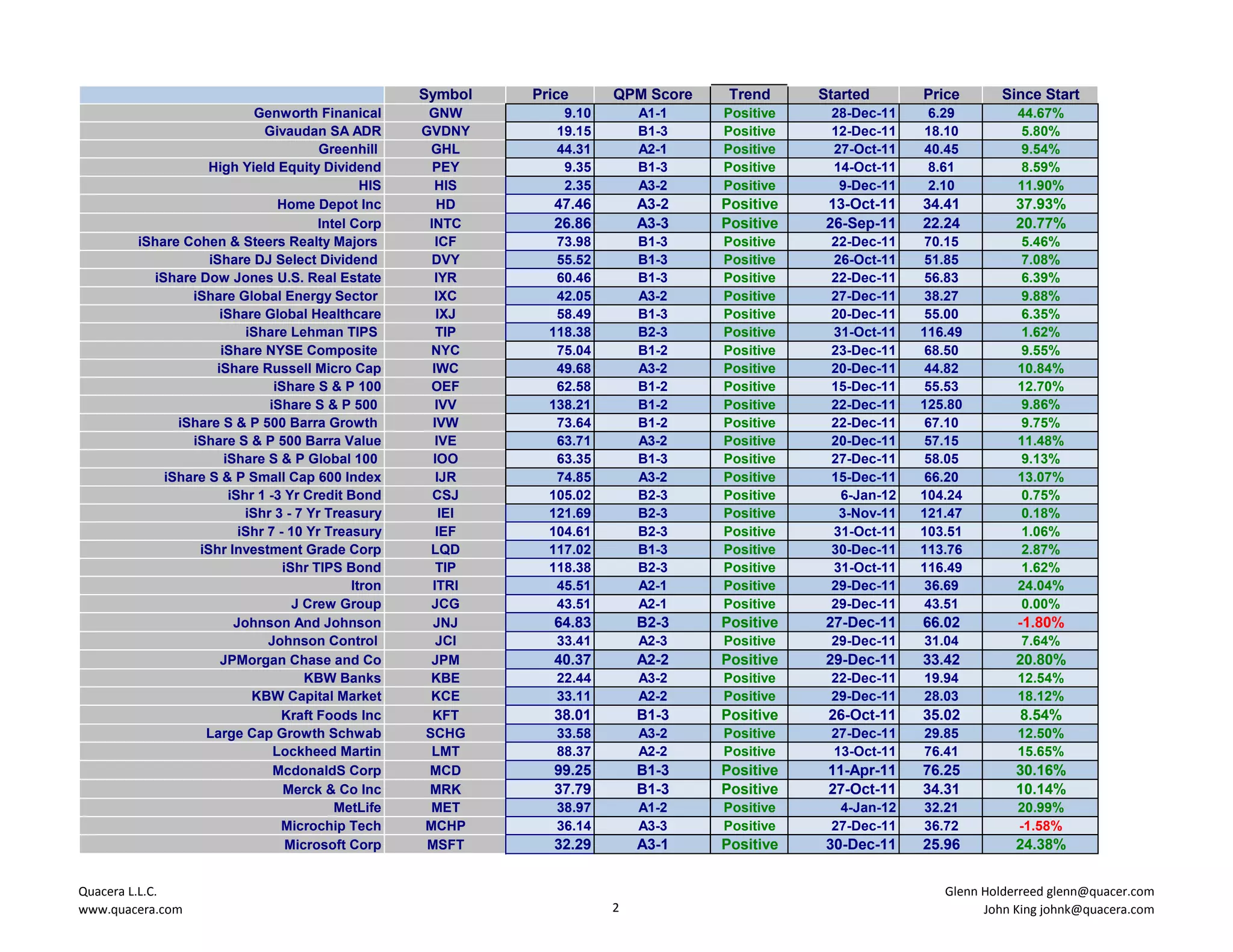

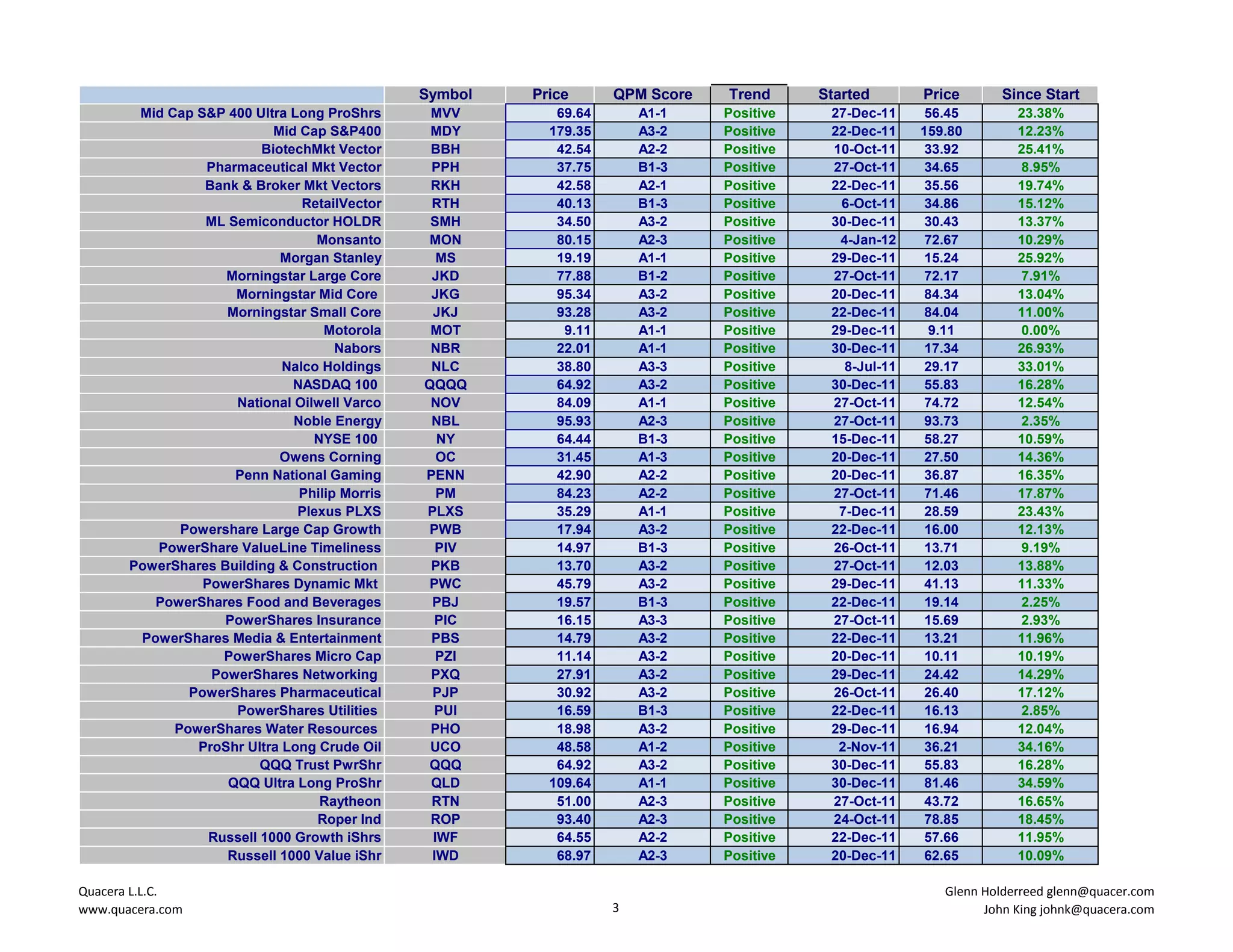

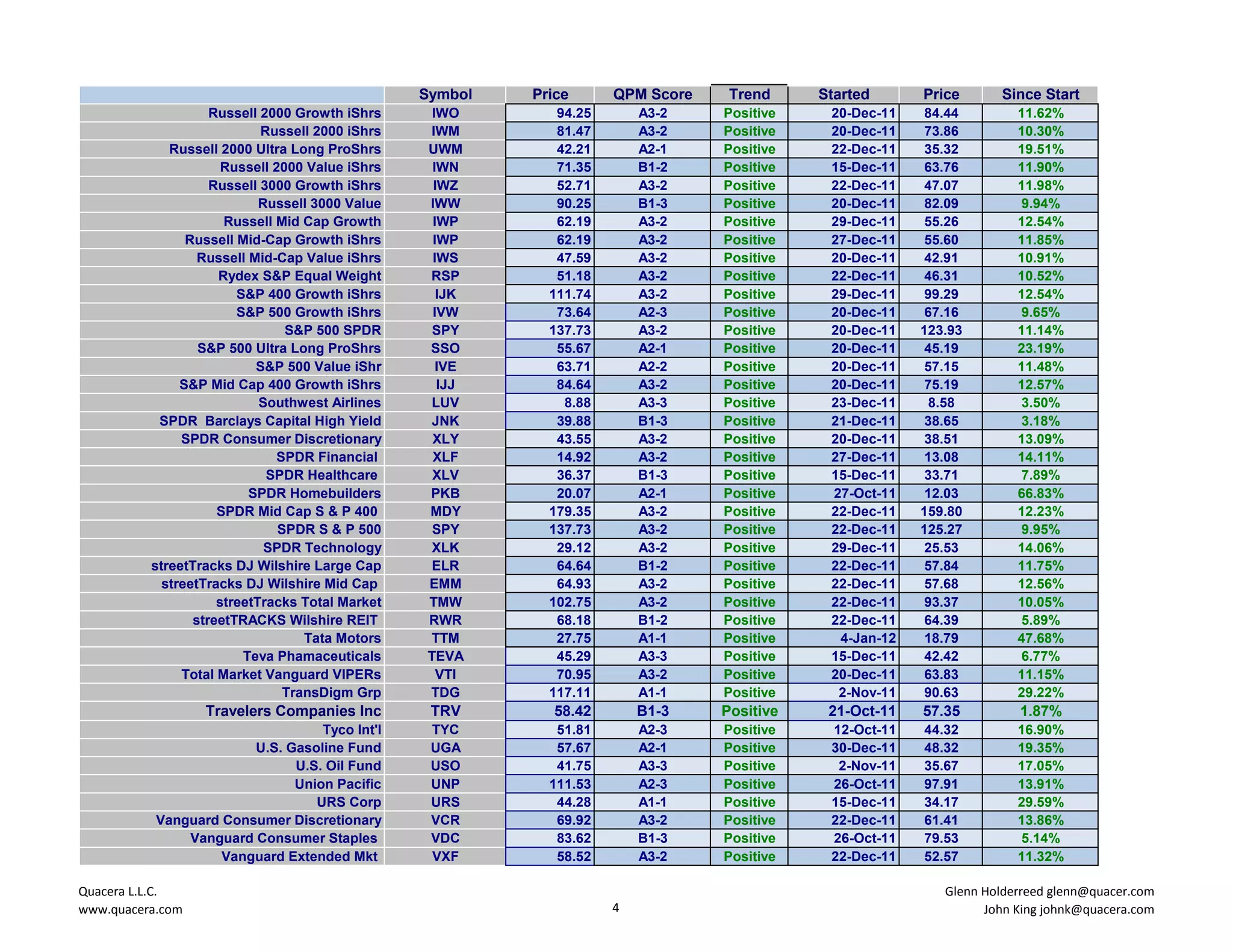

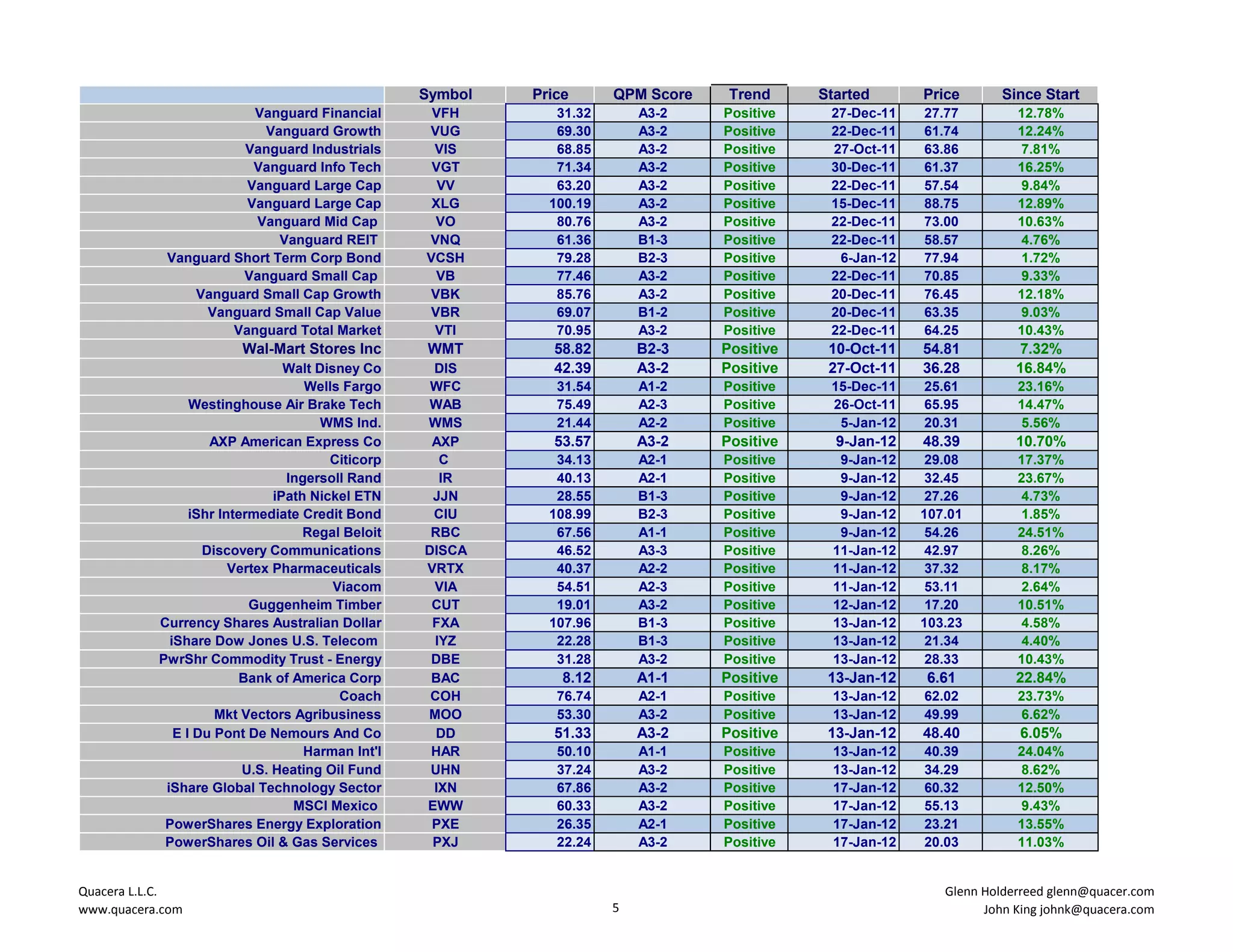

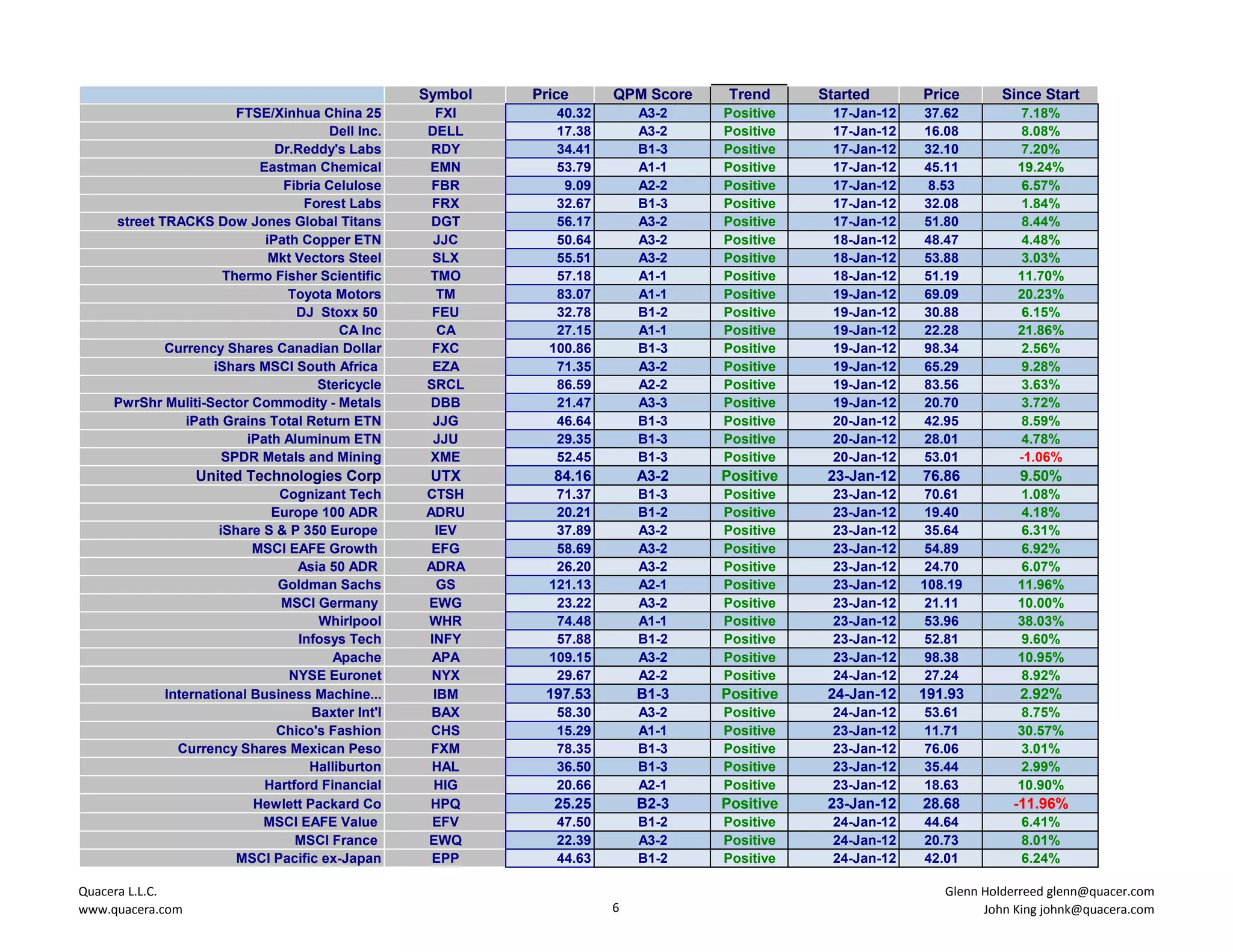

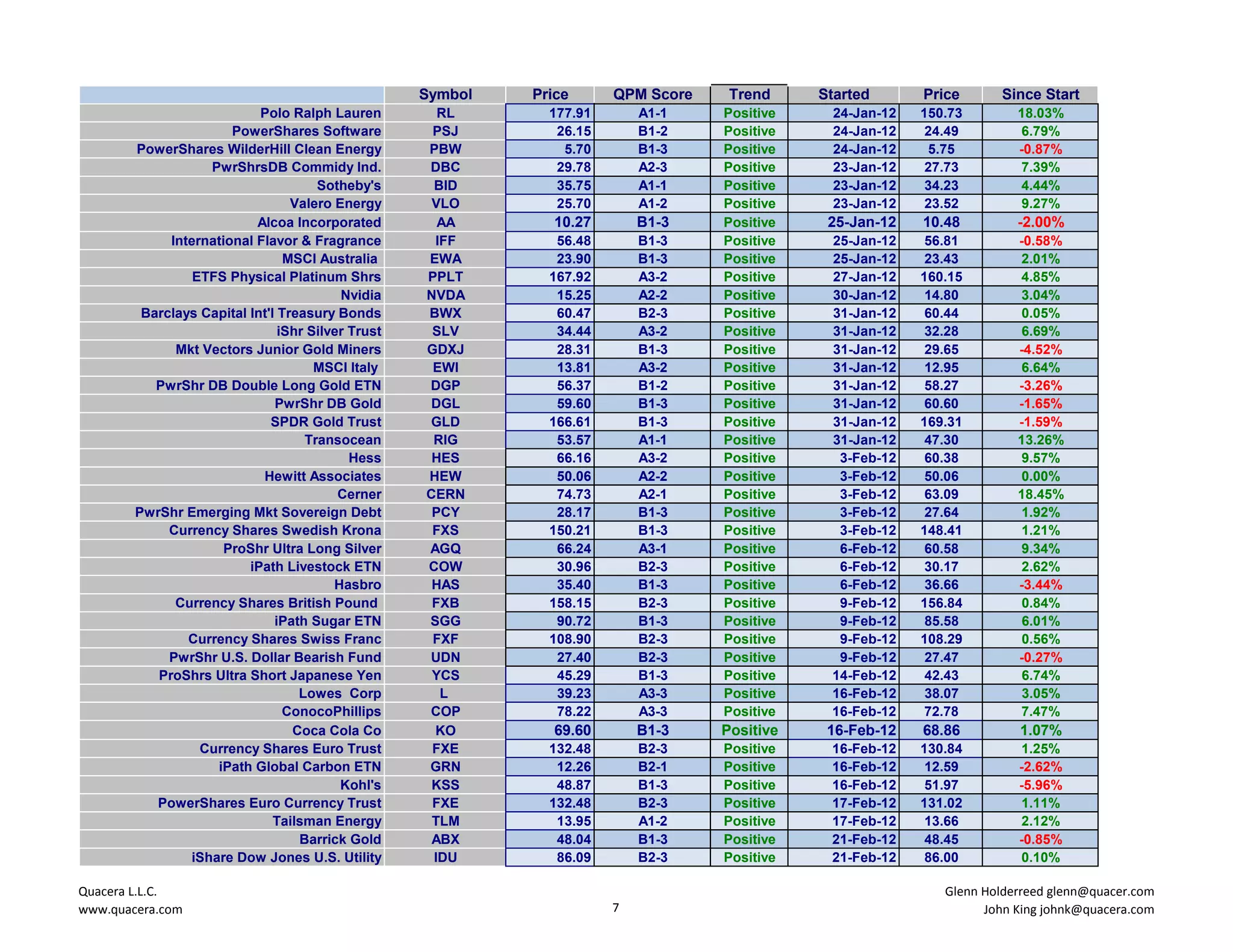

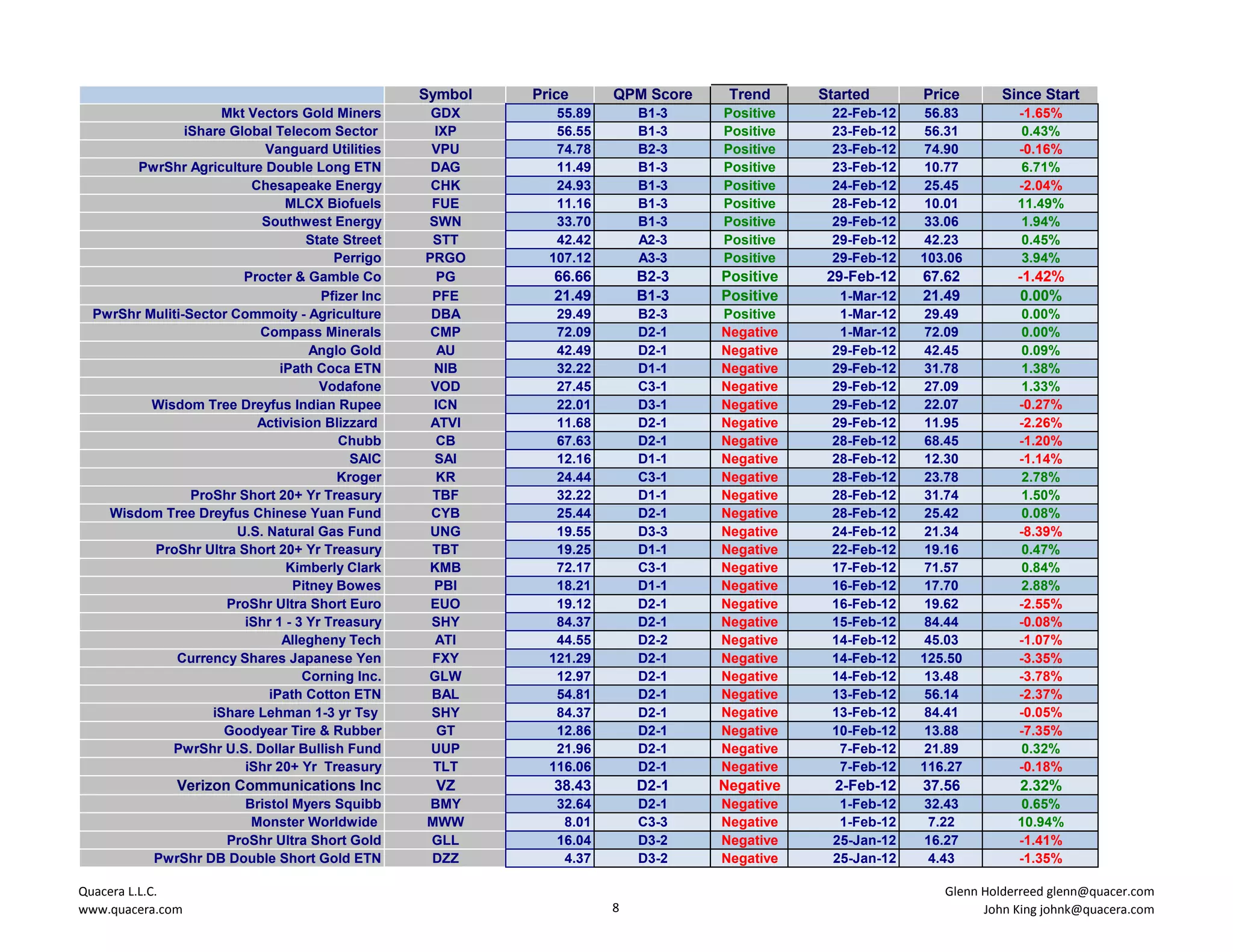

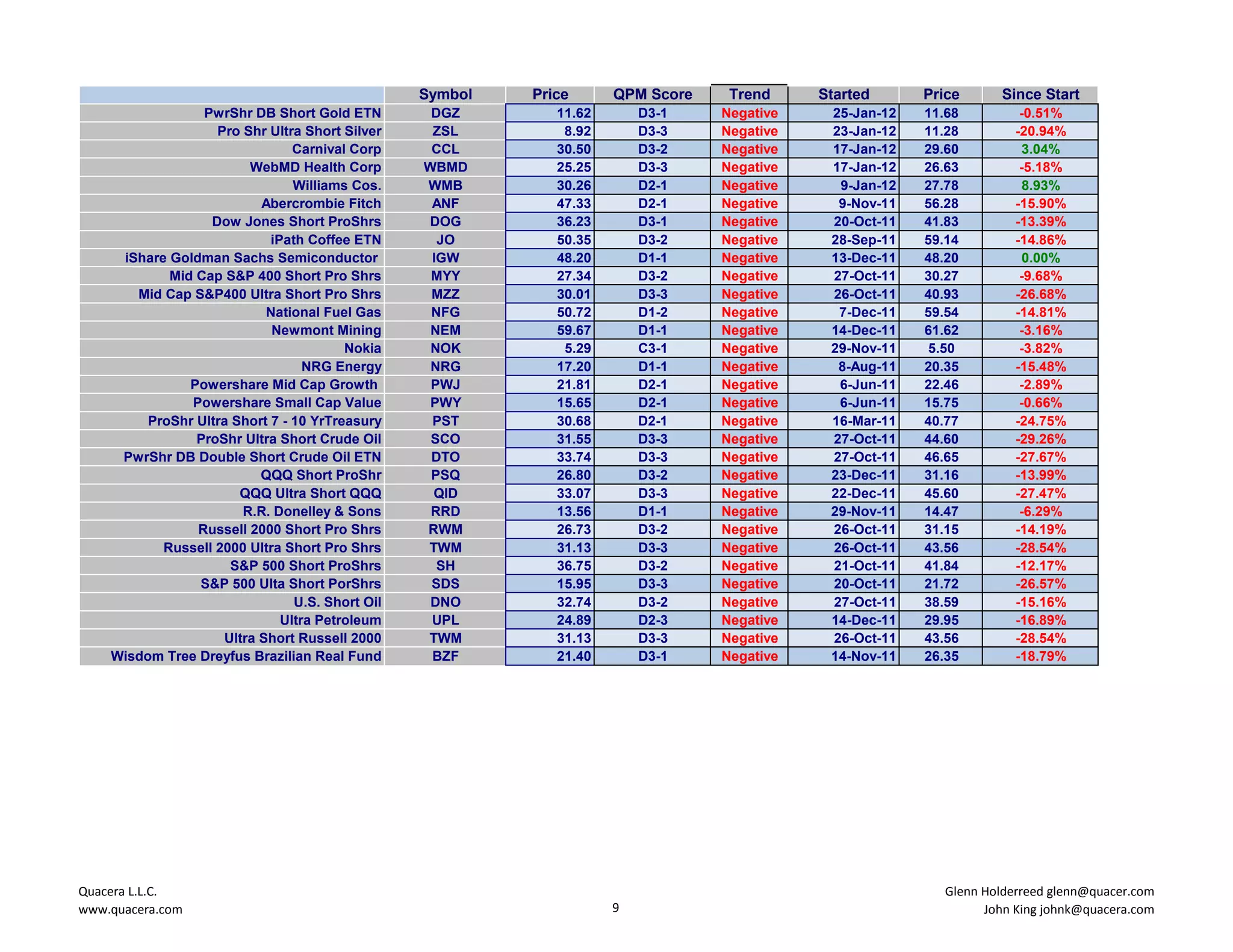

This report provides stock analysis and performance data for over 290 stocks. It finds that 82.91% of the stocks had a positive performance over their analyzed period, with an average gain of 10.74%, while the remaining 17.09% had an average loss of 6.98%. For each stock, it provides the ticker symbol, current price, analyst score, trend, start date of analysis period, start price, and percentage change. The report is informational only and does not constitute investment advice.