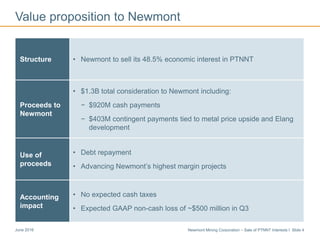

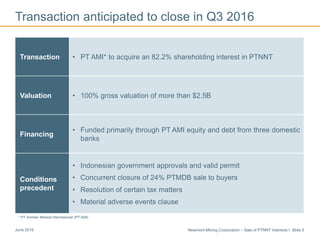

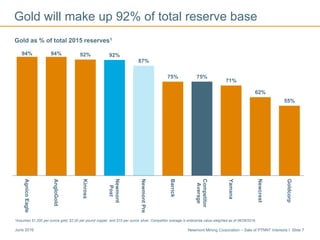

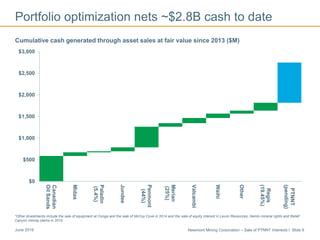

Newmont Mining Corporation is selling its 48.5% economic interest in PT Nusa Tenggara Mining for $1.3 billion total consideration. The sale is expected to close in Q3 2016 pending regulatory approvals. Proceeds will be used to repay debt and fund highest margin projects. Post-sale, 92% of Newmont's reserve base will be gold, improving the risk profile of its portfolio. The transaction supports Newmont's strategy of optimizing its portfolio through asset sales.