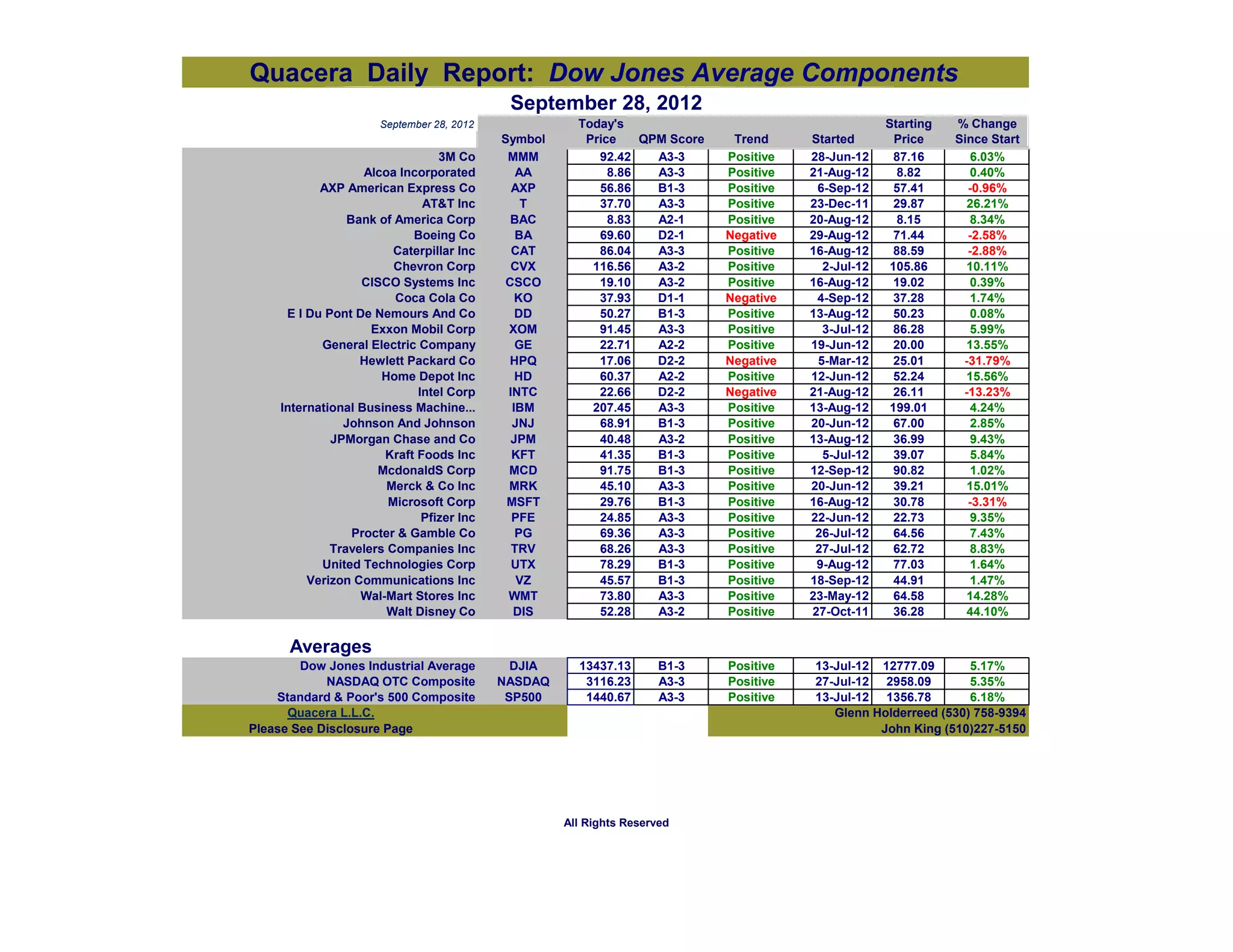

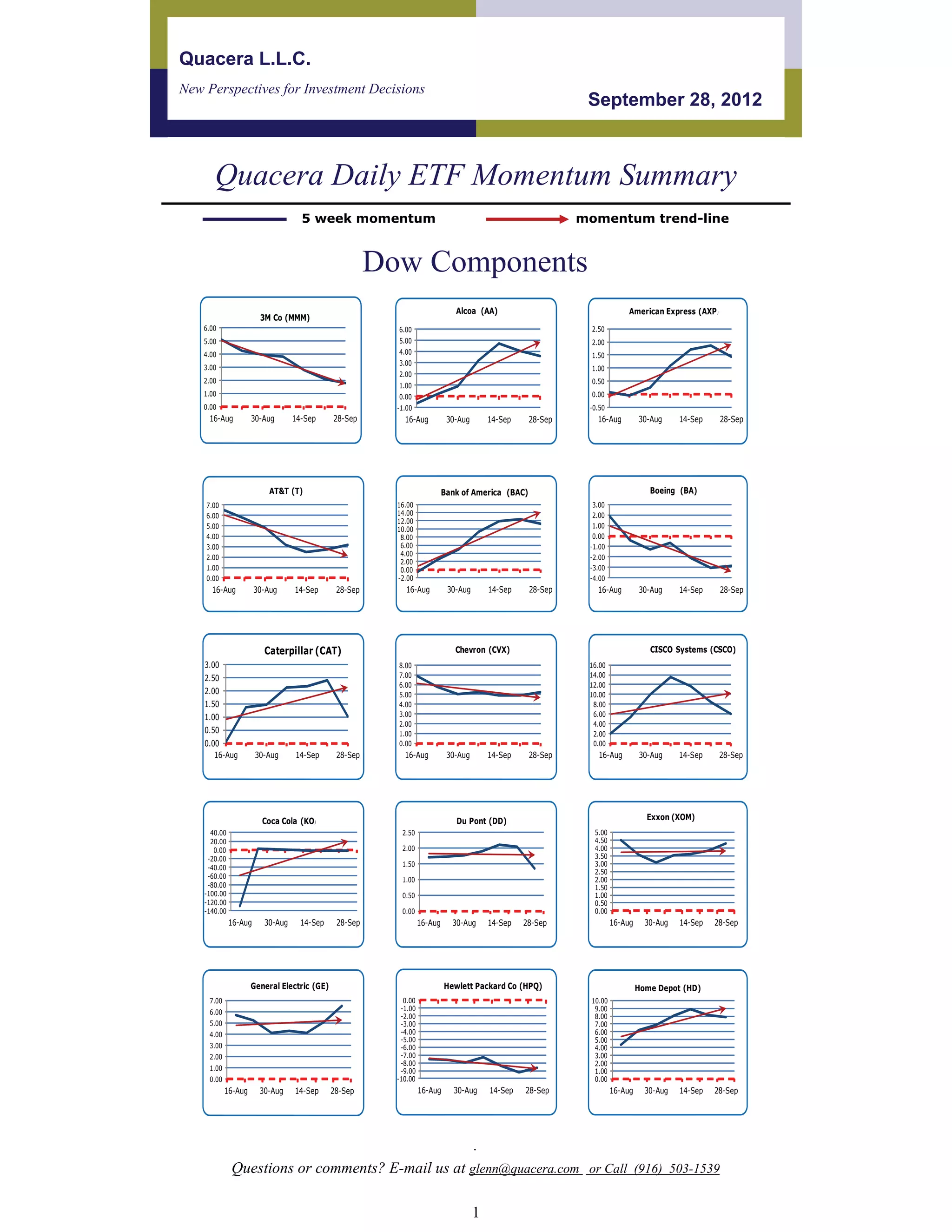

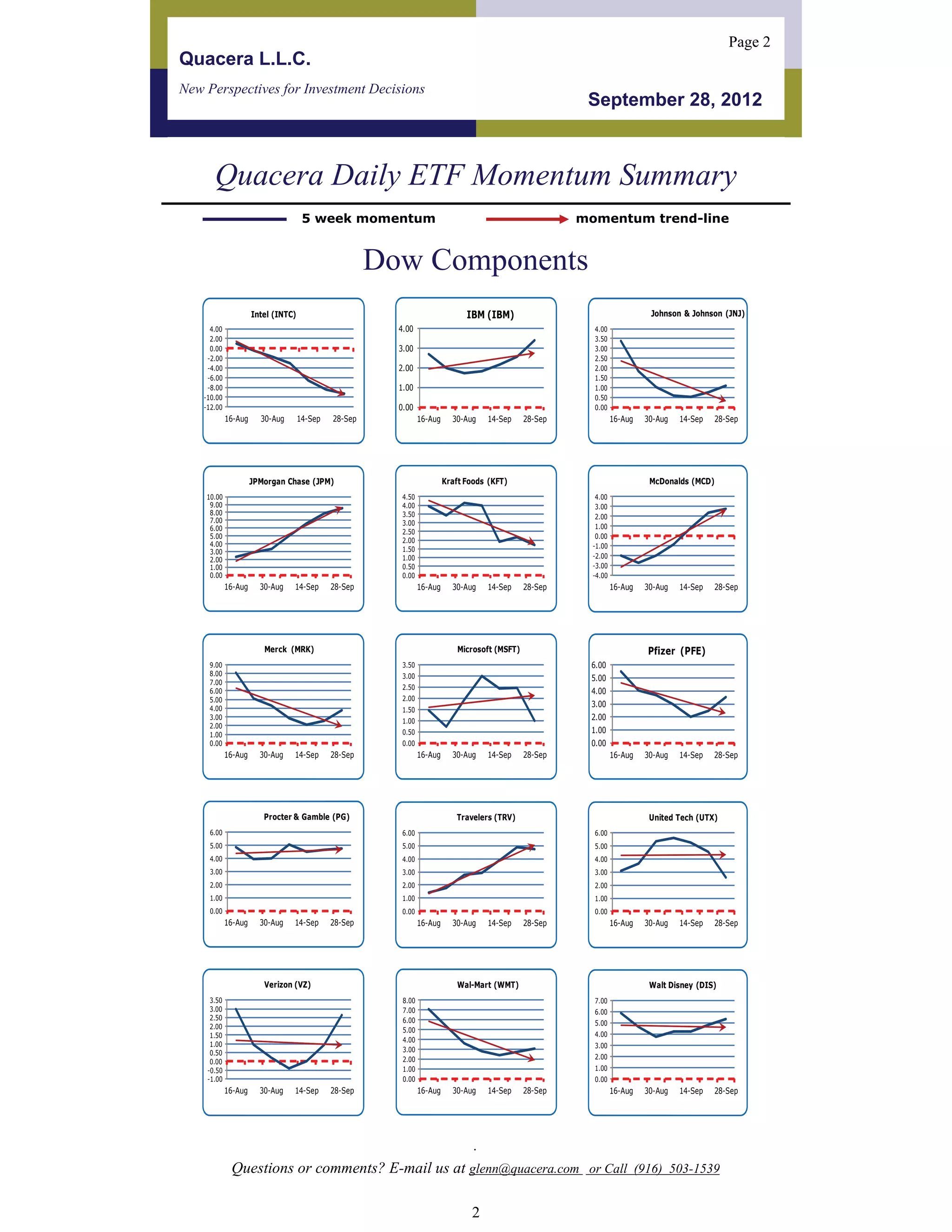

The document provides a daily report on the Dow Jones Industrial Average components, including each stock's symbol, price, QPM score assessing its momentum, trend, starting price and percentage change since starting. It also includes 5-week momentum charts for each stock and averages for the Dow, NASDAQ and S&P 500 indexes over the past month, all showing generally positive trends.