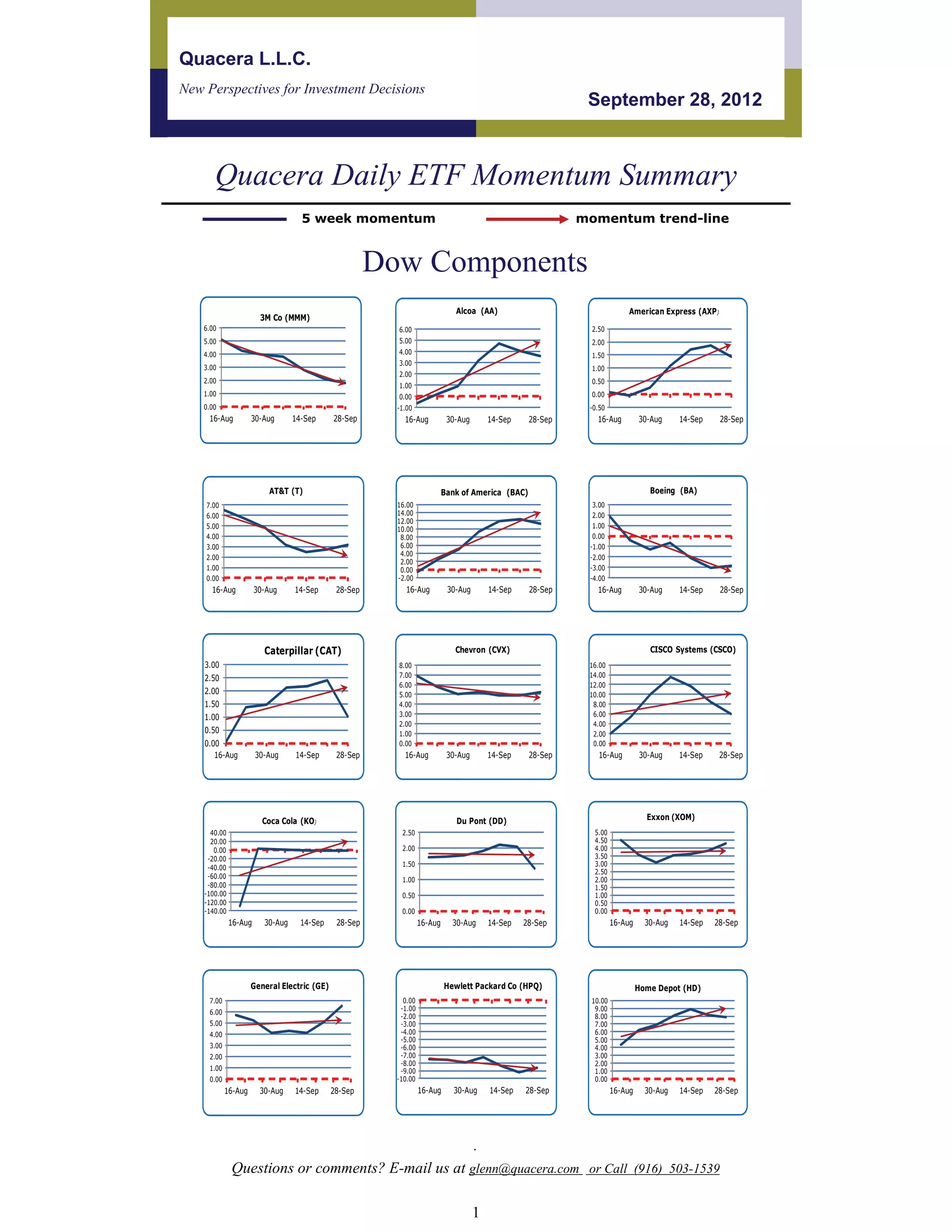

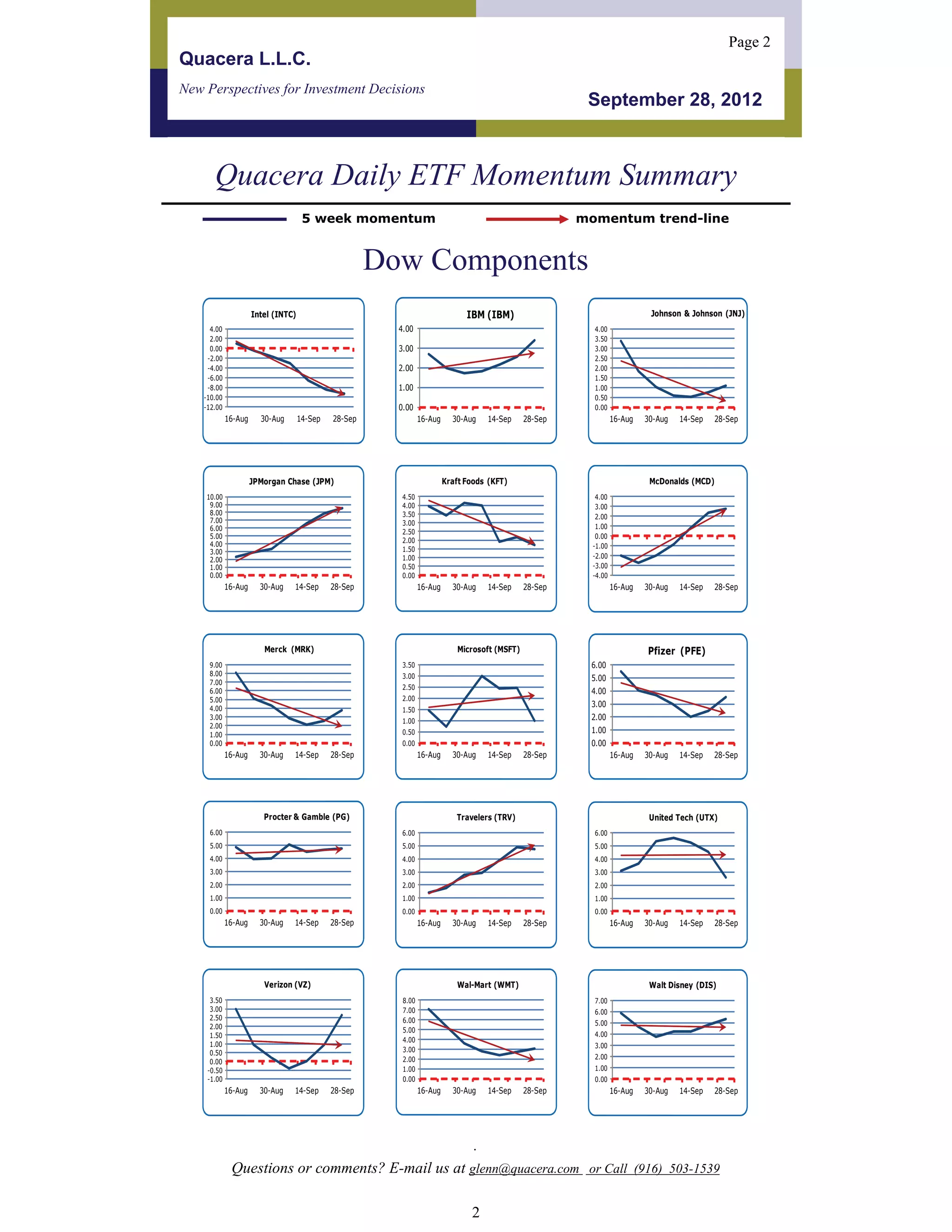

The document is a momentum summary from Quacera L.L.C. analyzing the 5-week momentum and trend lines of various Dow components from August 16th to September 28th. Graphs show the momentum of 30 large companies over the past 5 weeks, including 3M, American Express, AT&T, Bank of America, Boeing, Caterpillar, Chevron, Cisco, Coca Cola, Du Pont, Exxon, General Electric, Hewlett Packard, Home Depot, Intel, IBM, Johnson & Johnson, JPMorgan Chase, Kraft Foods, McDonalds, Merck, Microsoft, Pfizer, Procter & Gamble, Travelers, United Technologies,