Quacera Early Warning Report July 30th

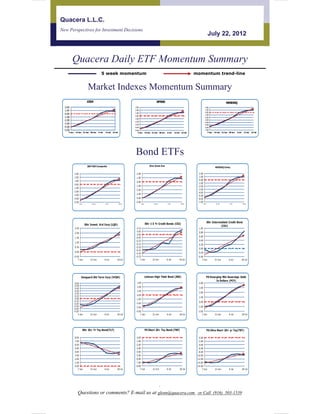

- 1. Quacera L.L.C. New Perspectives for Investment Decisions July 22, 2012 Quacera Daily ETF Momentum Summary 5 week momentum momentum trend-line Market Indexes Momentum Summary DJIA SP500 NASDAQ 2.00 3.00 2.00 1.00 2.00 1.00 1.00 0.00 0.00 -1.00 0.00 -1.00 -2.00 -1.00 -2.00 -3.00 -2.00 -4.00 -3.00 -3.00 -5.00 -4.00 -4.00 -6.00 -5.00 -5.00 -7.00 7-Jun 14-Jun 21-Jun 28-Jun 6-Jul 13-Jul 22-Jul 7-Jun 14-Jun 21-Jun 28-Jun 6-Jul 13-Jul 22-Jul 7-Jun 14-Jun 21-Jun 28-Jun 6-Jul 13-Jul 22-Jul Bond ETFs S&P 500 Composite Dow Jones Ave. NASDAQ Comp. 3.00 2.00 2.00 2.00 1.00 1.00 1.00 0.00 0.00 -1.00 0.00 -1.00 -2.00 -1.00 -2.00 -3.00 -2.00 -4.00 -3.00 -3.00 -5.00 -4.00 -4.00 -6.00 -5.00 -5.00 -7.00 7-Jun 21-Jun 6-Jul 20-Jul 7-Jun 21-Jun 6-Jul 20-Jul 7-Jun 21-Jun 6-Jul 20-Jul iShr Intermediate Credit Bond iShr Invest. Grd Corp (LQD) iShr 1-3 Yr Credit Bonds (CSJ) (CIU) 2.50 0.10 1.00 0.05 0.80 2.00 0.00 0.60 1.50 -0.05 -0.10 0.40 1.00 -0.15 0.20 0.50 -0.20 0.00 -0.25 0.00 -0.20 -0.30 -0.50 -0.35 -0.40 7-Jun 21-Jun 6-Jul 20-Jul 7-Jun 21-Jun 6-Jul 20-Jul 7-Jun 21-Jun 6-Jul 20-Jul Vanguard Sht Term Corp (VCSH) Lehman High Yield Bond (JNK) PS Emerging Mkt Sovereign Debt In Dollars (PCY) 0.60 3.00 4.00 0.50 2.00 0.40 3.00 0.30 1.00 0.20 2.00 0.10 0.00 1.00 0.00 -1.00 -0.10 0.00 -0.20 -2.00 -0.30 -3.00 -1.00 -0.40 -0.50 -4.00 -2.00 7-Jun 21-Jun 6-Jul 20-Jul 7-Jun 21-Jun 6-Jul 20-Jul 7-Jun 21-Jun 6-Jul 20-Jul iShr 20+ Yr Tsy Bond(TLT) PS Short 20+ Tsy Bond-(TBF) PS Ultra Short 20+ yr Tsy(TBT) 8.00 0.00 0.00 7.00 -1.00 -2.00 6.00 -2.00 -4.00 5.00 -3.00 -6.00 4.00 -4.00 -8.00 3.00 -5.00 -10.00 2.00 -6.00 -12.00 1.00 -7.00 -14.00 0.00 -8.00 -16.00 7-Jun 21-Jun 6-Jul 20-Jul 7-Jun 21-Jun 6-Jul 20-Jul 7-Jun 21-Jun 6-Jul 20-Jul . Questions or comments? E-mail us at glenn@quacera.com or Call (916) 503-1539

- 2. Page No.2 Quacera L.L.C. New Perspectives for Investment Decisions July 22, 2012 Bond ETFs iShr 1-3 Yr Treasury Bond-(SHY) iShr 7-10 Yr Tsy Bond-(IEF) PS Ultra Short 7-10 yr Tsy-(PST) 0.06 3.00 0.00 0.05 2.50 -1.00 0.04 2.00 -2.00 0.03 0.02 1.50 -3.00 0.01 1.00 -4.00 0.00 0.50 -5.00 -0.01 -0.02 0.00 -6.00 7-Jun 21-Jun 6-Jul 20-Jul 7-Jun 21-Jun 6-Jul 20-Jul 7-Jun 21-Jun 6-Jul 20-Jul iShr 3-7 Yr Treasury Bond -(IEI) SPDR Lehman Int'l Tsy Bond- iShr TIPS Bond Fund-(TIP) (BWX)_ 0.80 1.20 0.50 0.70 1.00 0.00 0.60 0.80 0.50 -0.50 0.40 0.60 0.30 -1.00 0.40 0.20 0.20 -1.50 0.10 0.00 0.00 -2.00 7-Jun 21-Jun 6-Jul 20-Jul 7-Jun 21-Jun 6-Jul 20-Jul 7-Jun 21-Jun 6-Jul 20-Jul 2

- 3. Page No.3 Quacera L.L.C. New Perspectives for Investment Decisions July 22, 2012 Commodity ETFs DB Commodity Trackin Index (DBC) . PwrShr Multi-Sector Commodity DB Agriculture Double Long (DAG) Agriculture (DBA) 4.00 10.00 40.00 2.00 8.00 30.00 0.00 6.00 4.00 20.00 -2.00 2.00 -4.00 10.00 0.00 -6.00 -2.00 0.00 -8.00 -4.00 -10.00 -10.00 -6.00 -12.00 -8.00 -20.00 7-Jun 14-Jun 21-Jun 28-Jun 6-Jul 13-Jul 20-Jul 7-Jun 14-Jun 21-Jun 28-Jun 6-Jul 13-Jul 20-Jul 7-Jun 14-Jun 21-Jun 28-Jun 6-Jul 13-Jul 20-Jul iPath Grains Total Return (JJG) iPath Livestock (COW) iPath Sugar Subindex (SSG) 30.00 1.20 15.00 25.00 1.00 10.00 20.00 0.80 0.60 5.00 15.00 0.40 10.00 0.00 0.20 5.00 0.00 -5.00 0.00 -0.20 -10.00 -5.00 -0.40 -10.00 -0.60 -15.00 7-Jun 14-Jun 21-Jun 28-Jun 6-Jul 13-Jul 20-Jul 7-Jun 14-Jun 21-Jun 28-Jun 6-Jul 13-Jul 20-Jul 7-Jun 14-Jun 21-Jun 28-Jun 6-Jul 13-Jul 20-Jul iPath Cotton Subindex (BAL) iPath Coffee Subindex (JO) iPath Coca Subindex (NIB ) 0.00 10.00 4.00 -2.00 3.00 5.00 2.00 -4.00 -6.00 0.00 1.00 -8.00 0.00 -5.00 -1.00 -10.00 -2.00 -12.00 -10.00 -3.00 -14.00 -4.00 -15.00 -16.00 -5.00 -18.00 -20.00 -6.00 7-Jun 14-Jun 21-Jun 28-Jun 6-Jul 13-Jul 20-Jul 7-Jun 14-Jun 21-Jun 28-Jun 6-Jul 13-Jul 20-Jul 7-Jun 14-Jun 21-Jun 28-Jun 6-Jul 13-Jul 20-Jul ELEMENTS linked to MLCX Biofuels Index PwrShr Multi-Sector Commodity Metals iPath Copper Subindex (JJC) ) (DBB) (FUE 20.00 0.00 0.00 15.00 -1.00 -2.00 10.00 -2.00 -4.00 -3.00 5.00 -4.00 -6.00 0.00 -5.00 -8.00 -5.00 -6.00 -10.00 -7.00 -10.00 -15.00 -8.00 -12.00 7-Jun 14-Jun 21-Jun 28-Jun 6-Jul 13-Jul 20-Jul 7-Jun 14-Jun 21-Jun 28-Jun 6-Jul 13-Jul 20-Jul 7-Jun 14-Jun 21-Jun 28-Jun 6-Jul 13-Jul 20-Jul iPath Nickel Subindex (JJN) iPath Aluminum Subindex (JJU) ) ProShr Ultra Short Silver (ZSL) 0.00 0.00 18.00 -1.00 -1.00 16.00 -2.00 -2.00 14.00 -3.00 -3.00 12.00 -4.00 -4.00 10.00 -5.00 -5.00 8.00 -6.00 -6.00 -7.00 6.00 -7.00 -8.00 4.00 -8.00 -9.00 2.00 -9.00 -10.00 0.00 7-Jun 14-Jun 21-Jun 28-Jun 6-Jul 13-Jul 20-Jul 7-Jun 14-Jun 21-Jun 28-Jun 6-Jul 13-Jul 20-Jul 7-Jun 14-Jun 21-Jun 28-Jun 6-Jul 13-Jul 20-Jul 3

- 4. Page No.4 Quacera L.L.C. New Perspectives for Investment Decisions July 22, 2012 Commodity ETFs (continued) iShr Silver Trust (SLV) ProShr Ultra Long Silver (AGQ) PwrShr DB Commodity Trust Gold (DGL) 0.00 0.00 0.00 -0.50 -1.00 -5.00 -1.00 -2.00 -3.00 -1.50 -10.00 -2.00 -4.00 -5.00 -2.50 -15.00 -6.00 -3.00 -7.00 -3.50 -20.00 -8.00 -4.00 -9.00 s -25.00 -4.50 -10.00 7-Jun 14-Jun 21-Jun 28-Jun 6-Jul 13-Jul 20-Jul 7-Jun 14-Jun 21-Jun 28-Jun 6-Jul 13-Jul 20-Jul 7-Jun 14-Jun 21-Jun 28-Jun 6-Jul 13-Jul 20-Jul ProShr Ultra Short Silver (ZSL) SPDR Gold Trust (GLD) DB Gold Double Short ETN (DZZ) 18.00 0.00 8.00 16.00 -0.50 7.00 14.00 -1.00 6.00 12.00 -1.50 10.00 -2.00 5.00 8.00 -2.50 4.00 6.00 -3.00 3.00 4.00 -3.50 2.00 2.00 -4.00 1.00 0.00 -4.50 0.00 7-Jun 14-Jun 21-Jun 28-Jun 6-Jul 13-Jul 20-Jul 7-Jun 14-Jun 21-Jun 28-Jun 6-Jul 13-Jul 20-Jul 7-Jun 14-Jun 21-Jun 28-Jun 6-Jul 13-Jul 20-Jul DB Gold Short ETN (DGZ) DB Gold Double Long ETN (DGP) iPath Global Carbon (GRN) 4.00 0.00 15.00 3.50 -1.00 -2.00 10.00 3.00 -3.00 5.00 2.50 -4.00 2.00 0.00 -5.00 1.50 -6.00 -5.00 1.00 -7.00 0.50 -8.00 -10.00 0.00 -9.00 -15.00 7-Jun 14-Jun 21-Jun 28-Jun 6-Jul 13-Jul 20-Jul 7-Jun 14-Jun 21-Jun 28-Jun 6-Jul 13-Jul 20-Jul 7-Jun 14-Jun 21-Jun 28-Jun 6-Jul 13-Jul 20-Jul ProShr Ultra Short Gold (GLL) ETFS Physical Platinum Shares (PPLT) ProShr Ulta Long Crude Oil (UCO) 7.00 0.00 0.00 6.00 -1.00 -5.00 5.00 -2.00 -10.00 4.00 -3.00 3.00 -4.00 -15.00 2.00 -5.00 -20.00 1.00 -6.00 -25.00 0.00 -7.00 -1.00 -8.00 -30.00 -2.00 -9.00 -35.00 7-Jun 14-Jun 21-Jun 28-Jun 6-Jul 13-Jul 20-Jul 7-Jun 14-Jun 21-Jun 28-Jun 6-Jul 13-Jul 20-Jul 7-Jun 14-Jun 21-Jun 28-Jun 6-Jul 13-Jul 20-Jul U.S. Natural Gas Fund (UNG) U.S. Oil Fund (USO) PwrShr DB Crude Oil Double Short ETN (DTO) 14.00 0.00 35.00 12.00 -2.00 -4.00 30.00 10.00 8.00 -6.00 25.00 6.00 -8.00 20.00 4.00 -10.00 15.00 2.00 -12.00 0.00 -14.00 10.00 -2.00 -16.00 5.00 -4.00 -18.00 0.00 7-Jun 14-Jun 21-Jun 28-Jun 6-Jul 13-Jul 20-Jul 7-Jun 14-Jun 21-Jun 28-Jun 6-Jul 13-Jul 20-Jul 7-Jun 14-Jun 21-Jun 28-Jun 6-Jul 13-Jul 20-Jul 4

- 5. Page No.5 Quacera L.L.C. New Perspectives for Investment Decisions July 22, 2012 Commodity ETFs (continued) U.S. Short Oil Fund (DNO) ProShr Ultra Short Crude Oil (SCO) U.S. Heating Oil Fund (UHN) 20.00 45.00 0.00 18.00 40.00 16.00 -2.00 35.00 14.00 -4.00 30.00 12.00 -6.00 25.00 10.00 -8.00 20.00 8.00 6.00 15.00 -10.00 4.00 10.00 -12.00 2.00 5.00 -14.00 0.00 0.00 -16.00 7-Jun 14-Jun 21-Jun 28-Jun 6-Jul 13-Jul 20-Jul 7-Jun 14-Jun 21-Jun 28-Jun 6-Jul 13-Jul 20-Jul 7-Jun 14-Jun 21-Jun 28-Jun 6-Jul 13-Jul 20-Jul PwrShr Commodity Trust Energy (DBE) U.S. Gasoline Fund (UGA) Mkt Vectors Junior Gold Miners (GDXJ) 0.00 2.00 0.00 -2.00 0.00 -2.00 -4.00 -2.00 -4.00 -4.00 -6.00 -6.00 -6.00 -8.00 -8.00 -8.00 -10.00 -10.00 -10.00 -12.00 -12.00 -12.00 -14.00 -14.00 -14.00 -16.00 7-Jun 14-Jun 21-Jun 28-Jun 6-Jul 13-Jul 20-Jul -16.00 7-Jun 14-Jun 21-Jun 28-Jun 6-Jul 13-Jul 20-Jul 7-Jun 14-Jun 21-Jun 28-Jun 6-Jul 13-Jul 20-Jul U.S. Heating Oil Fund (UHN) Mkt Vectors Gold Miners (GDX) Mkt Vectors Steel (SLX) 0.00 2.00 0.00 -2.00 1.00 -2.00 0.00 -4.00 -4.00 -1.00 -6.00 -6.00 -2.00 -8.00 -8.00 -3.00 -10.00 -10.00 -4.00 -5.00 -12.00 -12.00 -14.00 -6.00 -14.00 -7.00 -16.00 -16.00 -8.00 -18.00 7-Jun 14-Jun 21-Jun 28-Jun 6-Jul 13-Jul 20-Jul 7-Jun 14-Jun 21-Jun 28-Jun 6-Jul 13-Jul 20-Jul 7-Jun 14-Jun 21-Jun 28-Jun 6-Jul 13-Jul 20-Jul SPDR Metals and Mining Index (XME) Mkt Vectors Agribusiness (MOO) Guggenheim Timber (CUT) 0.00 4.00 2.00 -2.00 2.00 0.00 -4.00 0.00 -2.00 -6.00 -4.00 -2.00 -8.00 -6.00 -4.00 -10.00 -6.00 -8.00 -12.00 -8.00 -10.00 -14.00 -16.00 -10.00 -12.00 -18.00 -12.00 -14.00 7-Jun 14-Jun 21-Jun 28-Jun 6-Jul 13-Jul 20-Jul 7-Jun 14-Jun 21-Jun 28-Jun 6-Jul 13-Jul 20-Jul 7-Jun 14-Jun 21-Jun 28-Jun 6-Jul 13-Jul 20-Jul 5

- 6. Page No.6 Quacera L.L.C. New Perspectives for Investment Decisions July 22, 2012 Currency ETFs U.S. Dollar Bullish Fund (UUP) U.S. Dollar Bearish Fund (UDN) Euro Trust (FXE) 3.00 0.00 0.00 2.50 -0.50 -0.50 -1.00 2.00 -1.00 -1.50 1.50 -1.50 -2.00 -2.50 1.00 -2.00 -3.00 0.50 -2.50 -3.50 -4.00 0.00 -3.00 -4.50 7-Jun 21-Jun 6-Jul 20-Jul 7-Jun 21-Jun 6-Jul 20-Jul 7-Jun 21-Jun 6-Jul 20-Jul Ultra Short Euro (EUO) Japanese Yen (FXY) Ultra Short Japanese Yen (YCS) 9.00 0.00 8.00 -0.50 2.00 7.00 1.80 -1.00 6.00 1.60 -1.50 1.40 -2.00 5.00 1.20 4.00 -2.50 1.00 3.00 0.80 -3.00 2.00 0.60 -3.50 0.40 -4.00 1.00 0.20 0.00 0.00 -4.50 7-Jun 21-Jun 6-Jul 20-Jul 7-Jun 21-Jun 6-Jul 20-Jul 7-Jun 21-Jun 6-Jul 20-Jul Chinese Yuan Fund (CB) Australian Dollar (FXA) Canadian Dollar (FXC) 0.00 3.00 0.50 -0.10 2.00 0.00 1.00 -0.50 -0.20 0.00 -1.00 -0.30 -1.00 -1.50 -0.40 -2.00 -3.00 -2.00 -0.50 -2.50 -4.00 -0.60 -5.00 -3.00 -0.70 -6.00 -3.50 7-Jun 21-Jun 6-Jul 20-Jul 7-Jun 21-Jun 6-Jul 20-Jul 7-Jun 21-Jun 6-Jul 20-Jul Brazilian Real Fund (BZF) British Pound Sterling Trust Swiss Franc Trust (FXF) 0.00 0.00 0.00 (FXB) -1.00 -0.50 -0.50 -2.00 -1.00 -3.00 -1.50 -1.00 -4.00 -2.00 -1.50 -5.00 -2.50 -2.00 -6.00 -3.00 -7.00 -3.50 -2.50 s -8.00 -4.00 -3.00 7-Jun 21-Jun 6-Jul 20-Jul 7-Jun 21-Jun 6-Jul 20-Jul 7-Jun 21-Jun 6-Jul 20-Jul Indian Rupee (ICN) Swedish Krona Trust (FXS) 0.00 2.00 -1.00 1.00 0.00 -2.00 -1.00 -3.00 -2.00 -4.00 -3.00 -4.00 s -5.00 -5.00 -6.00 -6.00 7-Jun 21-Jun 6-Jul 20-Jul 7-Jun 21-Jun 6-Jul 20-Jul 6

- 7. Page No.7 Quacera L.L.C. New Perspectives for Investment Decisions July 22, 2012 Dow Components Alcoa (AA) American Express (AXP) 3M Co (MMM) 4.00 0.00 3.00 3.00 -2.00 2.00 2.00 1.00 -4.00 1.00 0.00 -6.00 0.00 -1.00 -1.00 -8.00 -2.00 -2.00 -10.00 -3.00 -3.00 -12.00 -4.00 -4.00 -14.00 -5.00 7-Jun 21-Jun 6-Jul 20-Jul 7-Jun 21-Jun 6-Jul 20-Jul 7-Jun 21-Jun 6-Jul 20-Jul AT&T (T) Bank of America (BAC) Boeing (BA) 8.00 4.00 4.00 7.00 2.00 2.00 6.00 0.00 5.00 -2.00 0.00 -4.00 4.00 -2.00 -6.00 3.00 -8.00 -4.00 2.00 -10.00 1.00 -6.00 -12.00 0.00 -14.00 -8.00 7-Jun 21-Jun 6-Jul 20-Jul 7-Jun 21-Jun 6-Jul 20-Jul 7-Jun 21-Jun 6-Jul 20-Jul Caterpillar (CAT) Chevron (CVX) CISCO Systems (CSCO) 0.00 6.00 0.00 4.00 -2.00 -5.00 -4.00 2.00 -6.00 -10.00 0.00 -8.00 -2.00 -10.00 -15.00 -12.00 -4.00 -14.00 -20.00 -6.00 -16.00 7-Jun 21-Jun 6-Jul 20-Jul 7-Jun 21-Jun 6-Jul 20-Jul 7-Jun 21-Jun 6-Jul 20-Jul Coca Cola (KO) Du Pont (DD) Exxon (XOM) 4.00 0.00 4.00 3.50 -1.00 3.00 2.00 3.00 -2.00 1.00 2.50 0.00 -3.00 2.00 -1.00 -4.00 -2.00 1.50 -5.00 -3.00 1.00 -4.00 0.50 -6.00 -5.00 0.00 -7.00 -6.00 7-Jun 21-Jun 6-Jul 20-Jul 7-Jun 21-Jun 6-Jul 20-Jul 7-Jun 21-Jun 6-Jul 20-Jul General Electric (GE) Hewlett Packard Co (HPQ) Home Depot (HD) 5.00 0.00 5.00 4.00 -2.00 4.00 3.00 -4.00 3.00 2.00 -6.00 2.00 1.00 -8.00 1.00 0.00 -1.00 -10.00 0.00 -2.00 -12.00 -1.00 -3.00 -14.00 -2.00 7-Jun 21-Jun 6-Jul 20-Jul 7-Jun 21-Jun 6-Jul 20-Jul 7-Jun 21-Jun 6-Jul 20-Jul 7

- 8. Page No.8 Quacera L.L.C. New Perspectives for Investment Decisions July 22, 2012 Dow Components (continued) Intel (INTC) IBM (IBM) Johnson & Johnson (JNJ) 0.00 0.00 7.00 -1.00 6.00 5.00 -2.00 -1.00 4.00 -3.00 3.00 -2.00 2.00 -4.00 1.00 -5.00 0.00 -3.00 -1.00 -6.00 -2.00 -7.00 -4.00 -3.00 7-Jun 21-Jun 6-Jul 20-Jul 7-Jun 21-Jun 6-Jul 20-Jul 7-Jun 21-Jun 6-Jul 20-Jul JPMorgan Chase (JPM) Kraft Foods (KFT) McDonalds (MCD) 0.00 2.50 0.00 -2.00 2.00 -1.00 -4.00 1.50 -2.00 -6.00 -8.00 1.00 -3.00 -10.00 0.50 -4.00 -12.00 0.00 -5.00 -14.00 -0.50 -6.00 -16.00 -18.00 -1.00 -7.00 -20.00 -1.50 -8.00 7-Jun 21-Jun 6-Jul 20-Jul 7-Jun 21-Jun 6-Jul 20-Jul 7-Jun 21-Jun 6-Jul 20-Jul Merck (MRK) Microsoft (MSFT) Pfizer (PFE) 10.00 2.00 4.00 8.00 1.00 0.00 3.00 6.00 -1.00 2.00 4.00 -2.00 -3.00 1.00 2.00 0.00 -4.00 0.00 -5.00 -2.00 -6.00 -1.00 -4.00 -7.00 -2.00 7-Jun 21-Jun 6-Jul 20-Jul 7-Jun 21-Jun 6-Jul 20-Jul 7-Jun 21-Jun 6-Jul 20-Jul Procter & Gamble (PG) Travelers (TRV) United Tech (UTX) 0.00 2.50 0.00 -1.00 -1.00 2.00 -2.00 -2.00 -3.00 1.50 -4.00 -3.00 1.00 -5.00 -4.00 -6.00 0.50 -7.00 -5.00 -8.00 -6.00 0.00 -9.00 7-Jun 21-Jun 6-Jul 20-Jul 7-Jun 21-Jun 6-Jul 20-Jul 7-Jun 21-Jun 6-Jul 20-Jul Verizon (VZ) Wal-Mart (WMT) Walt Disney (DIS) 9.00 12.00 8.00 8.00 7.00 10.00 7.00 6.00 6.00 8.00 5.00 5.00 6.00 4.00 4.00 3.00 4.00 3.00 2.00 2.00 2.00 1.00 1.00 0.00 0.00 0.00 7-Jun 21-Jun 6-Jul 20-Jul 7-Jun 21-Jun 6-Jul 20-Jul 7-Jun 21-Jun 6-Jul 20-Jul 8

- 9. Page No.9 Quacera L.L.C. New Perspectives for Investment Decisions July 22, 2012 Index ETFs PwrShr High Yield Equity Vanguard Total Market VIPERs Dow Diamonds (DIA) Dividend (PEY) (VTI) 2.50 2.00 2.00 2.00 1.00 1.50 1.00 0.00 1.00 0.00 0.50 -1.00 0.00 -2.00 -1.00 -0.50 -3.00 -2.00 -1.00 -4.00 -3.00 -1.50 -2.00 -5.00 -4.00 -2.50 -6.00 -5.00 7-Jun 21-Jun 6-Jul 20-Jul 7-Jun 21-Jun 6-Jul 20-Jul 7-Jun 21-Jun 6-Jul 20-Jul ProShrs Ultra Long Dow 30 ProShrs Ultra Long S&P 500 ProShrs Short Dow 30 (DOG) (DDM) (SSO) 4.00 4.00 4.00 2.00 3.00 2.00 0.00 2.00 0.00 -2.00 1.00 -2.00 -4.00 0.00 -4.00 -6.00 -1.00 -6.00 -8.00 -2.00 -8.00 -10.00 -3.00 -10.00 7-Jun 21-Jun 6-Jul 20-Jul 7-Jun 21-Jun 6-Jul 20-Jul 7-Jun 21-Jun 6-Jul 20-Jul ProShrs Short S&P 500 (SH) PwrShr QQQ Trust (QQQ) ProShrs Ultra Short S&P 500 (SDS) 5.00 10.00 2.00 4.00 8.00 1.00 3.00 6.00 0.00 4.00 2.00 -1.00 2.00 1.00 -2.00 0.00 0.00 -3.00 -2.00 -1.00 -4.00 -4.00 -2.00 -6.00 -5.00 -3.00 -8.00 -6.00 7-Jun 21-Jun 6-Jul 20-Jul 7-Jun 21-Jun 6-Jul 20-Jul 7-Jun 21-Jun 6-Jul 20-Jul ProShr Ultrat Long QQQ (QLD) ProShr Short QQQ (PSQ) ProShrs Ultra Short QQQ (QID) 4.00 6.00 12.00 2.00 5.00 10.00 0.00 4.00 8.00 -2.00 3.00 6.00 2.00 4.00 -4.00 1.00 2.00 -6.00 0.00 0.00 -8.00 -1.00 -2.00 -10.00 -2.00 -4.00 -12.00 -3.00 -6.00 7-Jun 21-Jun 6-Jul 20-Jul 7-Jun 21-Jun 6-Jul 20-Jul 7-Jun 21-Jun 6-Jul 20-Jul Short Russell 2000 (RWM) Russell 3000 Growth (IWZ) iShr Russell 1000 Growth (IWF) 6.00 2.00 2.00 1.00 1.00 4.00 0.00 0.00 2.00 -1.00 -1.00 0.00 -2.00 -2.00 -3.00 -2.00 -4.00 -3.00 -4.00 -5.00 -4.00 -6.00 -6.00 -5.00 7-Jun 21-Jun 6-Jul 20-Jul 7-Jun 21-Jun 6-Jul 20-Jul 7-Jun 21-Jun 6-Jul 20-Jul 9

- 10. Page No. Quacera L.L.C. New Perspectives for Investment Decisions July 22, 2012 Index ETFs (Continued) Schwab U.S. Large-Cap Growth iShr S&P 500 Growth (IVW) iShr Russell Mid-Cap Growth (SCHG) (IWP) 2.00 2.00 0.00 1.00 1.00 -1.00 0.00 0.00 -2.00 -1.00 -1.00 -3.00 -2.00 -2.00 -4.00 -3.00 -4.00 -3.00 -5.00 -5.00 -4.00 -6.00 -6.00 -5.00 -7.00 7-Jun 21-Jun 6-Jul 20-Jul 7-Jun 21-Jun 6-Jul 20-Jul 7-Jun 21-Jun 6-Jul 20-Jul iShr Russell 2000 Growth Vanguard Small-Cap Growth iShr Mid-Cap 400 Growth (IJK) (IWO) (VBK) 0.00 4.00 4.00 -1.00 2.00 2.00 -2.00 0.00 0.00 -3.00 -2.00 -2.00 -4.00 -4.00 -4.00 -5.00 -6.00 -6.00 -6.00 -7.00 -8.00 -8.00 7-Jun 21-Jun 6-Jul 20-Jul 7-Jun 21-Jun 6-Jul 20-Jul 7-Jun 21-Jun 6-Jul 20-Jul iShr S&P 500 Value (IVE) iShr Russell Mid-Cap Value iShr Russell 1000 Value (IWD) 2.00 (IWS) 3.00 2.00 1.00 2.00 1.00 0.00 0.00 1.00 0.00 -1.00 -1.00 -2.00 -1.00 -2.00 -3.00 -2.00 -3.00 -4.00 -3.00 -4.00 -5.00 -4.00 -6.00 -5.00 -5.00 7-Jun 21-Jun 6-Jul 20-Jul -6.00 7-Jun 21-Jun 6-Jul 20-Jul 7-Jun 21-Jun 6-Jul 20-Jul iShr Mid-Cap 400 Value (IJJ) iShr Russell 2000 Value (IWN) Vanguard Small-Cap Value (VBR) 2.00 3.00 4.00 1.00 2.00 2.00 0.00 1.00 -1.00 0.00 0.00 -2.00 -1.00 -2.00 -3.00 -2.00 -4.00 -3.00 -4.00 -5.00 -4.00 -6.00 -6.00 -5.00 -7.00 -6.00 -8.00 7-Jun 21-Jun 6-Jul 20-Jul 7-Jun 21-Jun 6-Jul 20-Jul 7-Jun 21-Jun 6-Jul 20-Jul Russell 3000 Value (IWW) SPDR S&P 500 (SPY) Mid Cap S&P iShr (MDY) 3.00 2.00 1.00 2.00 1.00 0.00 1.00 0.00 -1.00 0.00 -2.00 -1.00 -1.00 -3.00 -2.00 -2.00 -4.00 -3.00 -3.00 -5.00 -4.00 -4.00 -6.00 -5.00 -5.00 -7.00 7-Jun 21-Jun 6-Jul 20-Jul 7-Jun 21-Jun 6-Jul 20-Jul 7-Jun 21-Jun 6-Jul 20-Jul 10

- 11. Page No.11 Quacera L.L.C. New Perspectives for Investment Decisions July 22, 2012 Index ETFs (Continued) Mid Cap S&P 400 Ultra Long Mid Cap S&P 400 Short ProShrs Mid Cap S&P 400 Ultra Short ProShrs (MVV) (MYY) ProShrs (MZZ) 2.00 6.00 12.00 0.00 5.00 10.00 -2.00 4.00 8.00 -4.00 3.00 6.00 -6.00 2.00 4.00 -8.00 1.00 2.00 -10.00 0.00 0.00 -12.00 -1.00 -2.00 -14.00 -2.00 -4.00 7-Jun 21-Jun 6-Jul 20-Jul 7-Jun 21-Jun 6-Jul 20-Jul 7-Jun 21-Jun 6-Jul 20-Jul Russell 2000 iShrs (IWM) Russell 2000 Ultra Long ProShrs Russell 2000 Ultra Short Pro (UWM) Shrs (TWM) 4.00 10.00 15.00 3.00 2.00 5.00 10.00 1.00 0.00 0.00 5.00 -1.00 -2.00 -3.00 -5.00 0.00 -4.00 -5.00 -10.00 -5.00 -6.00 -7.00 -15.00 -10.00 7-Jun 21-Jun 6-Jul 20-Jul 7-Jun 21-Jun 6-Jul 20-Jul 7-Jun 21-Jun 6-Jul 20-Jul 11